- United States

- /

- Banks

- /

- NYSE:NTB

3 Dividend Stocks Yielding Up To 6.1%

Reviewed by Simply Wall St

As the U.S. stock markets grapple with the impact of newly imposed tariffs and economic uncertainties, investors are increasingly seeking stability in dividend stocks. In such volatile times, a good dividend stock can provide a reliable income stream while potentially offering some insulation from market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.46% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.99% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.52% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.99% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.70% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.16% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.55% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.14% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

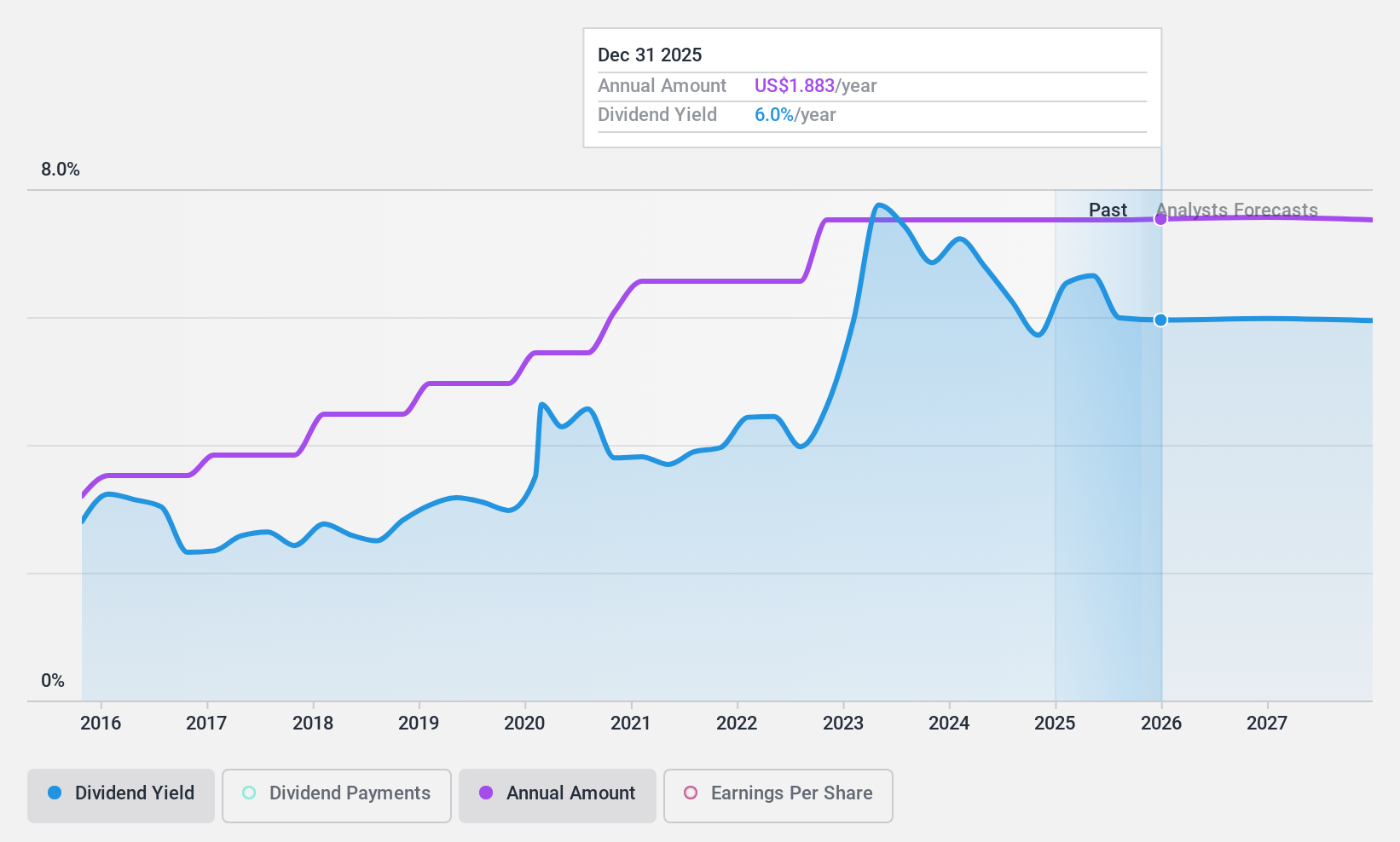

First Interstate BancSystem (NasdaqGS:FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering a variety of banking products and services across the United States with a market cap of $3.21 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily through its Community Banking segment, which accounts for $931.90 million.

Dividend Yield: 6.1%

First Interstate BancSystem offers a compelling dividend yield of 6.14%, placing it in the top 25% of U.S. dividend payers, with stable and growing dividends over the past decade. Despite recent financial challenges, including increased net charge-offs and decreased net income to US$226 million in 2024, dividends remain covered by earnings at an 85.7% payout ratio and are expected to be sustainable with improved coverage forecasted in three years. Recent executive changes aim for strategic continuity amidst these financial dynamics.

- Dive into the specifics of First Interstate BancSystem here with our thorough dividend report.

- The valuation report we've compiled suggests that First Interstate BancSystem's current price could be quite moderate.

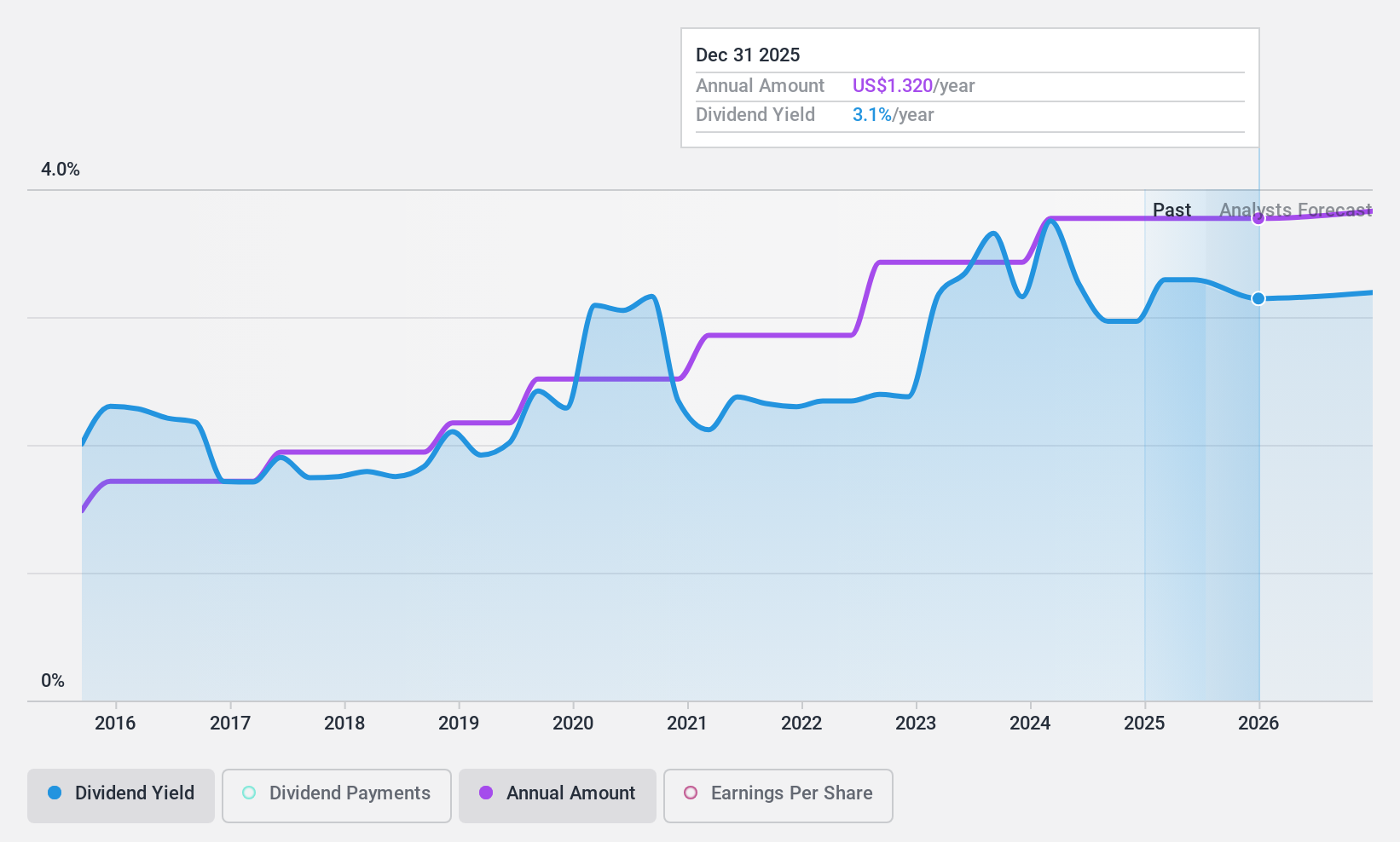

TriCo Bancshares (NasdaqGS:TCBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.44 billion.

Operations: TriCo Bancshares generates revenue primarily through its Community Banking segment, which accounts for $389.19 million.

Dividend Yield: 3%

TriCo Bancshares maintains a stable dividend history, with its recent quarterly dividend of US$0.33 per share reflecting a consistent payout strategy supported by a 38% earnings coverage ratio. Despite lower-than-top-tier yields at 3.05%, the dividends have shown growth and stability over the past decade. Recent financial results indicated slight declines in net interest income and net income for 2024, while upcoming executive changes are expected to be smoothly managed without impacting financial practices.

- Unlock comprehensive insights into our analysis of TriCo Bancshares stock in this dividend report.

- Upon reviewing our latest valuation report, TriCo Bancshares' share price might be too pessimistic.

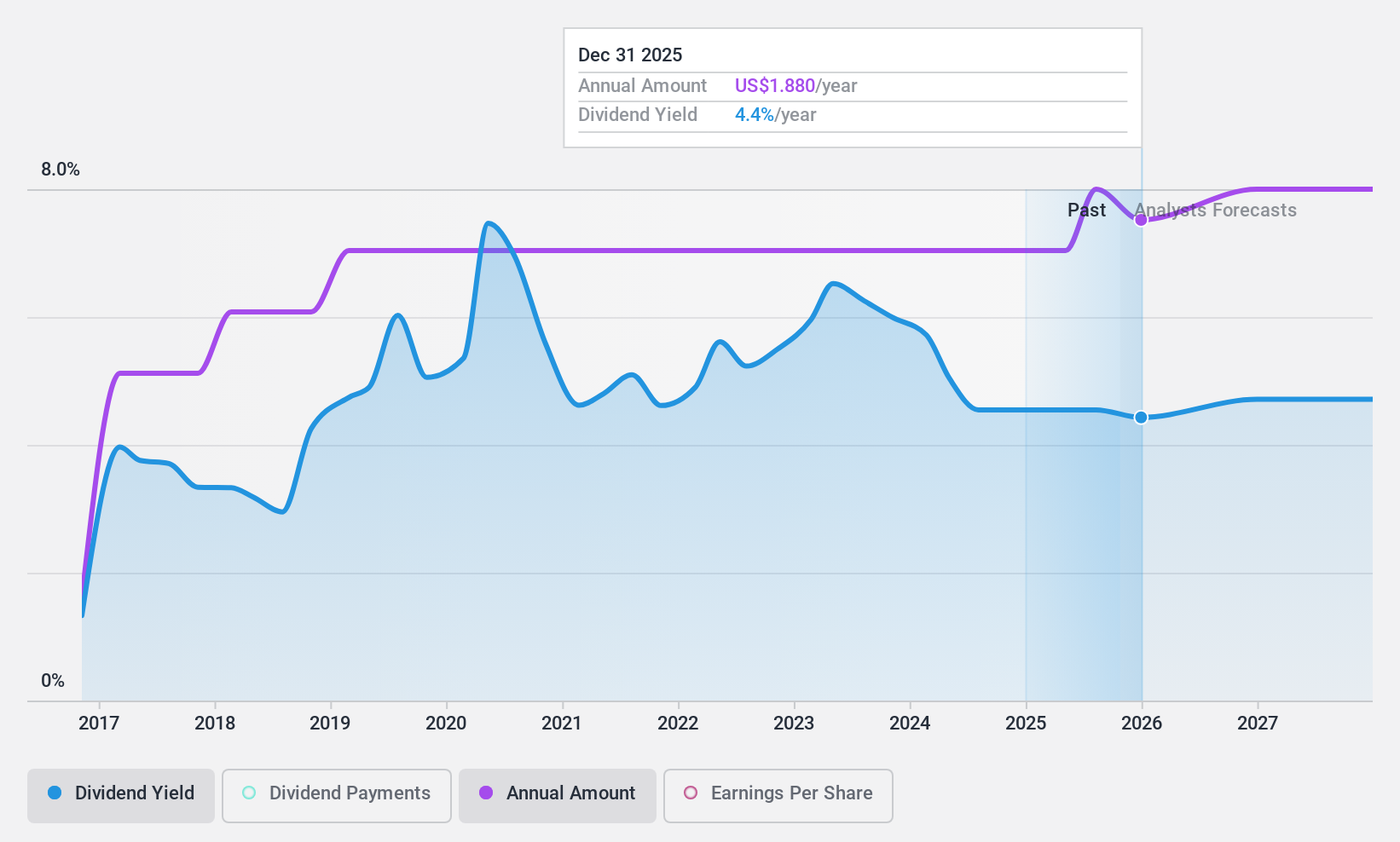

Bank of N.T. Butterfield & Son (NYSE:NTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of N.T. Butterfield & Son Limited offers community, commercial, and private banking services to individuals and small to medium-sized businesses, with a market cap of $1.67 billion.

Operations: The Bank of N.T. Butterfield & Son Limited generates $579.93 million in revenue from its banking services segment.

Dividend Yield: 4.5%

Bank of N.T. Butterfield & Son offers a compelling dividend profile with a payout ratio of 36.7%, ensuring dividends are well covered by earnings. Despite having paid dividends for less than 10 years, the yield is competitive at 4.53%. Recent earnings showed slight declines in net interest income and net income for 2024, yet the company continues to support its dividend strategy with a recent quarterly payment of $0.44 per share and ongoing share repurchase activities totaling $69.76 million as part of its capital management priorities.

- Navigate through the intricacies of Bank of N.T. Butterfield & Son with our comprehensive dividend report here.

- Our expertly prepared valuation report Bank of N.T. Butterfield & Son implies its share price may be lower than expected.

Summing It All Up

- Explore the 143 names from our Top US Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bank of N.T. Butterfield & Son might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTB

Bank of N.T. Butterfield & Son

Provides a range of community, commercial, and private banking services to individuals and small to medium-sized businesses.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)