- United States

- /

- Banks

- /

- NasdaqGS:FITB

Does Fifth Third Present Long-Term Value After Latest Earnings and Dividend Increase in 2025?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads with Fifth Third Bancorp, wondering whether it’s time to buy, hold, or move on, you’re in good company. The stock’s journey hasn't been straightforward lately. After a dip of 1.4% in the past week and a slide of 5.4% over the last month, some investors might be feeling uneasy. Year-to-date, though, shares are up 1.8%, and the long-term view is difficult to ignore: a solid 46.0% return over three years and a striking 120.2% over five years.

Those kinds of numbers often raise questions. Is the recent weakness just part of normal market swings, or does it signal something more fundamental? Some of the caution comes as regional banks have faced macroeconomic headwinds, but for every downbeat headline, there are signs that investors are simply recalibrating their risk appetite, especially as broader market conditions evolve.

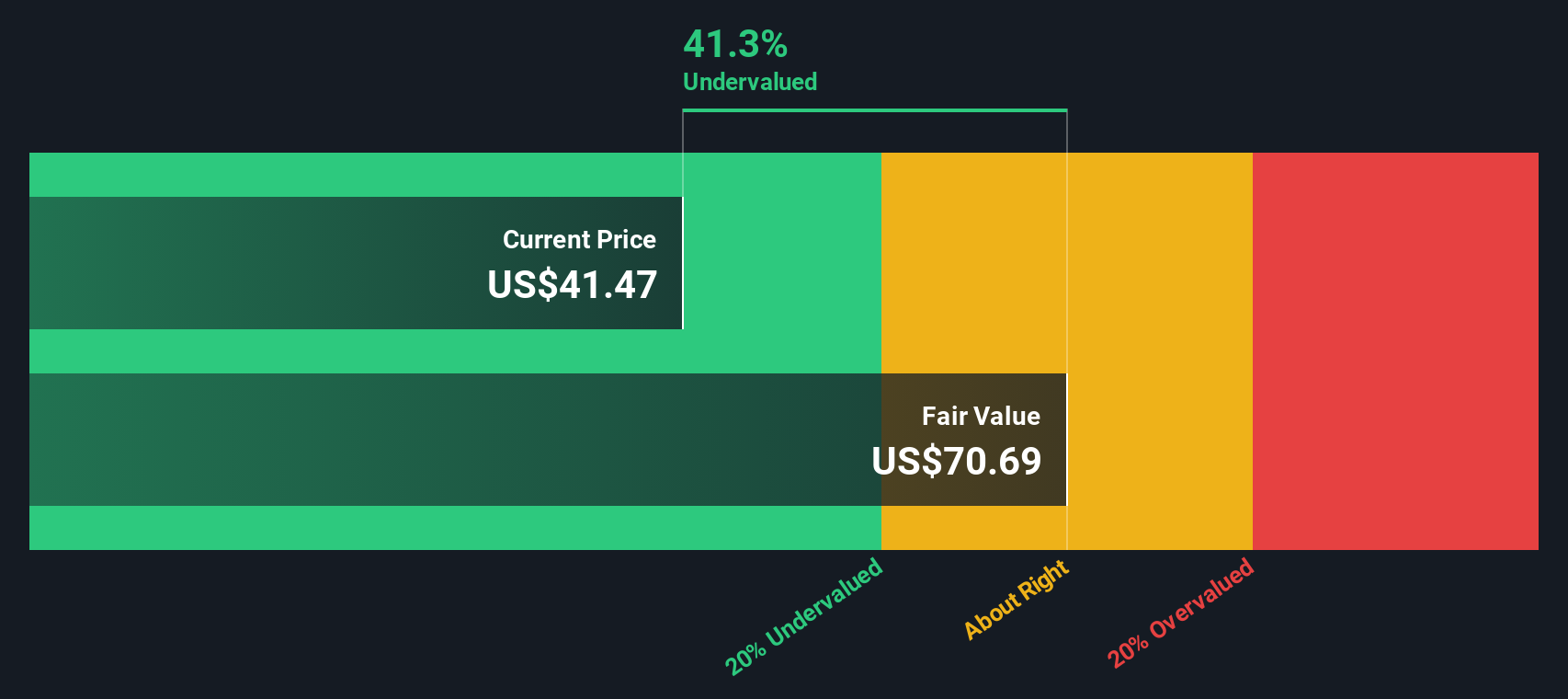

Now, here’s where it gets interesting for anyone thinking about value: Fifth Third Bancorp currently has a valuation score of 3 out of 6, meaning it looks undervalued on three standard checks. This score matters, but as with any scorecard, it only tells part of the story.

Let’s break down what goes into that valuation score, how each approach weighs Fifth Third’s strengths and weaknesses, and, most importantly, see if there’s an even better way to size up its true worth down the road.

Why Fifth Third Bancorp is lagging behind its peers

Approach 1: Fifth Third Bancorp Excess Returns Analysis

The Excess Returns model focuses on how well a company puts its invested capital to work after covering the cost of equity. Essentially, it measures a company's ability to generate returns above what shareholders require, painting a picture of whether management is creating real value.

For Fifth Third Bancorp, the numbers stack up as follows:

- Book Value: $28.47 per share

- Stable Earnings Per Share (EPS): $3.87, estimated using the future Return on Equity projections from 14 analysts

- Cost of Equity: $2.21 per share

- Excess Return: $1.66 per share

- Average Return on Equity: 12.65%

- Stable Book Value: $30.59 per share, predicted from 15 analysts' forecasts

Based on this approach, the intrinsic fair value for Fifth Third Bancorp is notably higher than the current share price. The model indicates shares are trading at a 39.3% discount to fair value. This solid excess return, paired with strong equity performance, points to meaningful value creation for investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Fifth Third Bancorp is undervalued by 39.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

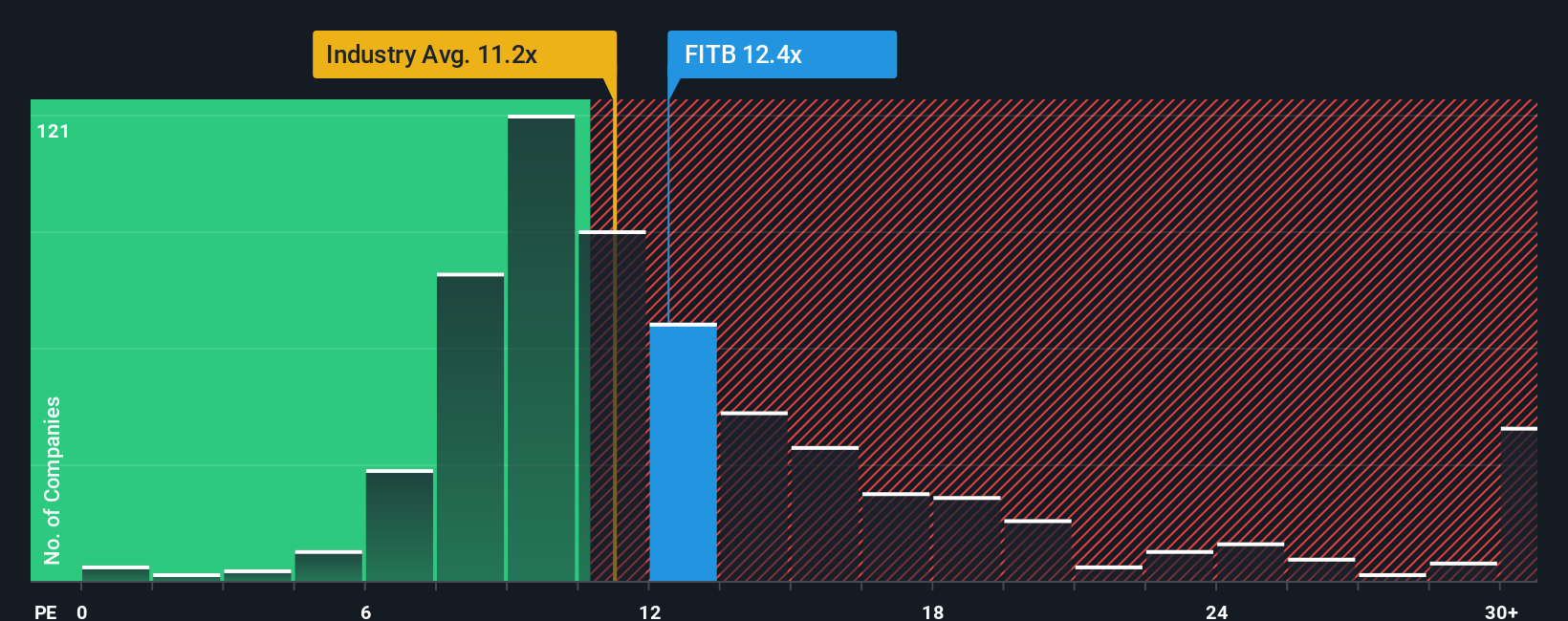

Approach 2: Fifth Third Bancorp Price vs Earnings

For profitable companies like Fifth Third Bancorp, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. It offers a clear, direct comparison of what you pay for each dollar of earnings and is especially relevant when those earnings are stable and meaningful over time.

Of course, what makes for a “fair” PE ratio is not one-size-fits-all. It depends on both expected growth and risk. Companies with higher growth prospects or lower perceived risks often trade at higher PE multiples, while those facing headwinds may see their ratios lag the industry.

Currently, Fifth Third Bancorp trades at a PE ratio of 13.0x. For context, this is higher than the average for its banking peers at 10.9x and above the industry average of 11.7x. However, when we look at the proprietary Fair Ratio from Simply Wall St, which takes into account not just earnings and growth but also risk, profit margins, industry dynamics, and company size, the fair PE for Fifth Third is 14.0x. This benchmark goes beyond basic peer or industry averages by layering in factors that directly affect what a rational investor should pay for the company’s earnings today.

With a current PE of 13.0x and a fair value benchmark at 14.0x, Fifth Third Bancorp's shares are trading slightly below their calculated fair value. This suggests potential undervaluation by the market right now.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fifth Third Bancorp Narrative

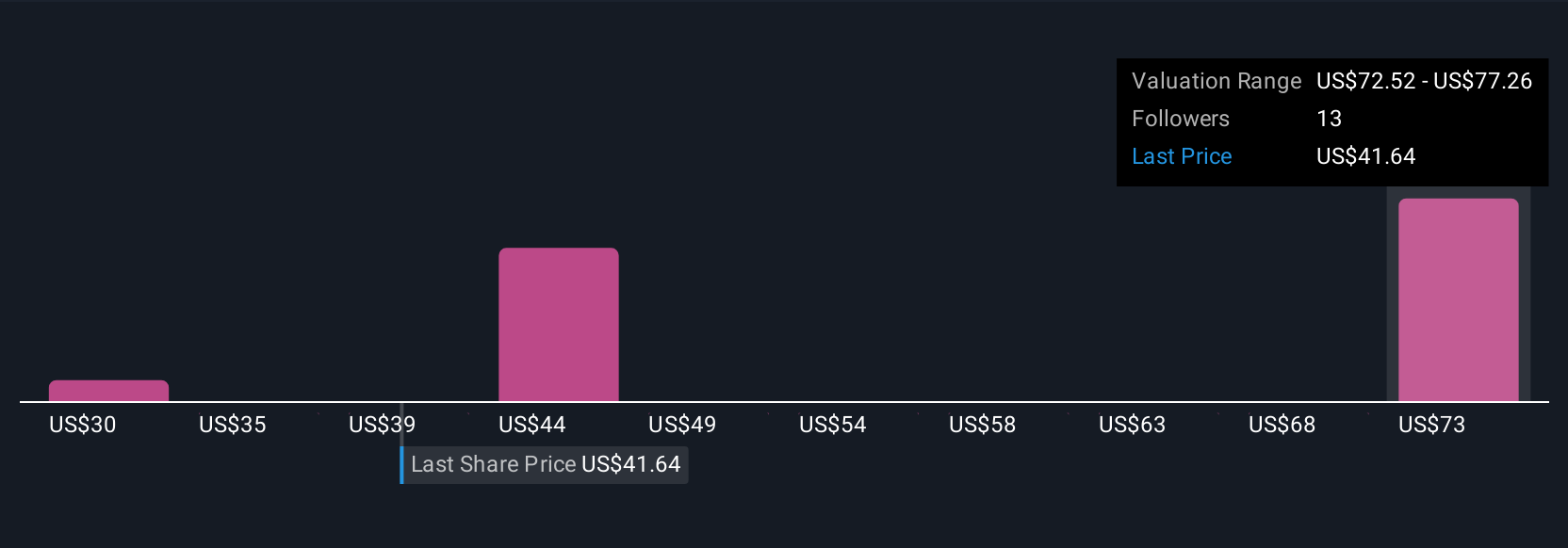

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your personal perspective, a story you build about where Fifth Third Bancorp is headed, supported by your assumptions about its future revenues, earnings, and profit margins. Narratives connect the company’s real-world journey to clear financial forecasts and then translate them directly into a fair value. This approach makes complex analysis accessible to everyone, not just the pros.

On Simply Wall St’s Community page, millions of investors already use Narratives to quickly see whether a stock looks under- or over-valued according to their view, based on the latest news, earnings, and changing expectations. Instead of relying solely on static price targets or ratios, Narratives update dynamically when new information arrives. This allows your fair value and buy or sell decisions to stay current. For example, some investors might be optimistic about Fifth Third Bancorp’s Southeast expansion and digital lending platform and so project a robust fair value of $55, while others may focus on regulatory headwinds or slowing loan growth and set their fair value closer to $43. With Narratives, your investment stance becomes clear and actionable in real time.

Do you think there's more to the story for Fifth Third Bancorp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives