- United States

- /

- Banks

- /

- NasdaqGS:FBNC

Is First Bancorp Still an Opportunity After Its 21.7% Surge in 2025?

Reviewed by Bailey Pemberton

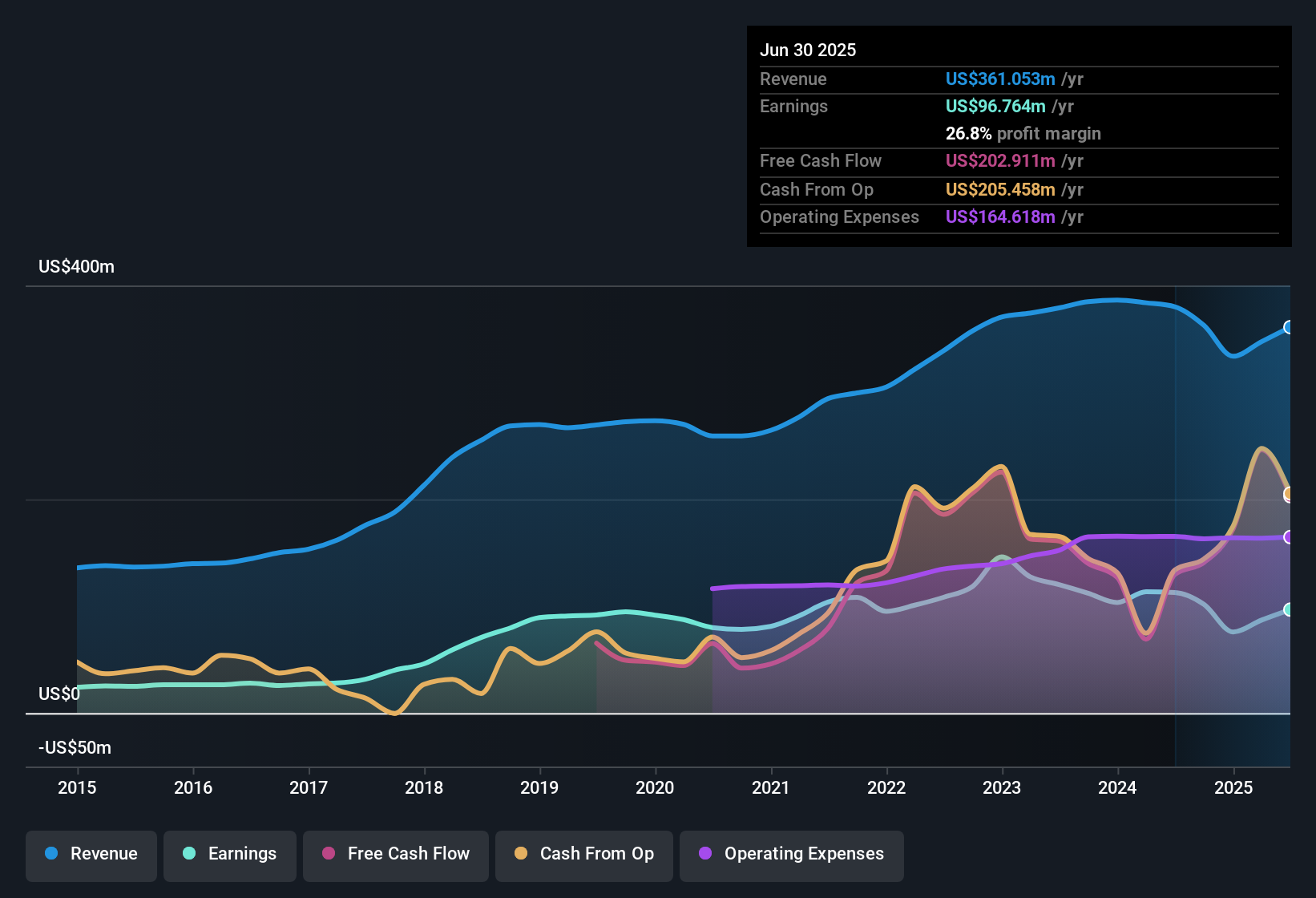

If you have First Bancorp in your portfolio or on your watchlist, you're probably wondering if now is the right moment to act, hold, or move on. The stock has shown quite the journey recently. After a slight 1.5% dip over the last week and a 5.6% slide in the past month, it is still up an impressive 21.7% since the start of the year, not to mention a massive 151.9% gain over the last five years. Clearly, there has been real momentum here, but also some near-term volatility that has left investors sizing up its true potential.

A lot of this movement can be traced to broader trends in the banking sector, from shifting interest rate expectations to renewed confidence after a period of financial caution. First Bancorp, known for steady performance, seems to have benefited both from the sector’s rebound and increased optimism about regional banks’ resilience.

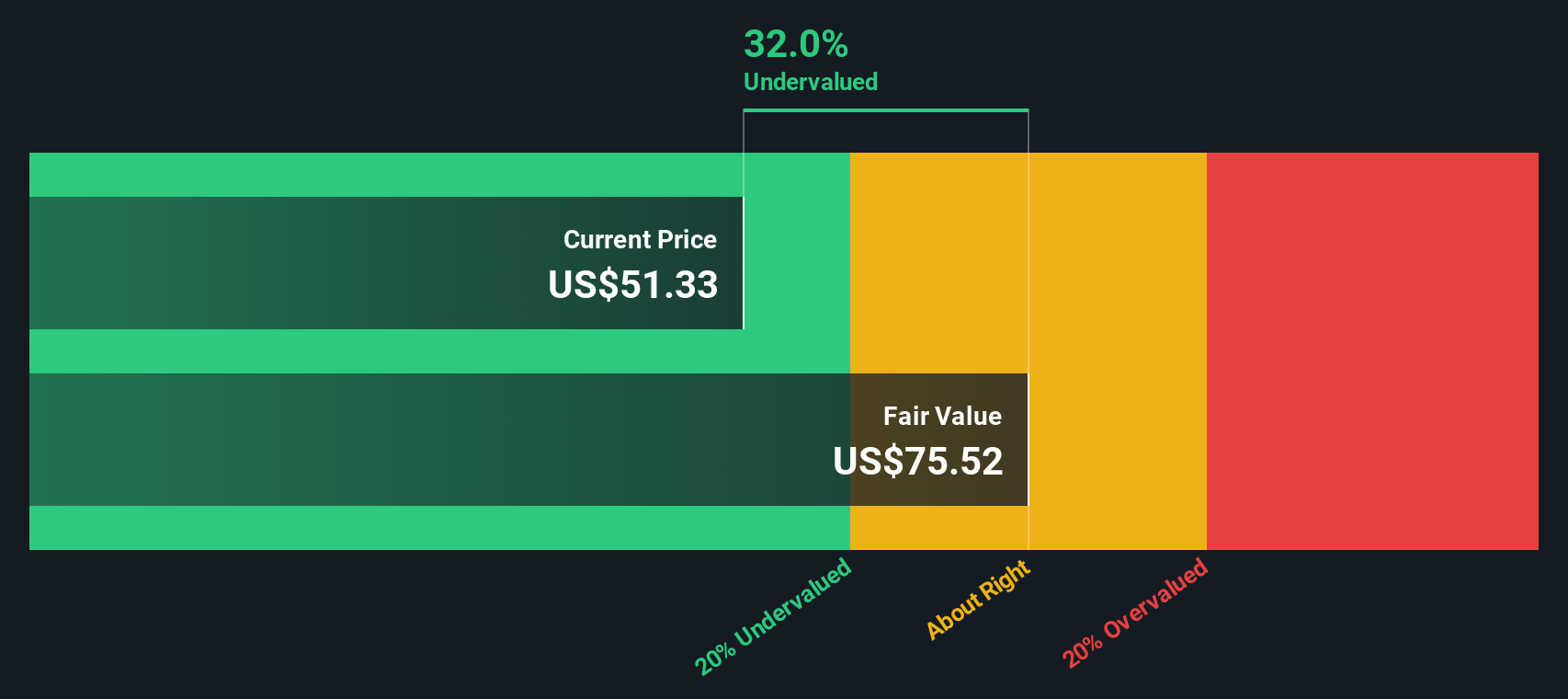

But with markets always forward-looking, deciding whether First Bancorp stock is undervalued, fairly priced, or even a bit frothy is more than just a numbers game. On a standard value screening, the company scores a 2, meaning it is considered undervalued by two out of six valuation checks. That is enough to warrant closer inspection, but not a slam dunk either.

Let’s break down what these valuation approaches actually tell us about the stock’s prospects. Stay tuned, because there is a smarter way to interpret these numbers than you might expect, coming up at the end of the article.

First Bancorp scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Bancorp Excess Returns Analysis

The Excess Returns model estimates a company's intrinsic value by focusing on how much profit it generates above the required return for its equity investors, based on its book value. In simpler terms, this approach asks whether First Bancorp is creating value over and above what its shareholders could earn elsewhere with the same amount of risk.

For First Bancorp, the relevant numbers paint a clear picture. The company’s Book Value stands at $37.53 per share, while its stable, forward-looking Earnings Per Share (EPS) is projected at $4.05. This profitability is judged against a Cost of Equity of $2.77 per share. The result is that First Bancorp delivers an annual Excess Return of $1.28 per share for its shareholders, with an average Return on Equity of 9.90%. Notably, analysts expect both EPS and Book Value per share to rise steadily, with stable Book Value projections reaching $40.90 per share in coming years.

After calculating these excess returns over time and discounting them to the present, the model values First Bancorp at a 30.7% discount to its intrinsic value, indicating the stock is significantly undervalued based on its profitability relative to invested capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Bancorp is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: First Bancorp Price vs Earnings

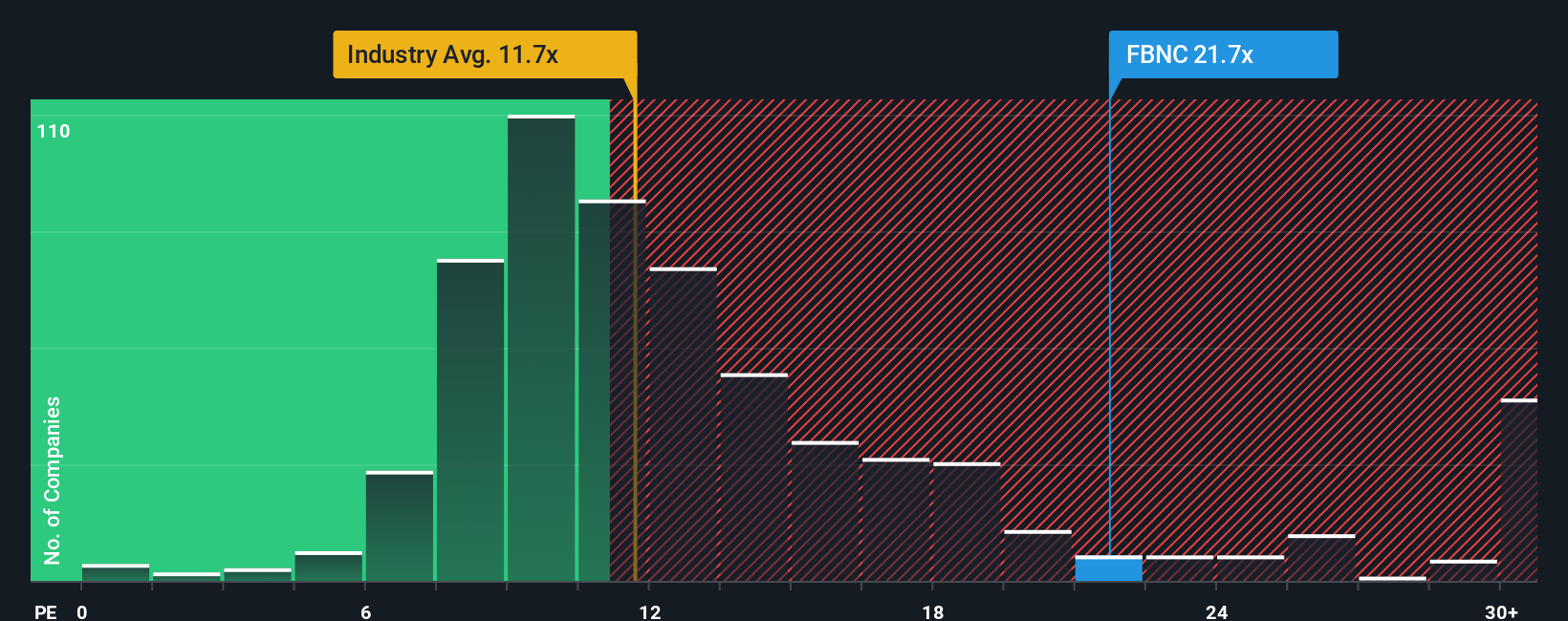

For profitable companies like First Bancorp, the Price-to-Earnings (PE) ratio is a widely used and suitable way to assess valuation. It tells investors how much they're paying for each dollar of earnings, which is especially meaningful when a business has a consistent profit history. The "right" PE ratio to use as a reference, however, depends on expectations for future earnings growth and the risks associated with those earnings. Faster-growing or more stable companies often justify higher multiples.

First Bancorp currently trades at a PE ratio of 22.4x. To put this in context, this is notably higher than the average for its direct peers at 14.4x and the broader banking industry, which stands at 11.8x. At first glance, this suggests a premium valuation. However, simple peer or industry comparisons can be misleading, as they do not fully capture the company’s unique prospects or risk profile.

This is where the proprietary “Fair Ratio” from Simply Wall St comes in. Rather than relying solely on broad benchmarks, the Fair Ratio calculates what a justified PE multiple should be for First Bancorp by considering its earnings growth, size, profit margins, and risks, all in the context of its industry and the overall market. For First Bancorp, the Fair Ratio is calculated at 16.4x. Compared with its actual PE of 22.4x, the shares appear somewhat expensive on this metric, indicating that the stock may be overvalued relative to what is warranted by fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Bancorp Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful framework where you connect your story about a company, such as what you believe about its future growth or business strategy, directly to your underlying financial forecast. This includes the fair value you estimate, and your assumptions about future revenue, earnings, and margins.

Narratives go beyond static numbers by linking the company’s story with dynamic forecasts, allowing you to see how your outlook translates into a financial valuation. This approach creates a more holistic investment process, where you can easily adjust your expectations and see the impact instantly. On Simply Wall St’s Community page, millions of investors create and share Narratives, making this tool both easy to use and widely accessible.

With Narratives, you can clearly compare your estimated Fair Value to the stock’s current Price, helping you decide when to buy, hold, or sell. As new information comes in, such as earnings reports or news events, Narratives are updated in real time to ensure your analysis stays relevant. For example, some investors see First Bancorp as worth as much as $80 per share based on aggressive growth, while others estimate a fair value closer to $40, reflecting more cautious assumptions.

Do you think there's more to the story for First Bancorp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion