- United States

- /

- Trade Distributors

- /

- NYSE:GIC

US Market's Hidden Treasures Featuring Esquire Financial Holdings Plus 2 More

Reviewed by Simply Wall St

The United States market has shown a positive trend, with a 1.8% rise over the last week and a 10% increase in the past year, while earnings are projected to grow by 14% annually. In this environment, identifying stocks that offer unique opportunities and potential for growth can be key to uncovering hidden treasures like Esquire Financial Holdings and others.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services to legal and small businesses as well as commercial and retail customers in the United States, with a market cap of approximately $572.89 million.

Operations: Esquire Financial Holdings generates revenue primarily from its community banking segment, totaling $120.12 million. The company's financial performance includes a focus on commercial banking products and services tailored to legal and small business clients.

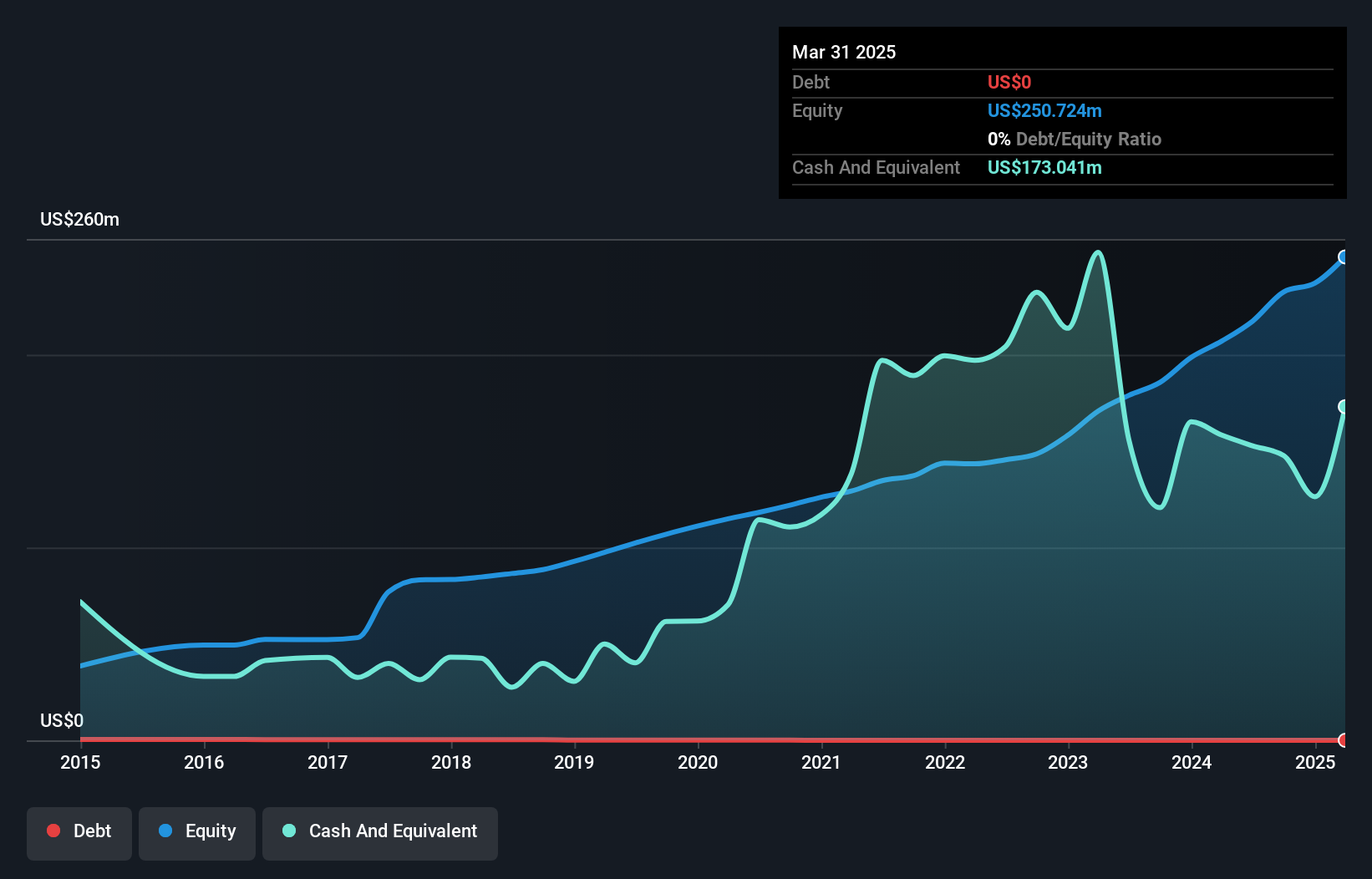

With total assets of US$1.9 billion and equity of US$237.1 million, Esquire Financial Holdings stands out with its robust financial health. It has deposits totaling US$1.6 billion and loans at US$1.4 billion, maintaining a net interest margin of 6.1%. The bank's allowance for bad loans is sufficient at 0.8% of total loans, indicating prudent risk management practices. Earnings grew by 6% over the past year, outperforming the industry average by a significant margin and trading at approximately 61% below estimated fair value suggests potential undervaluation in the market’s eyes.

- Click here and access our complete health analysis report to understand the dynamics of Esquire Financial Holdings.

Learn about Esquire Financial Holdings' historical performance.

Global Industrial (NYSE:GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of MRO products in the United States and Canada, with a market cap of approximately $857.02 million.

Operations: Global Industrial generates revenue primarily from its Industrial Products Group, totaling $1.32 billion. The company's market cap stands at approximately $857.02 million.

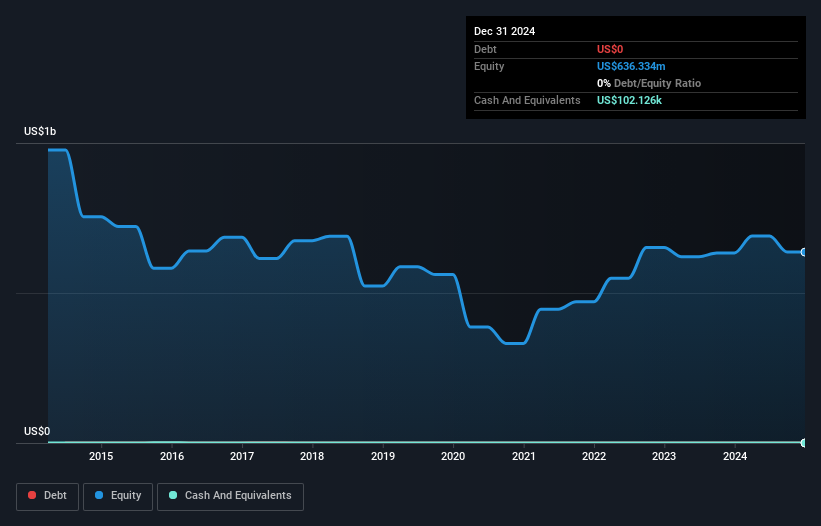

Global Industrial, a smaller player in the industrial distribution sector, recently appointed Anesa Chaibi as CEO, bringing her extensive B2B and e-commerce experience to the forefront. Despite facing challenges such as a 5.6% drop in Q4 sales to US$302 million and net income falling to US$10.7 million from US$15.3 million, strategic initiatives like Salesforce integration aim to boost customer engagement and operational efficiency. With earnings per share at US$0.27 compared to last year's US$0.40, analysts are optimistic about revenue growth of 2.9% annually over three years, projecting profit margins rising from 4.6% to 6.6%.

Adams Natural Resources Fund (NYSE:PEO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Adams Natural Resources Fund, Inc. is a publicly owned investment manager with a market capitalization of approximately $592.45 million.

Operations: Adams Natural Resources Fund generates revenue primarily from its closed-end funds segment, amounting to $20.33 million.

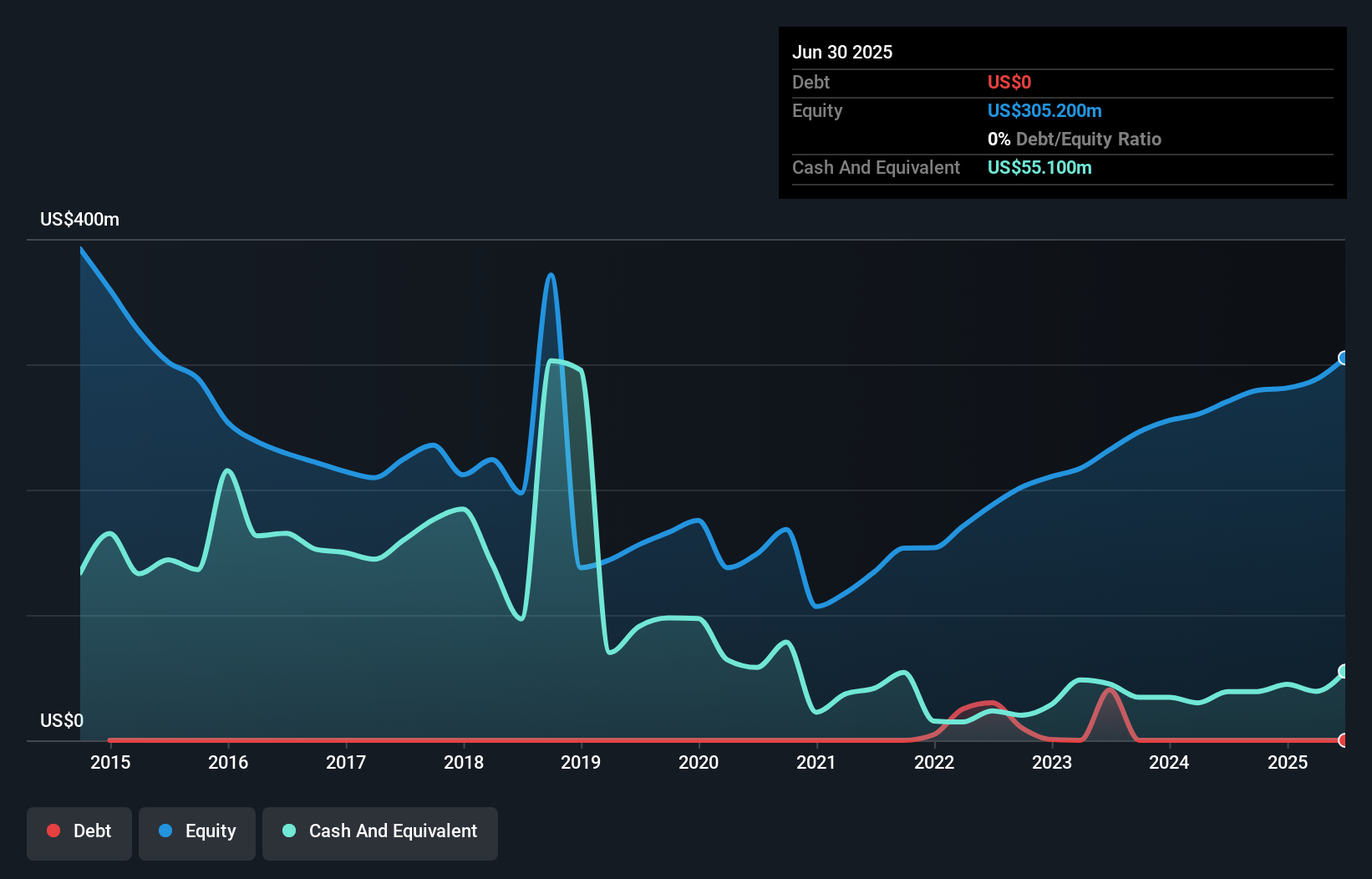

Adams Natural Resources Fund showcases impressive earnings growth, with a 218% increase over the past year, significantly outpacing the Capital Markets industry's 18%. The company reported a net income of US$30.85 million for 2024, bolstered by a one-off gain of US$14.2 million. Trading at about 59% below its estimated fair value, it presents an intriguing investment case despite recent dividend decreases to $0.53 per share. Notably debt-free for five years, Adams seems well-positioned financially but faces uncertainty regarding its cash runway due to insufficient data on free cash flow trends.

Next Steps

- Gain an insight into the universe of 286 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives