- United States

- /

- Medical Equipment

- /

- NasdaqGS:ATEC

US Growth Companies With Insider Ownership Up To 29%

Reviewed by Simply Wall St

Amid recent fluctuations in major U.S. indices and rising oil prices due to Middle East tensions, investors are seeking stability and growth potential in the market. One promising avenue is growth companies with high insider ownership, which often signals strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Here we highlight a subset of our preferred stocks from the screener.

Alphatec Holdings (NasdaqGS:ATEC)

Simply Wall St Growth Rating: ★★★★☆☆

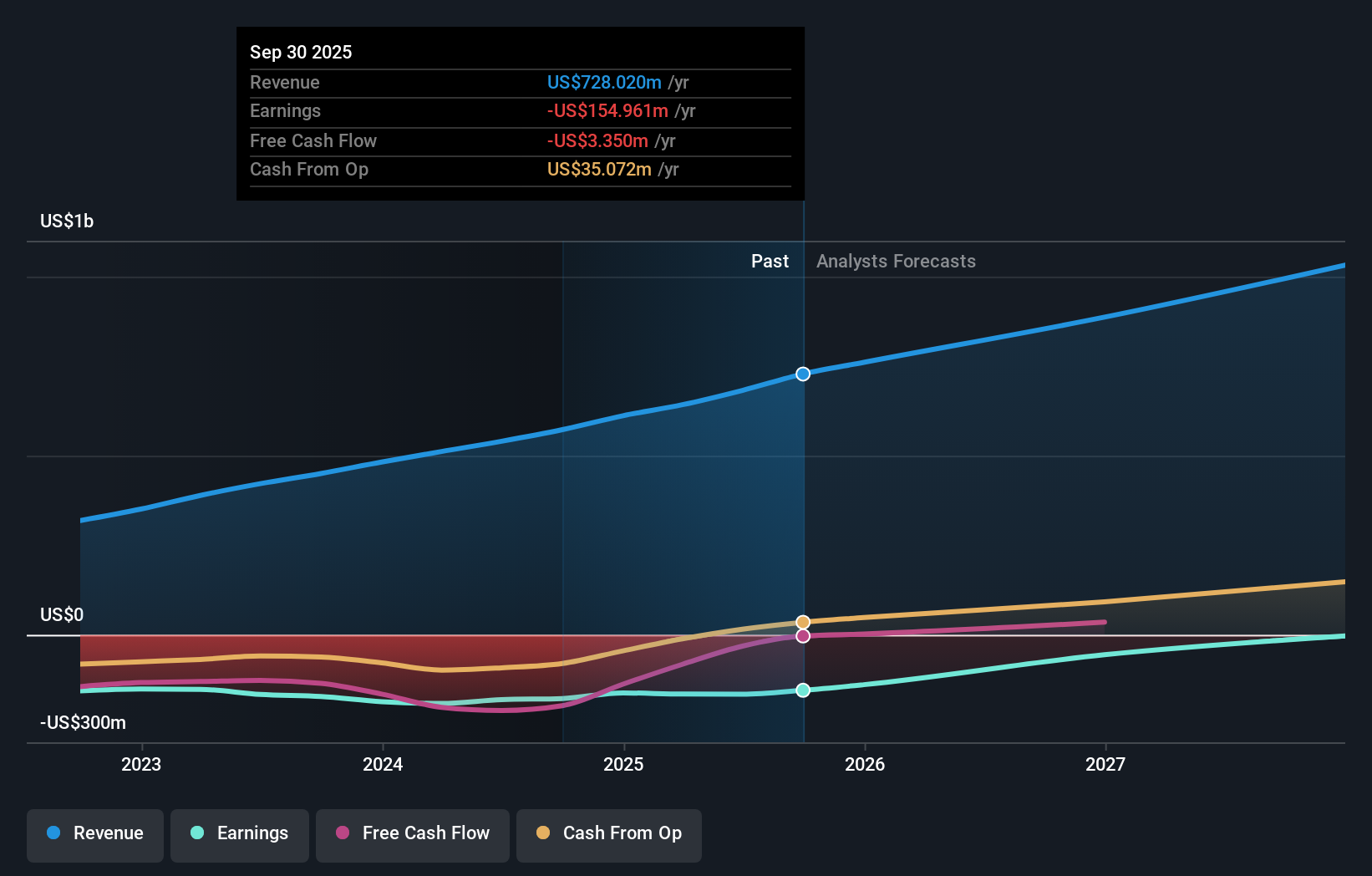

Overview: Alphatec Holdings, Inc. is a medical technology company that designs, develops, and advances technologies for the surgical treatment of spinal disorders in the United States and internationally, with a market cap of $780.96 million.

Operations: The company generates revenue primarily from its medical products segment, which reported $540.28 million.

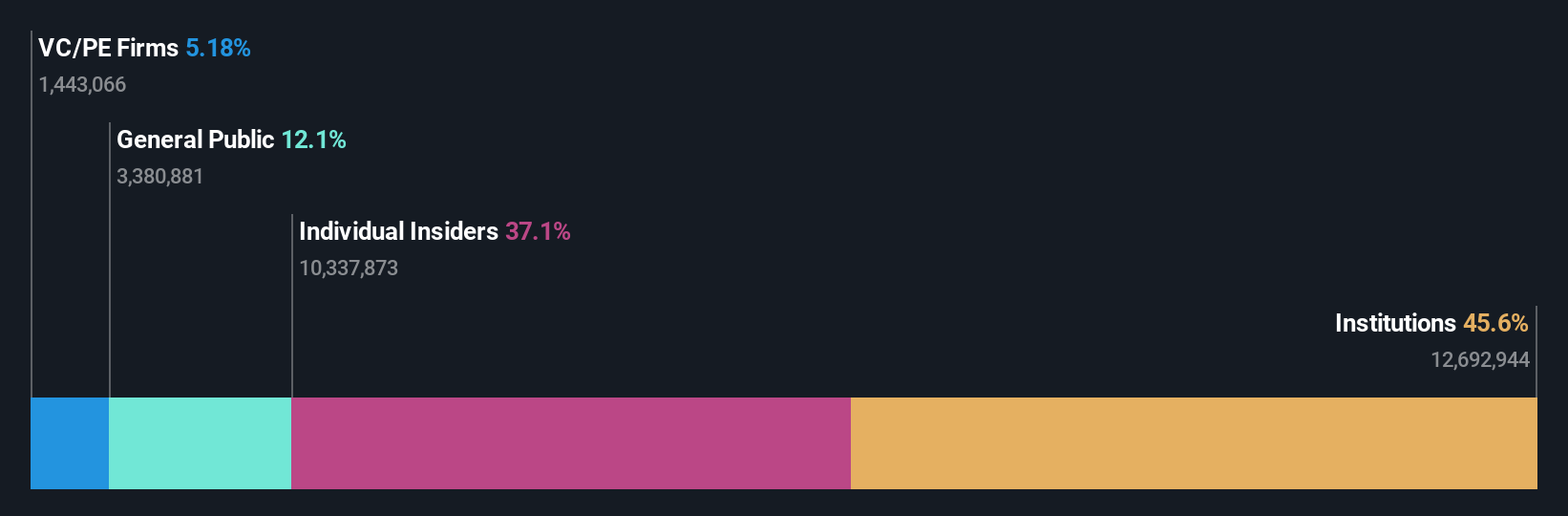

Insider Ownership: 12.3%

Alphatec Holdings has seen substantial insider buying over the past three months, reflecting confidence in its growth trajectory. The company is expected to become profitable within three years and its revenue growth rate of 16.4% per year outpaces the broader US market. Recent strategic moves include appointing industry veteran Keith Valentine to the Board and launching EOS Insight, an advanced AI-driven spine surgery platform, enhancing clinical decision-making and operational efficiency.

- Click to explore a detailed breakdown of our findings in Alphatec Holdings' earnings growth report.

- Our expertly prepared valuation report Alphatec Holdings implies its share price may be lower than expected.

FirstSun Capital Bancorp (NasdaqGS:FSUN)

Simply Wall St Growth Rating: ★★★★★☆

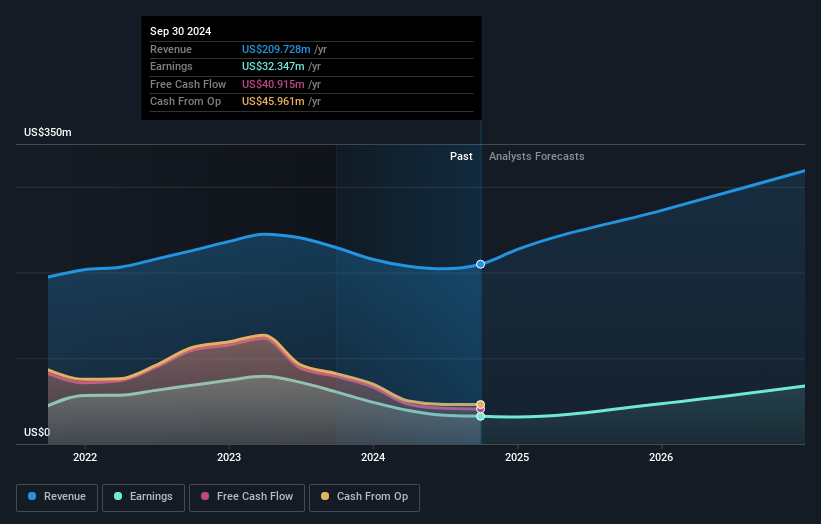

Overview: FirstSun Capital Bancorp, with a market cap of $1.18 billion, operates as a bank holding company for Sunflower Bank, offering commercial and consumer banking and financial services to small and medium-sized businesses in Texas, Kansas, Colorado, New Mexico, and Arizona.

Operations: FirstSun Capital Bancorp generates revenue primarily from its Banking segment ($302.74 million) and Mortgage Operations ($45.19 million).

Insider Ownership: 29.9%

FirstSun Capital Bancorp, recently added to the NASDAQ Composite and S&P TMI Index, is forecast to grow earnings at 60.5% per year, significantly outpacing the US market. Despite a slight decline in net income for Q2 2024 compared to last year, its revenue growth rate of 32.5% per year remains robust. Trading below its fair value estimate enhances its appeal as a growth investment with substantial insider ownership.

- Click here and access our complete growth analysis report to understand the dynamics of FirstSun Capital Bancorp.

- The analysis detailed in our FirstSun Capital Bancorp valuation report hints at an inflated share price compared to its estimated value.

Peapack-Gladstone Financial (NasdaqGS:PGC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Peapack-Gladstone Financial Corporation, with a market cap of $471.01 million, operates as the bank holding company for Peapack-Gladstone Bank, offering private banking and wealth management services in the United States.

Operations: The company's revenue segments include $142.34 million from Banking and $62.05 million from Peapack Private services.

Insider Ownership: 10.5%

Peapack-Gladstone Financial Corporation, with significant insider ownership, is forecast to grow earnings at 20.5% per year, outpacing the US market. Despite a decline in Q2 2024 net income compared to last year, its revenue growth rate of 15.7% per year remains strong. Recent leadership changes and a $150 million shelf registration filing indicate strategic initiatives for future growth. Trading significantly below fair value enhances its appeal as a growth investment.

- Unlock comprehensive insights into our analysis of Peapack-Gladstone Financial stock in this growth report.

- The analysis detailed in our Peapack-Gladstone Financial valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Delve into our full catalog of 185 Fast Growing US Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATEC

Alphatec Holdings

A medical technology company, designs, develops, and advances technologies for the surgical treatment of spinal disorders in the United States and internationally.

Undervalued with reasonable growth potential.