- United States

- /

- Banks

- /

- NasdaqGS:FHB

First Hawaiian (FHB) Valuation: Is There Still Upside After Mixed Share Performance?

Reviewed by Kshitija Bhandaru

First Hawaiian (FHB) shares have shown mixed returns over the past year, drawing investor interest as banks respond to shifting economic conditions. Recent performance hints at evolving sentiment. This has prompted questions about value and outlook for this regional player.

See our latest analysis for First Hawaiian.

First Hawaiian’s share price has edged lower in recent months, as investor caution persists in the banking sector. Still, the bank’s 1-year total shareholder return of 12% signals some resilience, while long-term holders have seen solid gains build up over five years.

If you’re looking to broaden your strategy beyond regional banks, this could be the perfect chance to explore fast growing stocks with high insider ownership.

The question now is whether First Hawaiian’s current valuation offers a compelling entry point for investors, or if the recent share price already reflects expectations for future growth and stability in the sector.

Most Popular Narrative: 5.8% Undervalued

With First Hawaiian shares closing at $24.61 and the most-followed narrative setting fair value at $26.13, the gap between price and projection has investors watching closely for catalysts that could unlock fresh upside.

The ongoing expansion in Hawaii's population and consistently rising tourism spending are supporting stable to growing demand for loans and banking services. This should lead to gradually increasing loan balances and higher fee-based revenue over time.

Want to know what powers this upbeat valuation? The blueprint is based on aggressive assumptions for top-line growth, margin discipline, and a future profit multiple comparable to industry leaders. Can First Hawaiian meet these expectations, or is the story too good to be true? Uncover the numbers that could drive the next move.

Result: Fair Value of $26.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent deposit outflows or unexpected weakness in Hawaii's regional economy could quickly challenge the optimistic forecast for First Hawaiian's future growth.

Find out about the key risks to this First Hawaiian narrative.

Another View: A Closer Look at Price Ratios

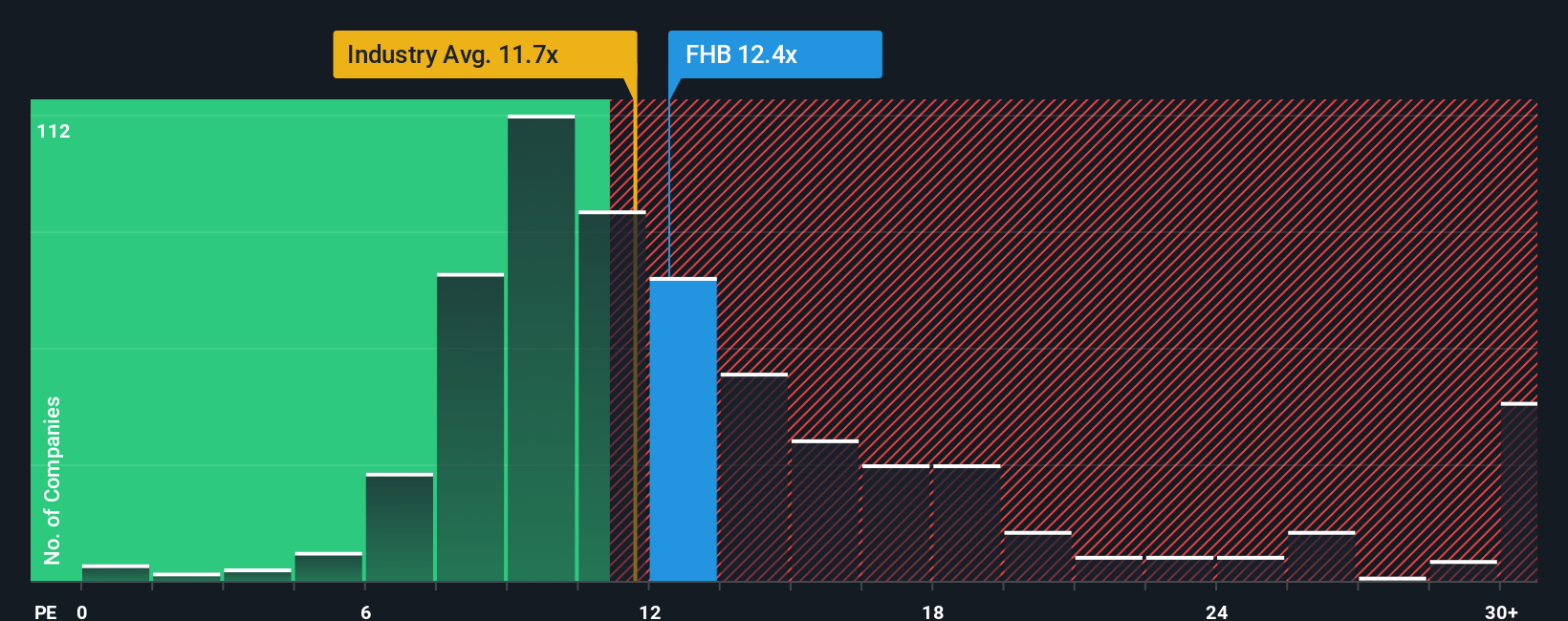

While some see First Hawaiian as slightly undervalued based on future earnings, our comparison with U.S. bank peers raises caution. The company trades at a price-to-earnings ratio of 12.4x, slightly higher than the industry’s 11.8x and notably above its fair ratio of 11.2x. This suggests valuation risk if market sentiment shifts. Could this leave less room for upside than the optimistic forecasts imply?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Hawaiian Narrative

If you’re curious to dig deeper, the data is yours to explore. Shaping your own investment narrative is just a few minutes away with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding First Hawaiian.

Looking for more investment ideas?

Smart investors act quickly on new opportunities. Don’t let the next big trend pass you by. Find potential gems in fast-changing sectors using our handpicked tools below.

- Tap into future breakthroughs by searching for innovation leaders at the forefront with these 24 AI penny stocks.

- Pocket consistent income by targeting strong yield plays among these 19 dividend stocks with yields > 3%.

- Ride the digital asset wave and track those reshaping finance by following these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FHB

First Hawaiian

Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives