- United States

- /

- Capital Markets

- /

- NYSE:VRTS

First Community Bankshares Leads Our 3 Top Dividend Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight downturn following a record-breaking winning streak, investors are closely monitoring the Federal Reserve's stance on interest rates and trade tariffs. Amidst this backdrop of economic uncertainty, dividend stocks remain an attractive option for those seeking steady income streams, with First Community Bankshares leading our list of top picks due to its consistent performance and reliable payouts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.09% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.35% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.04% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.55% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.05% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.94% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.13% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.59% | ★★★★★☆ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.29% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.46% | ★★★★★☆ |

Click here to see the full list of 151 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Community Bankshares, Inc. is the financial holding company for First Community Bank, offering a range of banking products and services, with a market cap of approximately $708.86 million.

Operations: First Community Bankshares, Inc. generates revenue through its Community Banking segment, which accounts for $162.59 million.

Dividend Yield: 3.2%

First Community Bankshares continues its 40-year streak of regular dividends, recently declaring a quarterly dividend of US$0.31 per share. Despite a lower dividend yield of 3.22% compared to top-tier payers, the payout is well-covered by earnings with a low payout ratio of 44.9%. The company has consistently increased its dividends over the past decade, though recent earnings show slight declines and net charge-offs were reported at US$1.39 million for Q1 2025.

- Click to explore a detailed breakdown of our findings in First Community Bankshares' dividend report.

- Our valuation report here indicates First Community Bankshares may be overvalued.

Valley National Bancorp (NasdaqGS:VLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valley National Bancorp is the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management services with a market cap of approximately $4.98 billion.

Operations: Valley National Bancorp generates revenue through its diverse financial services, including commercial and private banking, retail offerings, insurance products, and wealth management solutions.

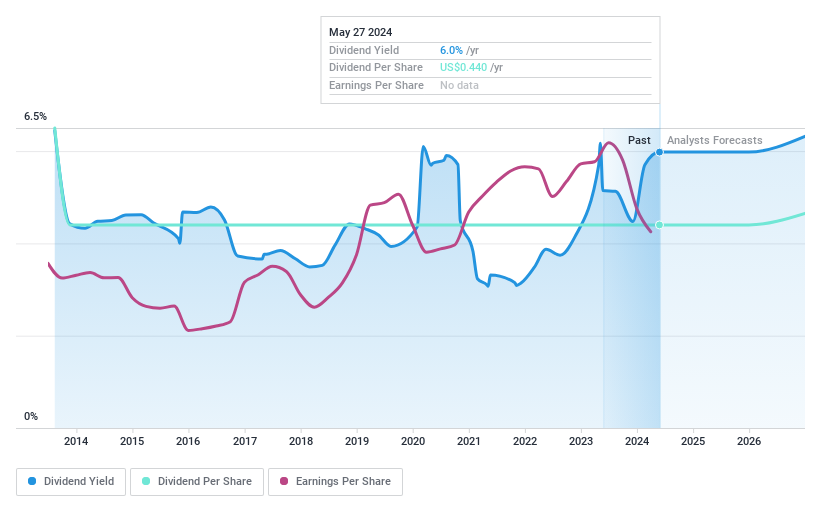

Dividend Yield: 4.9%

Valley National Bancorp offers a high dividend yield of 4.94%, placing it in the top 25% of US dividend payers, with dividends currently covered by earnings at a payout ratio of 63.6%. However, its dividend payments have been unstable over the past decade and have not grown. Recent earnings showed net interest income increased to US$420.11 million, though net charge-offs rose to US$41.95 million for Q1 2025.

- Navigate through the intricacies of Valley National Bancorp with our comprehensive dividend report here.

- According our valuation report, there's an indication that Valley National Bancorp's share price might be on the cheaper side.

Virtus Investment Partners (NYSE:VRTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of approximately $1.11 billion.

Operations: Virtus Investment Partners generates revenue primarily through its asset management services, amounting to $902.84 million.

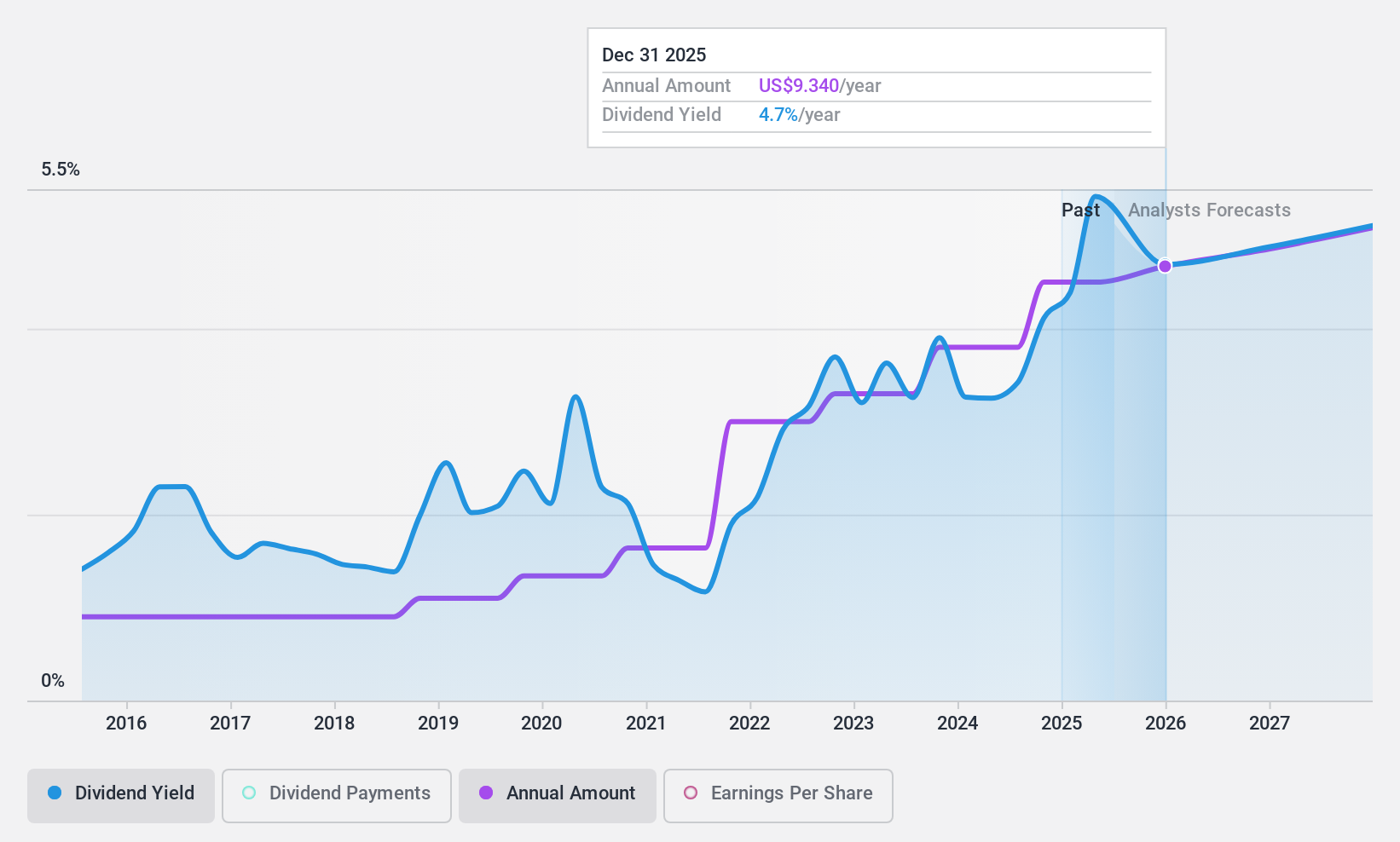

Dividend Yield: 5.6%

Virtus Investment Partners offers a dividend yield of 5.64%, ranking it among the top 25% of US dividend payers, with stable and growing dividends over the past decade. Despite a reasonable payout ratio of 50.5%, dividends aren't covered by free cash flows or earnings, raising sustainability concerns. Recent Q1 2025 results showed slight declines in revenue to US$217.93 million and net income to US$28.65 million, while completing significant share buybacks totaling US$709.16 million since 2010.

- Delve into the full analysis dividend report here for a deeper understanding of Virtus Investment Partners.

- Insights from our recent valuation report point to the potential undervaluation of Virtus Investment Partners shares in the market.

Next Steps

- Take a closer look at our Top US Dividend Stocks list of 151 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Virtus Investment Partners, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives