- United States

- /

- Banks

- /

- NasdaqGS:FIBK

First Interstate BancSystem (FIBK): Is the $150 Million Buyback Changing the Valuation Picture?

Reviewed by Simply Wall St

Most Popular Narrative: 1.9% Overvalued

The current consensus among analysts is that First Interstate BancSystem’s shares are trading just above fair value, with cautious optimism surrounding future potential.

"With over 70% of its deposits located in markets growing faster than the national average and a large, low-cost granular deposit base, First Interstate is poised to benefit from ongoing economic and population expansion in the Mountain West and Midwest. This supports long-term organic loan and deposit growth, which should positively impact future revenues and earnings."

What is fueling this eyebrow-raising price target? Analysts are betting on a dramatic transformation powered by bold assumptions that are not found in every research report. Want to see exactly what kind of expansion and financial leap analysts are forecasting? The key drivers of this valuation might surprise you.

Result: Fair Value of $32.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in loan balances and rising asset quality pressures could quickly challenge even the most optimistic outlook for First Interstate BancSystem.

Find out about the key risks to this First Interstate BancSystem narrative.Another View: Discounted Cash Flow Tells a Different Story

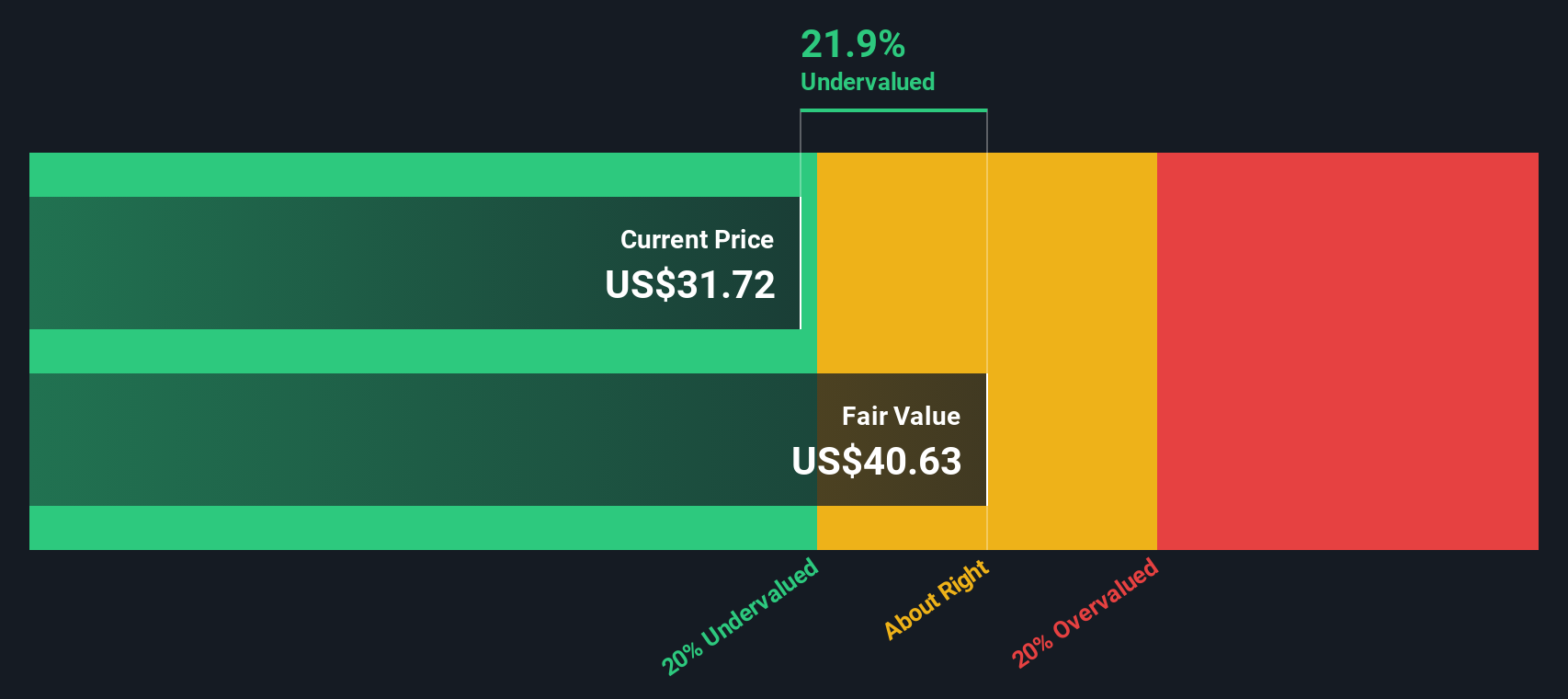

Taking a look at First Interstate BancSystem through our DCF model, the company appears undervalued based on future cash flow expectations. This approach offers a strikingly different conclusion from the consensus price target. Which perspective is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Interstate BancSystem for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Interstate BancSystem Narrative

If you want to dig deeper or draw your own conclusions from the numbers, you can easily craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your First Interstate BancSystem research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for opportunities others might overlook, so don’t limit your portfolio. There are dynamic investment themes you could be missing out on right now.

- Supercharge your watchlist and tap into the latest digital trends by checking out AI penny stocks reshaping industries with artificial intelligence breakthroughs.

- Lock in passive income with financial strength by finding dividend stocks with yields > 3% offering sustainable yields above 3% for more reliable returns in any market.

- Ride the next wave of innovation by searching for quantum computing stocks poised to accelerate growth with quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives