- United States

- /

- Banks

- /

- NasdaqGM:FRBA

I Ran A Stock Scan For Earnings Growth And First Bank (NASDAQ:FRBA) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in First Bank (NASDAQ:FRBA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for First Bank

How Quickly Is First Bank Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that First Bank has managed to grow EPS by 26% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

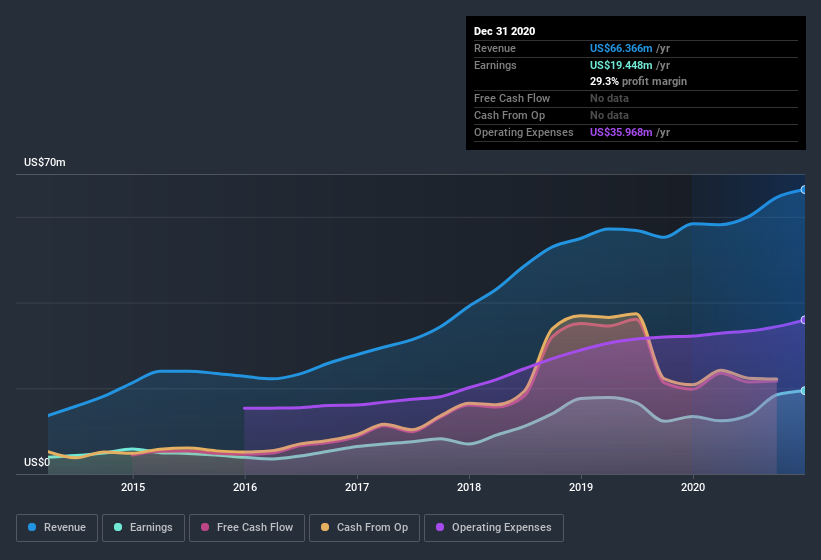

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that First Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. First Bank maintained stable EBIT margins over the last year, all while growing revenue 14% to US$66m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of First Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are First Bank Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it First Bank shareholders can gain quiet confidence from the fact that insiders shelled out US$474k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by Independent Director Douglas Borden for US$96k worth of shares, at about US$9.60 per share.

The good news, alongside the insider buying, for First Bank bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$14m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 6.0% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Patrick Ryan is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like First Bank with market caps between US$100m and US$400m is about US$935k.

The First Bank CEO received US$799k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add First Bank To Your Watchlist?

You can't deny that First Bank has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. Still, you should learn about the 1 warning sign we've spotted with First Bank .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of First Bank, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade First Bank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade First Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FRBA

First Bank

Provides various banking products and services to small to mid-sized businesses and individuals.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives