- United States

- /

- Banks

- /

- NasdaqGS:FRME

First Merchants Corporation (NASDAQ:FRME) Passed Our Checks, And It's About To Pay A US$0.26 Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that First Merchants Corporation (NASDAQ:FRME) is about to go ex-dividend in just 3 days. Ex-dividend means that investors that purchase the stock on or after the 4th of March will not receive this dividend, which will be paid on the 19th of March.

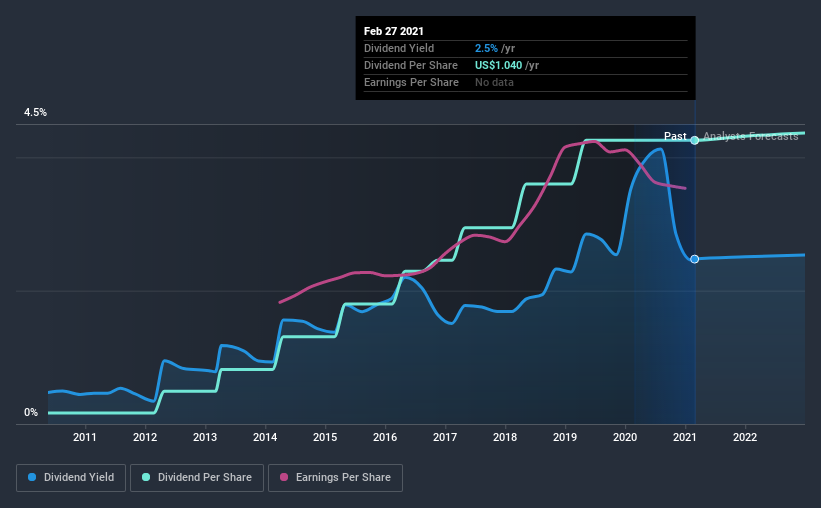

First Merchants's next dividend payment will be US$0.26 per share, and in the last 12 months, the company paid a total of US$1.04 per share. Based on the last year's worth of payments, First Merchants has a trailing yield of 2.5% on the current stock price of $42.05. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for First Merchants

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately First Merchants's payout ratio is modest, at just 38% of profit.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see First Merchants earnings per share are up 9.7% per annum over the last five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. First Merchants has delivered 39% dividend growth per year on average over the past 10 years. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid First Merchants? It has been growing its earnings per share somewhat in recent years, although it reinvests more than half its earnings in the business, which could suggest there are some growth projects that have not yet reached fruition. We think this is a pretty attractive combination, and would be interested in investigating First Merchants more closely.

Wondering what the future holds for First Merchants? See what the six analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading First Merchants or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:FRME

First Merchants

Operates as the financial holding company for First Merchants Bank that provides commercial and consumer banking services.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives