The First Bancshares, Inc.'s (NASDAQ:FBMS) dividend will be increasing to US$0.15 on 25th of August. This takes the annual payment to 1.4% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for First Bancshares

First Bancshares' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, First Bancshares' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 5.1% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 22% by next year, which is in a pretty sustainable range.

First Bancshares Has A Solid Track Record

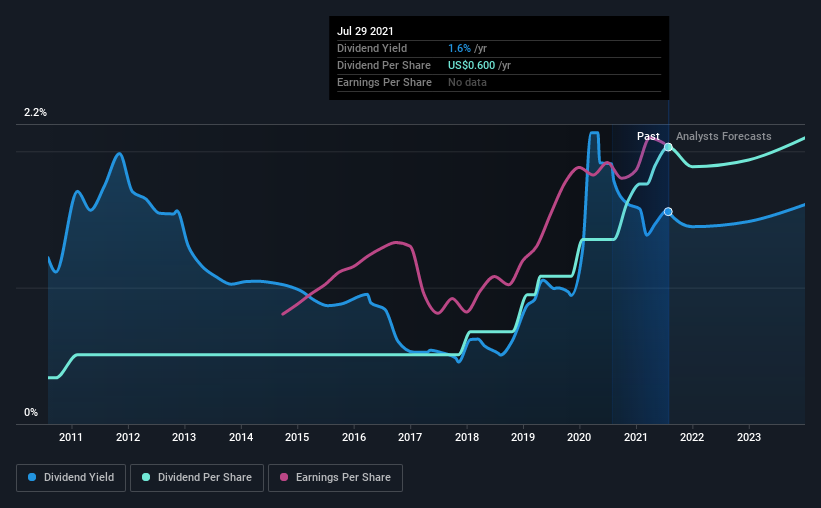

The company has a sustained record of paying dividends with very little fluctuation. Since 2011, the dividend has gone from US$0.10 to US$0.60. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

First Bancshares Could Grow Its Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that First Bancshares has grown earnings per share at 9.8% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

We Really Like First Bancshares' Dividend

Overall, a dividend increase is always good, and we think that First Bancshares is a strong income stock thanks to its track record and growing earnings. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for First Bancshares that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade First Bancshares, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:FBMS

First Bancshares

Operates as the bank holding company for The First Bank that provides general commercial and retail banking services.

Flawless balance sheet established dividend payer.