- United States

- /

- Banks

- /

- NasdaqGS:FSUN

Does Renewed Optimism in Fed Policy Shift the Investment Case for FirstSun Capital Bancorp (FSUN)?

Reviewed by Sasha Jovanovic

- In the past week, FirstSun Capital Bancorp was among several regional banks that saw increased investor interest after major banks posted stronger-than-anticipated third-quarter earnings, fueled by improved investment banking and trading results, and the Federal Reserve signaled a potential end to its quantitative tightening program.

- This shift in market sentiment has especially benefited regional banks, as expectations of greater financial sector liquidity and resilience have enhanced confidence in institutions like FirstSun Capital Bancorp.

- We’ll examine how renewed optimism toward the Federal Reserve’s policy outlook could influence FirstSun’s investment narrative and future prospects.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FirstSun Capital Bancorp Investment Narrative Recap

To feel confident as a FirstSun Capital Bancorp shareholder, you need to trust in the bank’s ability to expand deposits, manage credit quality in its C&I loan book, and leverage a rebound in sector liquidity for earnings growth. The recent investor enthusiasm tied to a potentially more accommodative Fed is a supportive backdrop for the sector, but near-term risks, particularly elevated charge-offs, remain significant, and this news only partially addresses those concerns. The immediate catalyst continues to be the stabilization and growth of core deposits, while credit costs represent the primary risk to watch.

Among recent developments, FirstSun’s inclusion in the S&P Regional Banks Select Industry Index on September 13, 2025, stands out. This recognition may drive increased interest from institutional investors and index funds, strengthening the liquidity and profile of FirstSun’s shares, which is especially relevant as broader sector momentum builds and investor focus sharpens on regional banking stability.

However, investors should be equally aware of potential headwinds: while optimism around the Federal Reserve’s policy stance is clear, elevated charge-offs within the C&I loan portfolio could still pressure future results if asset quality...

Read the full narrative on FirstSun Capital Bancorp (it's free!)

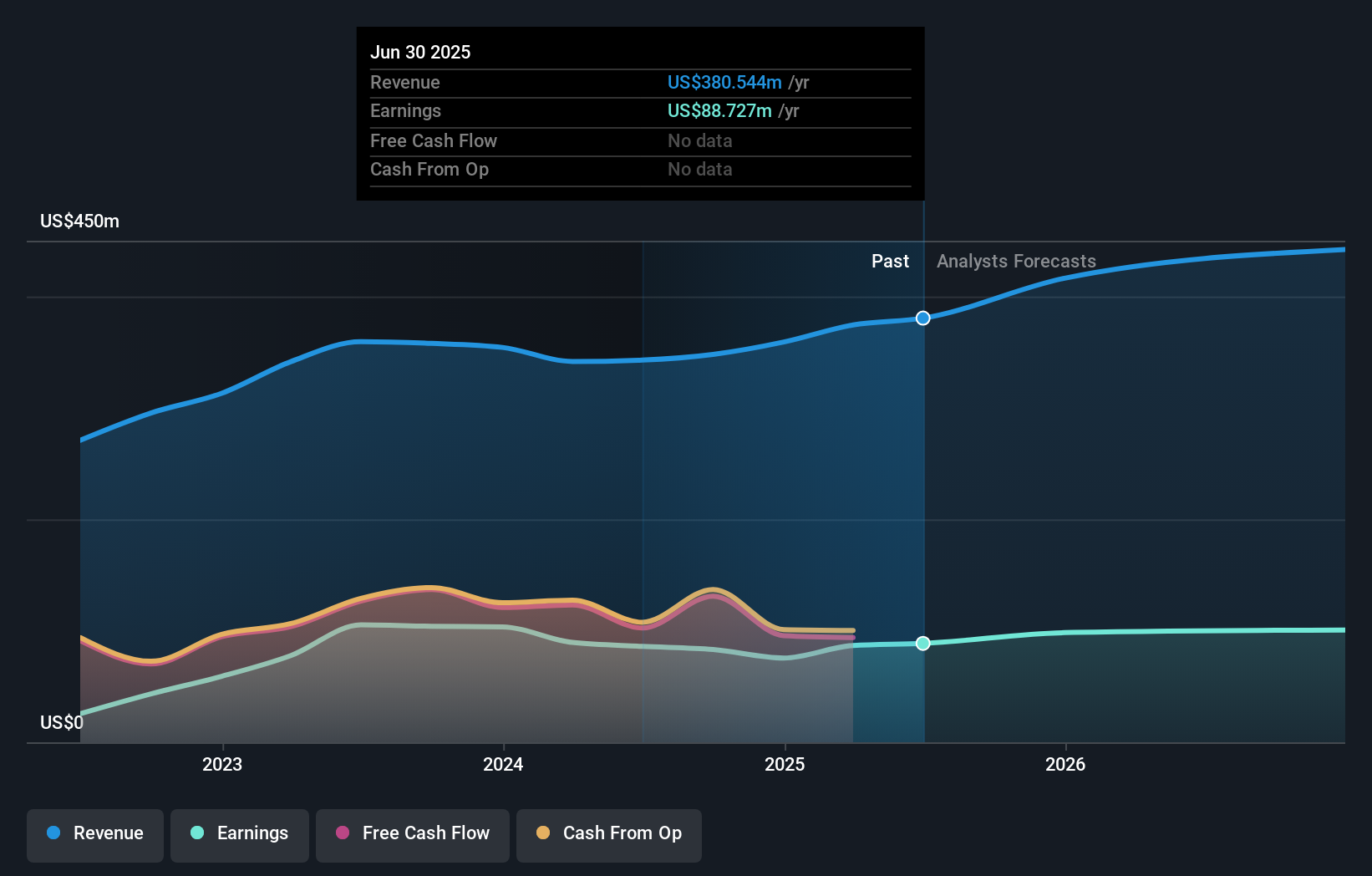

FirstSun Capital Bancorp's narrative projects $512.8 million in revenue and $113.8 million in earnings by 2028. This requires 10.5% yearly revenue growth and a $25.1 million earnings increase from $88.7 million today.

Uncover how FirstSun Capital Bancorp's forecasts yield a $43.25 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Only one community member on Simply Wall St values FirstSun shares at US$78.33. While expectations for regional bank liquidity have recently improved, charge-off levels underline the need to weigh both upside and downside as you compare other views.

Explore another fair value estimate on FirstSun Capital Bancorp - why the stock might be worth just $78.33!

Build Your Own FirstSun Capital Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstSun Capital Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FirstSun Capital Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstSun Capital Bancorp's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives