- United States

- /

- Banks

- /

- NasdaqGS:MCBS

Three Hidden Stock Gems in the United States with Promising Potential

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 2.3% over the last week and an impressive 35% in the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can uncover hidden gems that may offer promising opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: First Community Bankshares, Inc. is the financial holding company for First Community Bank, offering a range of banking products and services, with a market cap of $776.27 million.

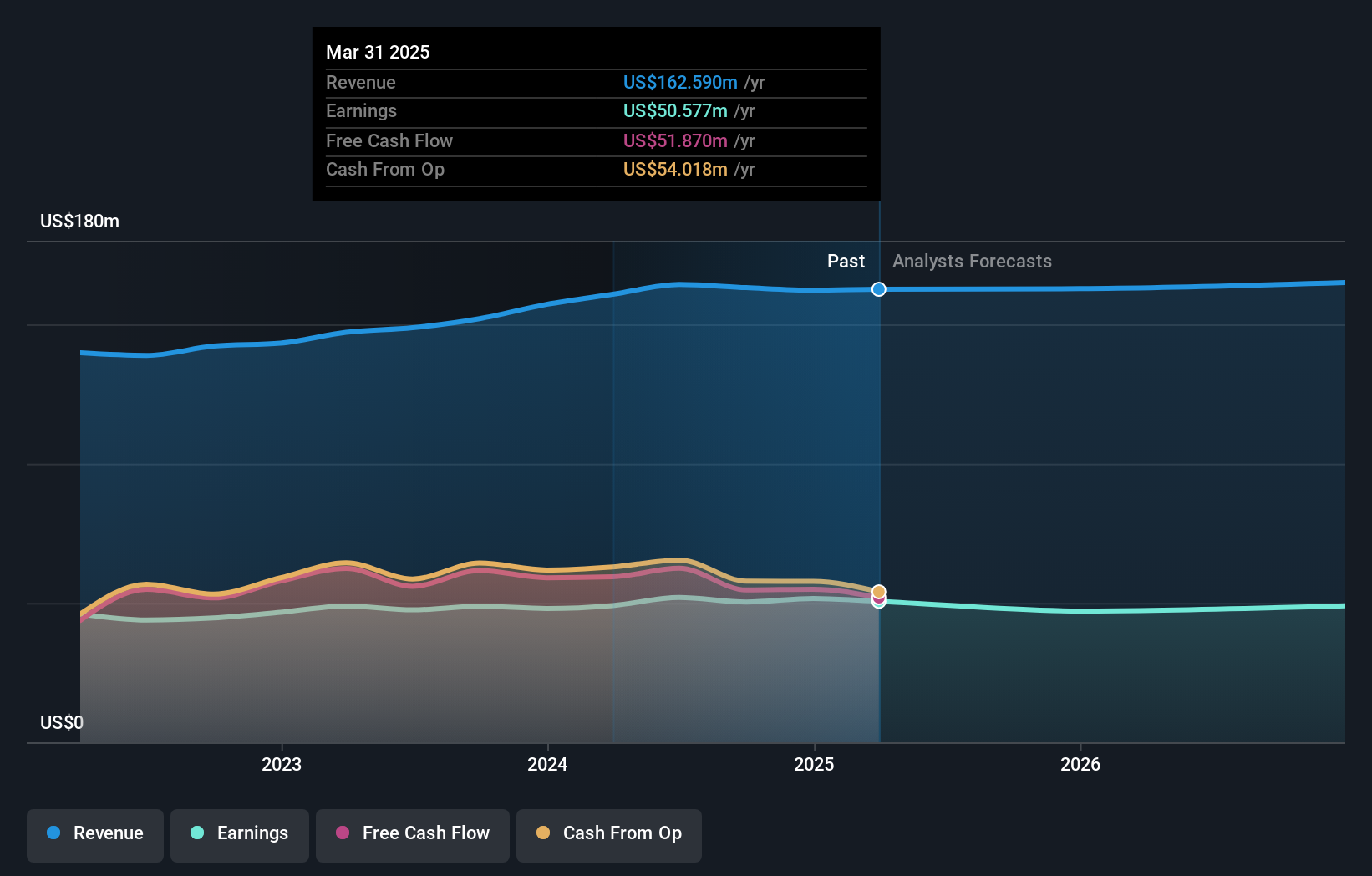

Operations: First Community Bankshares generates its revenue primarily from its community banking segment, which contributed $163.17 million. The company operates with a market cap of $776.27 million.

First Community Bankshares, with total assets of US$3.2 billion and equity of US$520.7 million, is a small cap financial entity that has shown resilience in a challenging industry landscape. Its total deposits stand at US$2.7 billion against loans of US$2.4 billion, supported by a net interest margin of 4.4%. The bank's allowance for bad loans is robust at 176%, covering non-performing loans which are just 0.8% of the total loan portfolio—indicative of sound risk management practices. Despite earnings growth outpacing the industry last year at 3.1%, future projections suggest an average annual decline of 2.5% over the next three years, posing potential challenges ahead.

- Click here and access our complete health analysis report to understand the dynamics of First Community Bankshares.

Gain insights into First Community Bankshares' past trends and performance with our Past report.

MetroCity Bankshares (NasdaqGS:MCBS)

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is a bank holding company for Metro City Bank, offering a range of banking products and services in the United States with a market capitalization of $767.81 million.

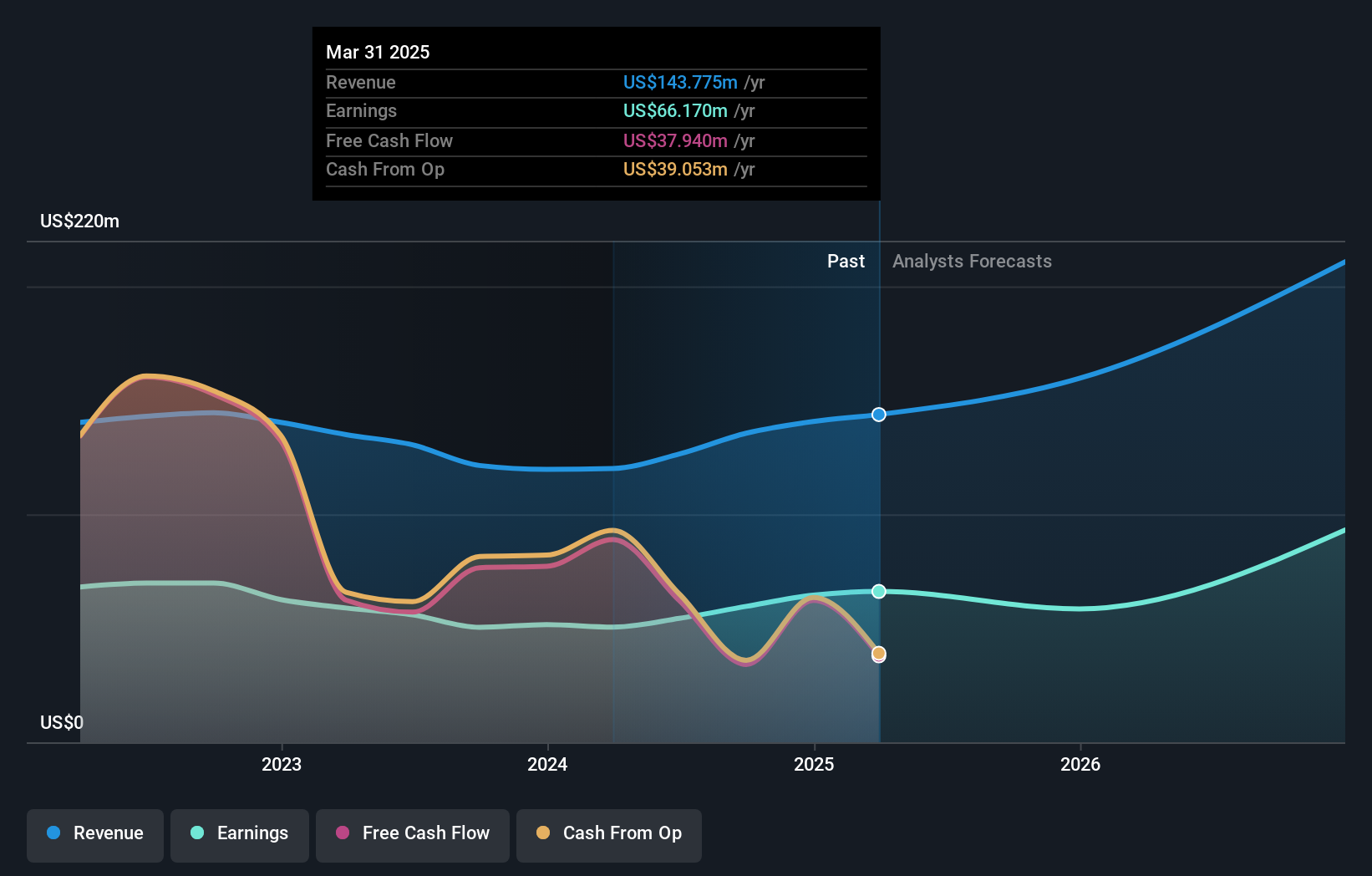

Operations: The primary revenue stream for MetroCity Bankshares comes from its community banking segment, generating $135.57 million. The company has a market capitalization of $767.81 million.

MetroCity Bankshares, with total assets of US$3.6 billion and equity of US$407.2 million, is a noteworthy player in the financial sector. The bank's robust allowance for bad loans stands at 0.5% of total loans, demonstrating prudent risk management. With deposits totaling US$2.7 billion and loans amounting to US$3.1 billion, it showcases a stable funding base primarily from customer deposits (86%). Recent earnings growth outpaced the industry at 18.2%, highlighting its competitive edge despite significant insider selling recently noted over three months ago and no shares repurchased in the last quarter under its buyback program.

United Fire Group (NasdaqGS:UFCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc., along with its subsidiaries, offers property and casualty insurance services to individuals and businesses across the United States, with a market capitalization of $504.95 million.

Operations: United Fire Group generates revenue primarily through property and casualty insurance services. The company's financial performance is influenced by its underwriting activities, investment income, and claims expenses.

United Fire Group, a nimble player in the insurance sector, has shown impressive financial resilience. Recently reporting a net income of US$19.75 million for Q3 2024 against US$6.38 million the previous year, the company is debt-free and boasts high-quality earnings. Its price-to-earnings ratio stands at 12.5x, undercutting the broader US market's 18.3x benchmark, suggesting potential undervaluation. With free cash flow positive and profitability achieved this year, United Fire Group seems well-positioned within its industry context to capitalize on future opportunities while maintaining robust financial health without debt concerns.

- Unlock comprehensive insights into our analysis of United Fire Group stock in this health report.

Understand United Fire Group's track record by examining our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 225 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCBS

MetroCity Bankshares

Operates as the bank holding company for Metro City Bank that provides banking products and services in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives