- United States

- /

- Capital Markets

- /

- NYSE:AC

US Market's Undiscovered Gems Featuring Three Promising Small Caps

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period marked by fluctuating Treasury yields and mixed economic signals, small-cap stocks present intriguing opportunities amidst broader market movements. In this dynamic environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and potential resilience against economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Mission Produce (AVO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mission Produce, Inc. specializes in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both in the United States and internationally with a market cap of approximately $883.43 million.

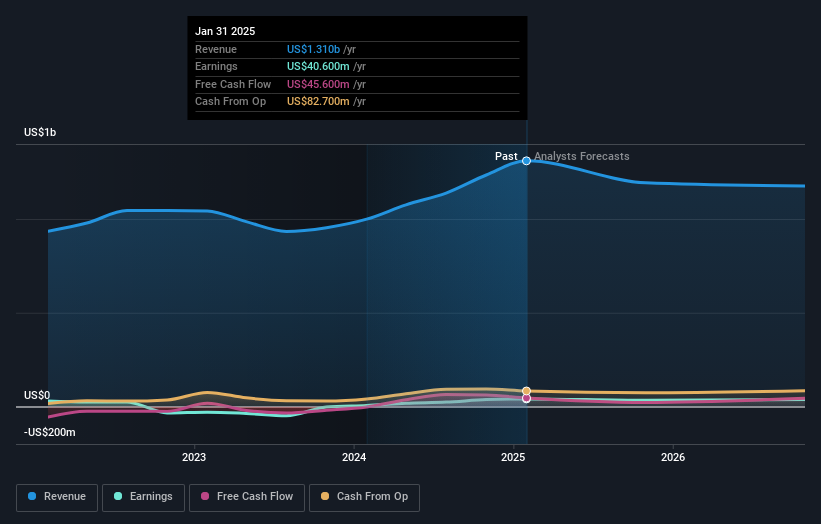

Operations: Mission Produce generates revenue primarily from its Marketing & Distribution segment, which accounts for $1.30 billion, followed by Blueberries at $85.30 million and International Farming at $75 million. The company's net profit margin reflects its financial performance efficiency in managing costs relative to its total revenue streams.

Mission Produce, with its nimble approach to the fresh produce market, is making strides in expanding its product lines beyond avocados to include blueberries and mangoes. This diversification aims to bolster growth potential while addressing supply chain challenges. The company reported a 32% increase in avocado sales for the fiscal first quarter and a noteworthy debt-to-equity ratio reduction from 53.1% to 25.4% over five years, indicating financial prudence. Despite being dropped from several Russell indices, Mission Produce's strategic focus on operational efficiency seems poised to enhance net margins as new categories mature, presenting intriguing prospects for investors.

First Bancorp (FNLC)

Simply Wall St Value Rating: ★★★★★★

Overview: The First Bancorp, Inc. is a bank holding company for First National Bank, offering various banking products and services to individual and corporate clients, with a market cap of $304.70 million.

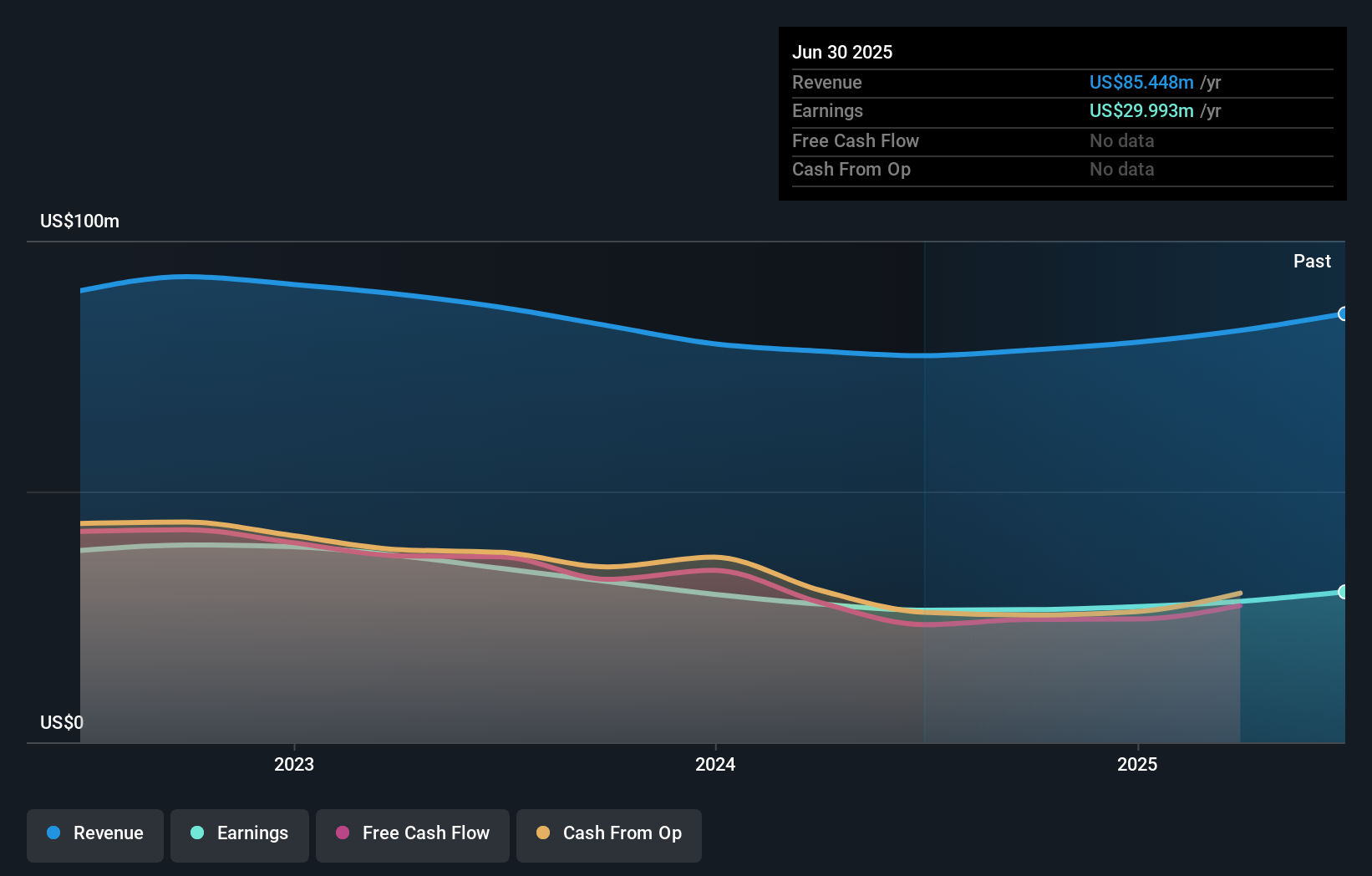

Operations: First Bancorp generates revenue primarily through its banking operations, amounting to $85.45 million.

With total assets of US$3.2 billion and equity at US$265.5 million, First Bancorp stands out for its robust financial health. The bank's deposits amount to US$2.7 billion, while loans are at US$2.4 billion, reflecting a balanced approach to growth and risk management. It has a sufficient allowance for bad loans at 0.3% of total loans, which is well within industry norms, ensuring stability in uncertain times. Additionally, its earnings have grown by 13.8% over the past year, surpassing the banks industry average of 12.8%, highlighting strong performance relative to peers in the sector.

- Click here and access our complete health analysis report to understand the dynamics of First Bancorp.

Gain insights into First Bancorp's historical performance by reviewing our past performance report.

Associated Capital Group (AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc. provides investment advisory services in the United States and has a market capitalization of approximately $698.83 million.

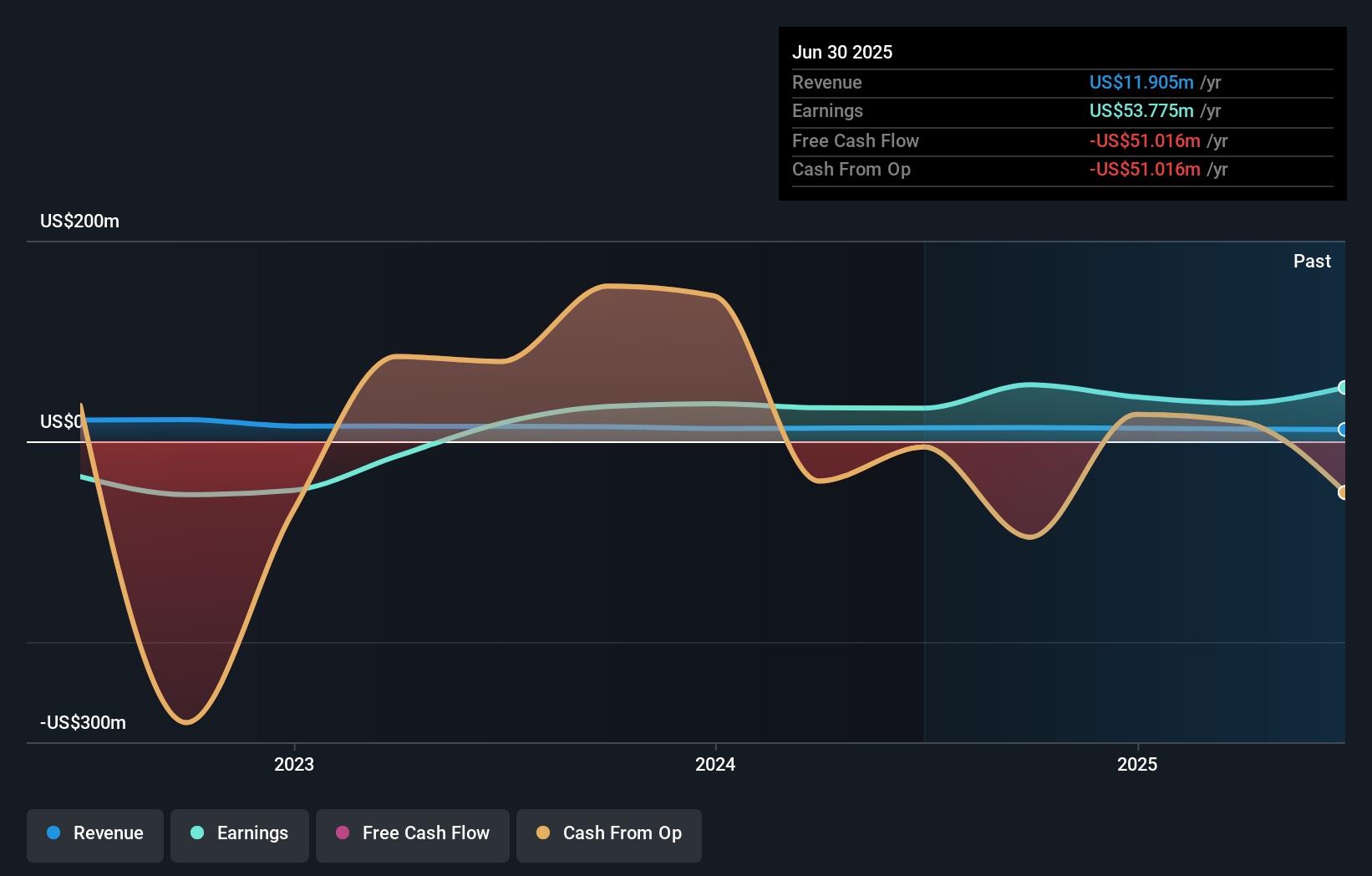

Operations: AC generates revenue primarily from its investment advisory and asset management services, amounting to $11.91 million.

Associated Capital Group, a nimble player in the financial sector, has demonstrated significant earnings growth of 62.3% over the past year, outpacing its industry peers. Operating debt-free for five years now, it recently reported a notable one-off gain of US$64.1 million impacting its latest results as of June 30, 2025. The company’s price-to-earnings ratio stands at 13x, which is quite attractive compared to the broader US market's 19.3x. Despite not being free cash flow positive currently, AC has actively repurchased shares this year and completed a substantial buyback program since December 2015.

- Navigate through the intricacies of Associated Capital Group with our comprehensive health report here.

Evaluate Associated Capital Group's historical performance by accessing our past performance report.

Make It Happen

- Explore the 286 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AC

Associated Capital Group

Provides investment advisory services in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives