- United States

- /

- Banks

- /

- NasdaqGS:WAFD

3 Reliable Dividend Stocks Offering Up To 3.5% Yield

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of steadiness, with the S&P 500 extending its winning streak and investor sentiment buoyed by easing trade tensions between the U.S. and China, many are turning their attention to reliable income-generating investments like dividend stocks. In such an environment, selecting stocks that offer consistent dividends can be a prudent strategy for investors seeking to balance potential growth with steady returns amidst ongoing economic uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.73% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.79% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.33% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.11% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.81% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.80% | ★★★★★☆ |

| Douglas Dynamics (NYSE:PLOW) | 4.03% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.85% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 4.82% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.82% | ★★★★★☆ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

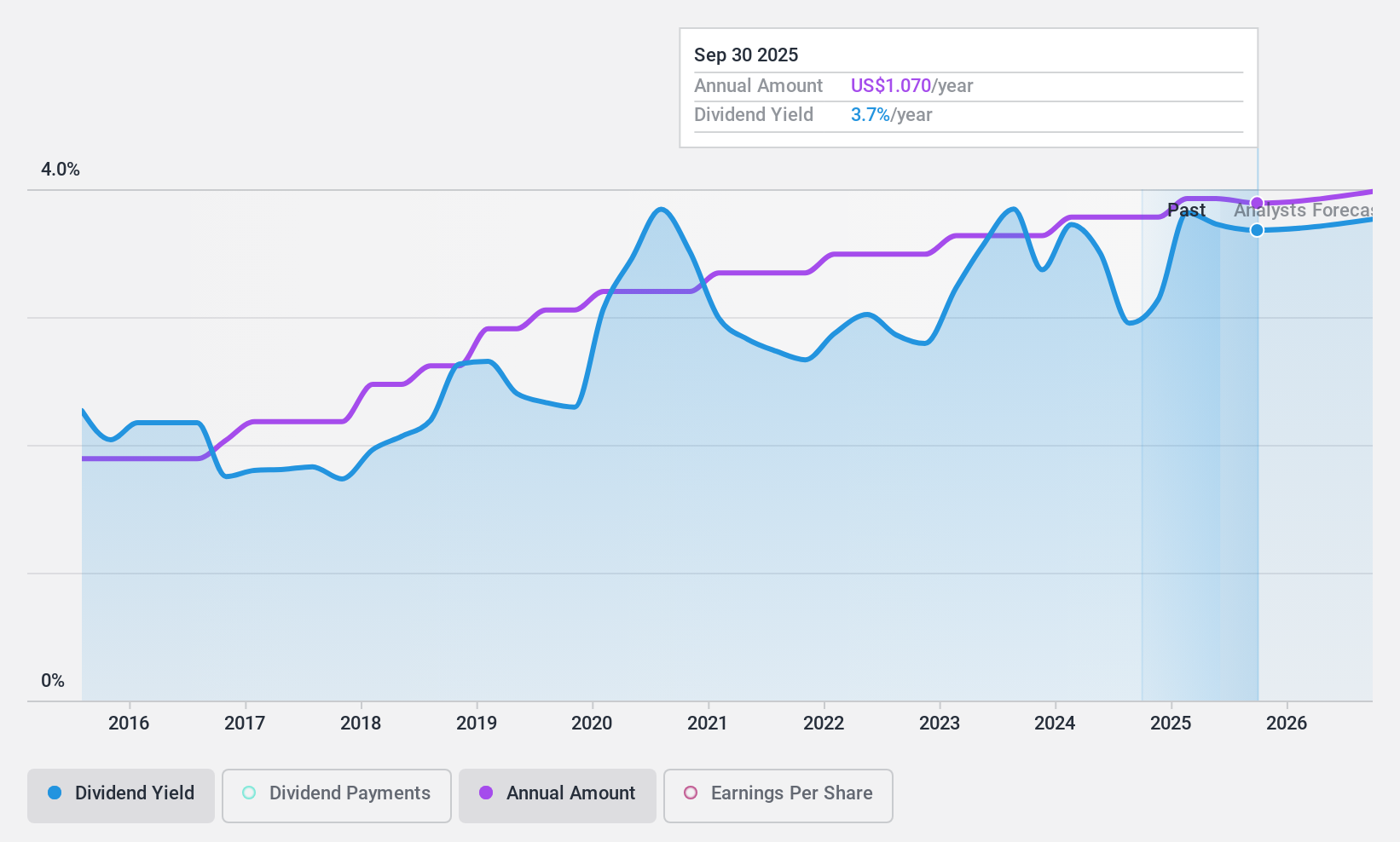

First Merchants (NasdaqGS:FRME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Merchants Corporation, with a market cap of $2.28 billion, operates as the financial holding company for First Merchants Bank, offering commercial and consumer banking services.

Operations: First Merchants Corporation generates revenue primarily through its Community Banking segment, which accounts for $615.41 million.

Dividend Yield: 3.6%

First Merchants offers a stable dividend history with increasing payments over the past decade and a reliable yield of 3.57%. Despite trading at 50.2% below its estimated fair value, concerns exist due to insufficient data on future dividend coverage. Recent earnings show growth, with net income rising to US$55.34 million in Q1 2025, supporting its low payout ratio of 39.3%. The company has also engaged in share buybacks totaling US$91.61 million this year.

- Get an in-depth perspective on First Merchants' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that First Merchants is trading behind its estimated value.

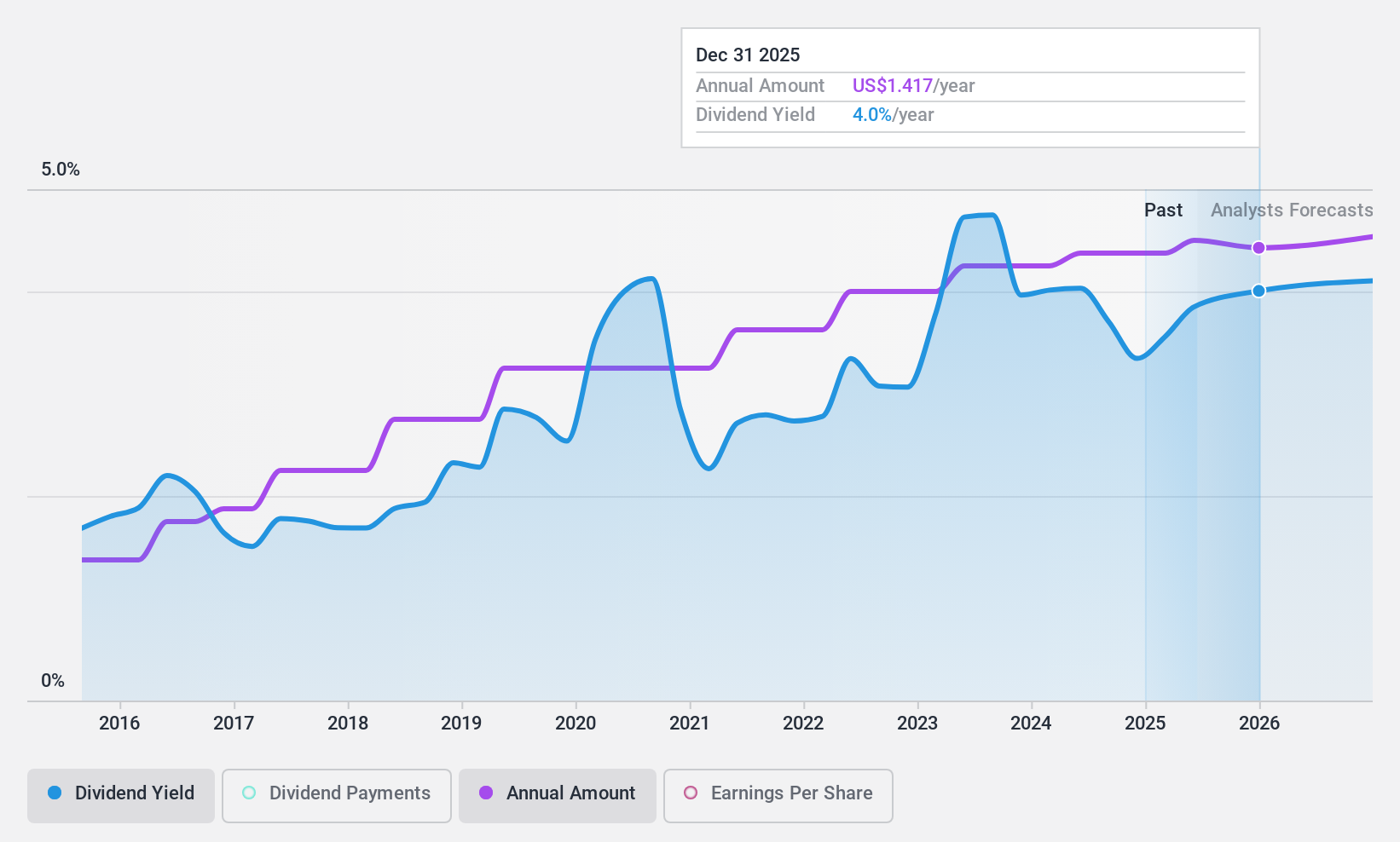

WaFd (NasdaqGS:WAFD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WaFd, Inc. is the bank holding company for Washington Federal Bank, offering lending, depository, insurance, and other banking services in the United States with a market cap of $2.37 billion.

Operations: WaFd, Inc. generates revenue primarily through its Banking and Financial Services segment, which amounts to $729.80 million.

Dividend Yield: 3.6%

WaFd's dividend history is marked by stability and growth over the past decade, offering a reliable yield of 3.59%. The company's dividends are well covered by earnings, reflected in a low payout ratio of 40.1%. Despite trading at 46.3% below estimated fair value, recent net income surged to US$56.25 million in Q2 2025, supporting its dividend sustainability. However, significant net charge-offs raise concerns about financial health despite ongoing share buybacks totaling US$1.69 billion since inception.

- Unlock comprehensive insights into our analysis of WaFd stock in this dividend report.

- Our valuation report unveils the possibility WaFd's shares may be trading at a discount.

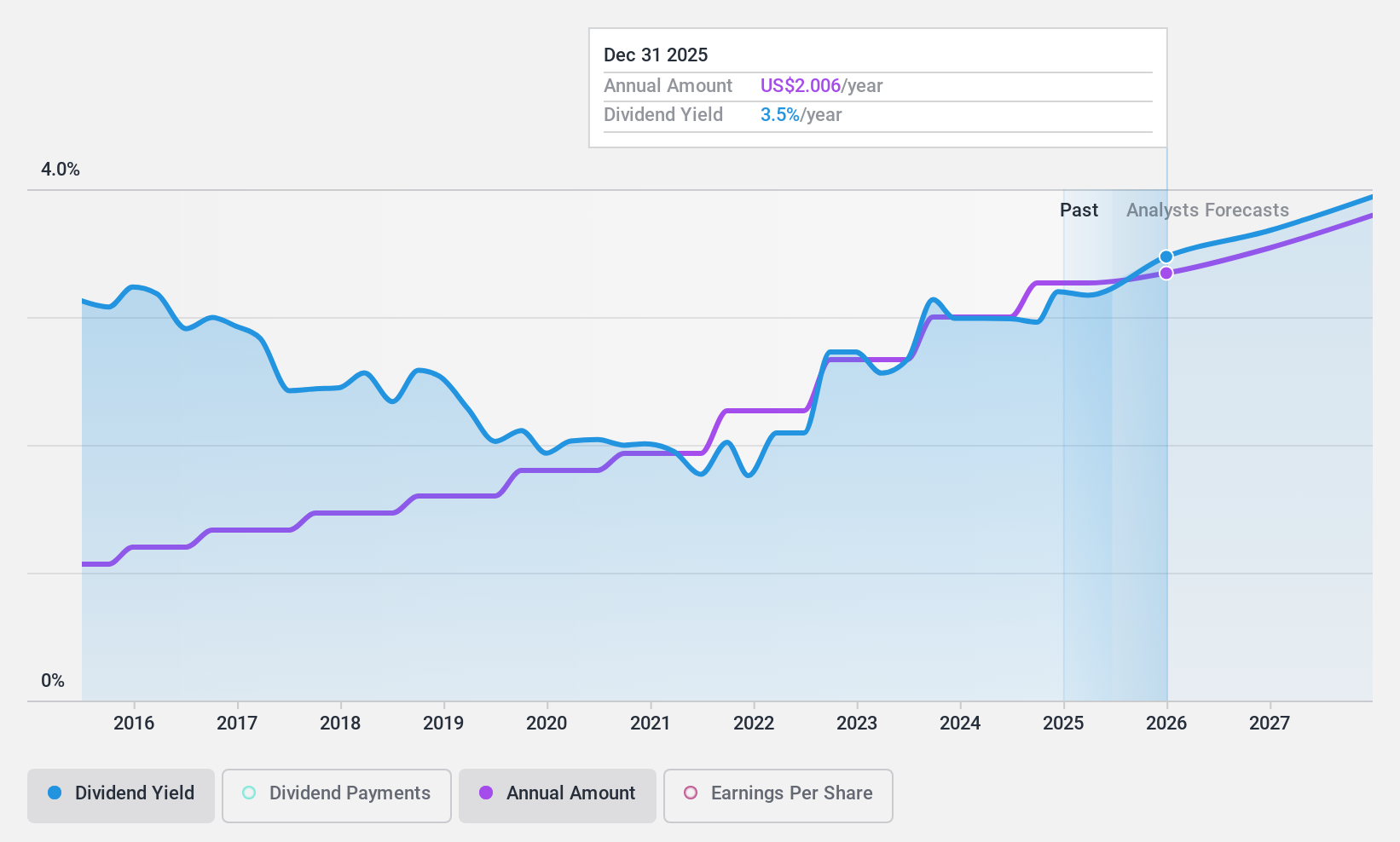

Terreno Realty (NYSE:TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of approximately $5.95 billion.

Operations: Terreno Realty Corporation generates revenue of $408.01 million from its investments in industrial real estate.

Dividend Yield: 3.4%

Terreno Realty's dividend has shown consistent growth over the past decade, supported by stable earnings and cash flow coverage with a payout ratio of 75.8% and cash payout ratio of 82%. While its dividend yield is lower than top-tier payers at 3.36%, it remains reliable. Recent acquisitions and leases, including a US$9.3 million property in Redmond, Washington, bolster its portfolio expansion efforts, potentially enhancing future revenue streams despite current trading below estimated fair value by 30.5%.

- Click here to discover the nuances of Terreno Realty with our detailed analytical dividend report.

- Our expertly prepared valuation report Terreno Realty implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 141 Top US Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade WaFd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives