- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Undiscovered Gems in the US Market to Watch This December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.1%, yet it remains robust with a 22% increase over the past year and earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover undiscovered gems that may offer promising opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services primarily to the legal industry, small businesses, and various customers across the United States with a market capitalization of approximately $616.60 million.

Operations: Esquire Financial Holdings generates its revenue primarily through community banking, with reported revenues of $116.21 million. The company has a market capitalization of approximately $616.60 million.

Esquire Financial Holdings, a nimble player in the financial sector, boasts total assets of US$1.8 billion with equity at US$232.6 million. The company is trading at 57% below its estimated fair value and has a net interest margin of 6.1%. With earnings growth of 3.8% over the past year, it outpaces the industry average of -11.7%. Esquire's low-risk funding structure is bolstered by customer deposits making up 99% of liabilities, while its allowance for bad loans stands robust at 0.8%, ensuring sound financial health despite recent insider selling activity.

Tiptree (NasdaqCM:TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc., with a market cap of $767.06 million, operates through its subsidiaries to offer specialty insurance products and related services primarily in the United States.

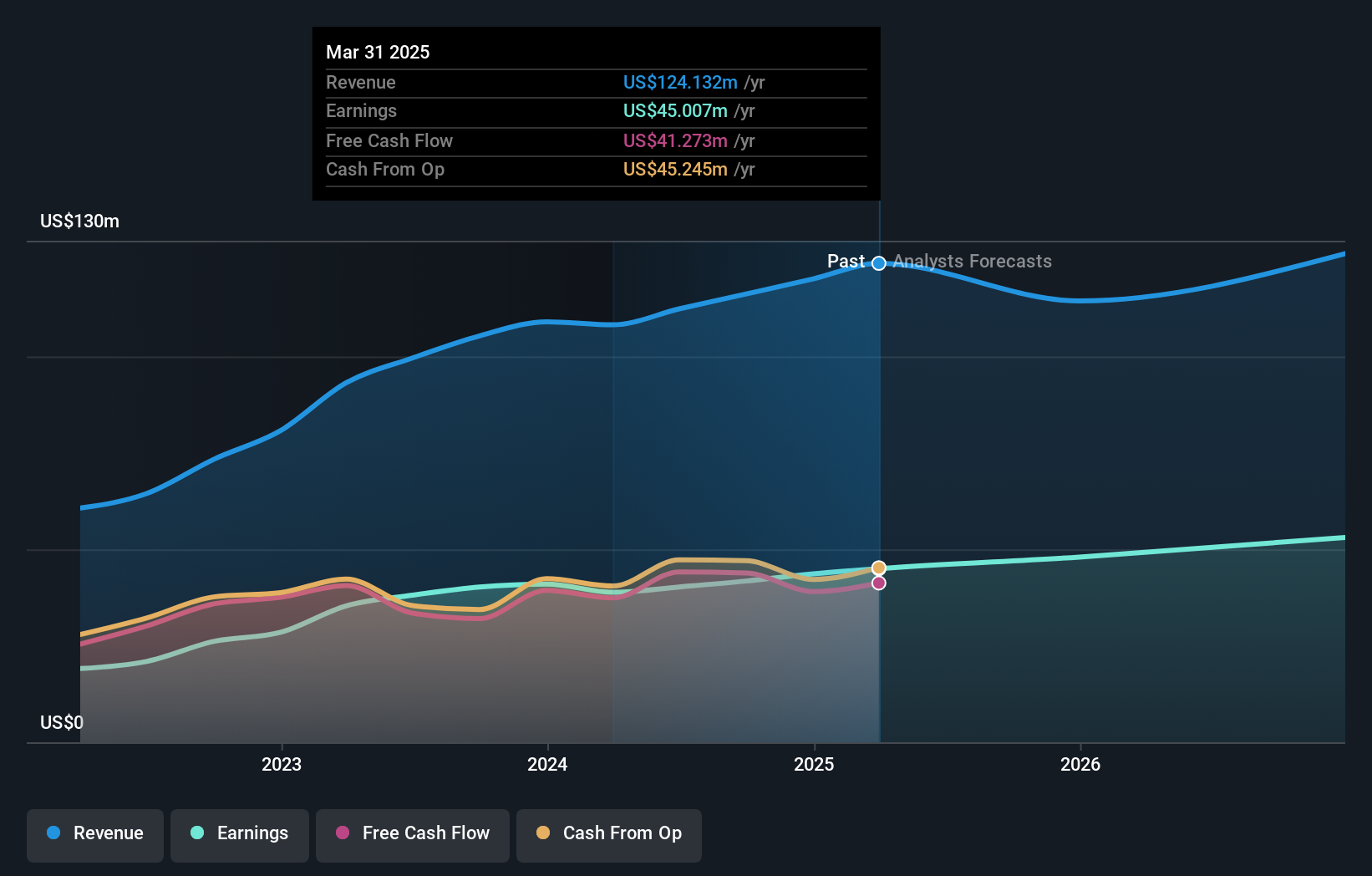

Operations: Tiptree generates significant revenue from its insurance segment, amounting to $1.92 billion, with additional contributions from its mortgage operations at $57.18 million. The company focuses on specialty insurance products and services within the U.S., which form the core of its business model.

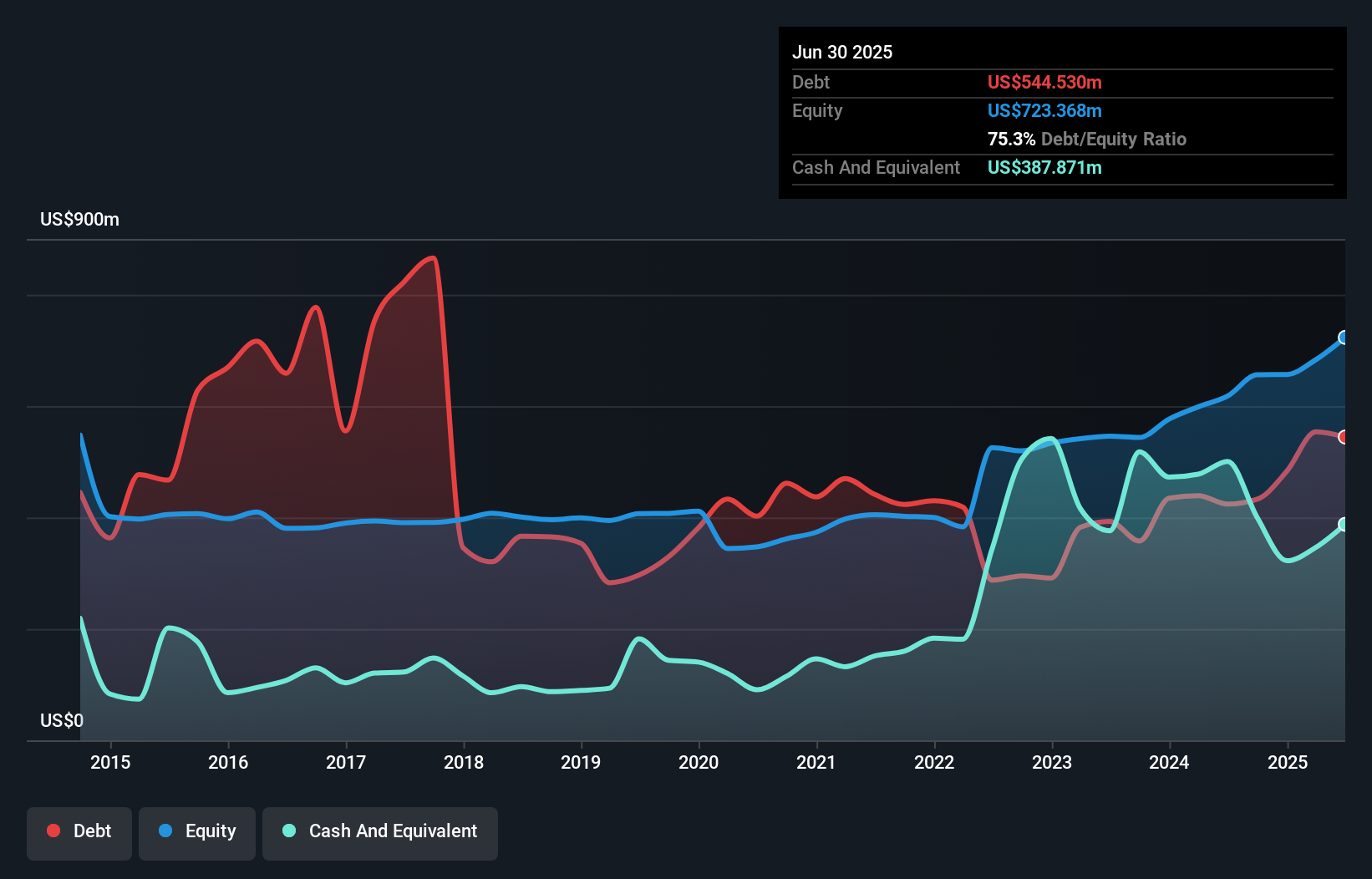

Tiptree showcases a robust earnings profile, with recent growth outpacing the insurance sector at 411.5% compared to 36.6%. The company's net debt to equity ratio stands satisfactorily at 5.1%, reflecting prudent financial management as it decreased from 80.9% over five years to a current level of 66%. Tiptree's interest payments are well covered by EBIT, boasting a coverage of 5.5 times, indicating strong operational efficiency. Recent announcements include a special dividend of $0.25 per share alongside its regular payout, highlighting shareholder returns amid rising revenue and net income for the latest quarter and nine months ending September 2024.

- Unlock comprehensive insights into our analysis of Tiptree stock in this health report.

Examine Tiptree's past performance report to understand how it has performed in the past.

Employers Holdings (NYSE:EIG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Employers Holdings, Inc. operates in the commercial property and casualty insurance industry primarily within the United States, with a market capitalization of approximately $1.26 billion.

Operations: Employers Holdings generates revenue primarily from its insurance operations, amounting to $889.80 million. The company's market capitalization stands at approximately $1.26 billion.

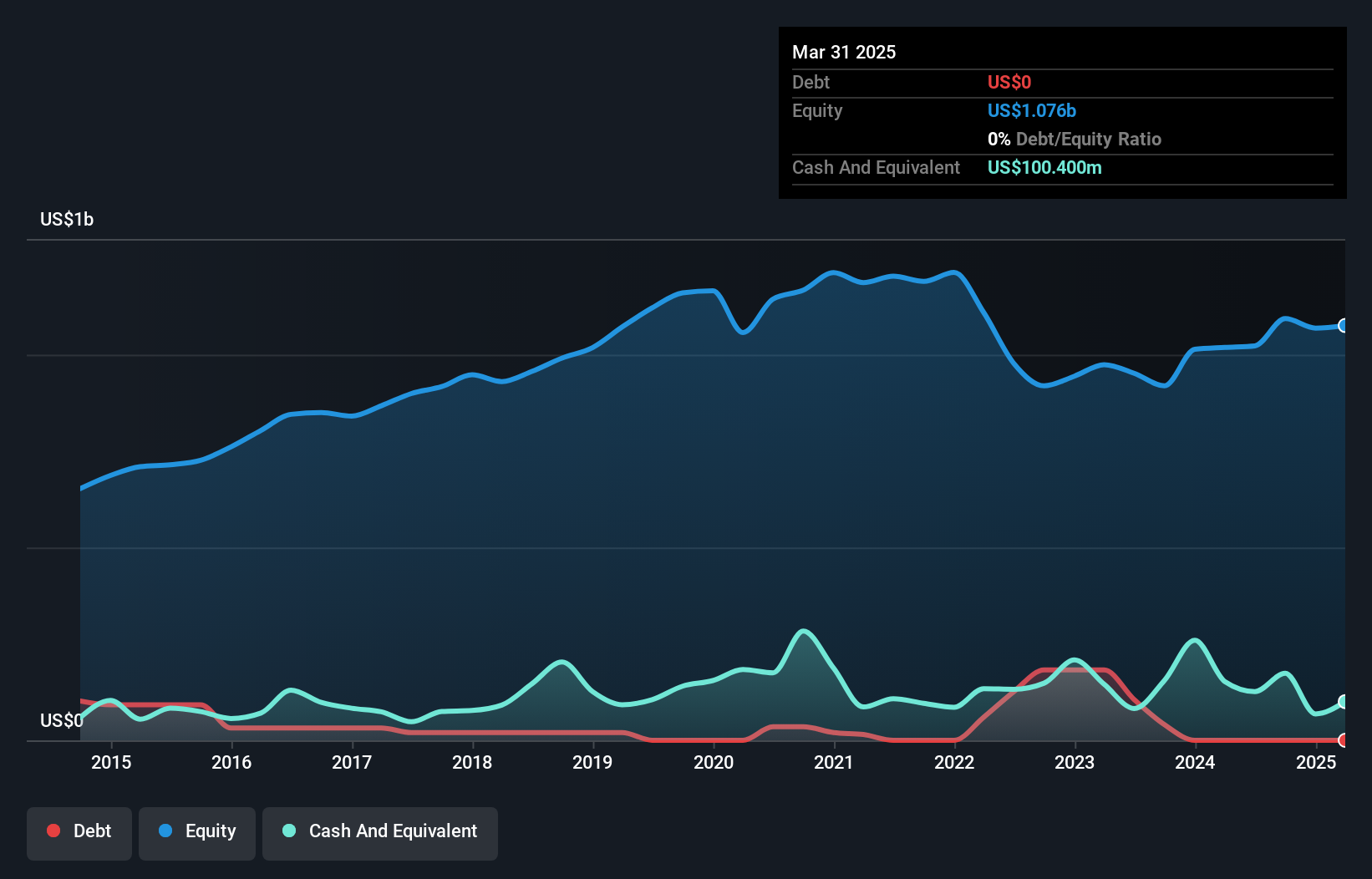

Employers Holdings, a notable player in the U.S. insurance market, showcases strong financial health with no debt and high-quality earnings. Recently, it reported third-quarter revenue of US$224 million, up from US$203.5 million last year, while net income doubled to US$30.3 million. The company repurchased 183,823 shares for US$8.37 million recently and has completed buybacks totaling 1.52 million shares since July 2023. Despite an anticipated decline in earnings by an average of 19% annually over the next three years due to industry challenges like declining premiums and employment volatility, Employers remains profitable with a solid cash runway.

Taking Advantage

- Delve into our full catalog of 244 US Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services primarily in the United States.

Solid track record with excellent balance sheet and pays a dividend.