- United States

- /

- Biotech

- /

- NasdaqGS:TSVT

2seventy bio, Inc.'s (NASDAQ:TSVT) 28% Dip In Price Shows Sentiment Is Matching Revenues

Unfortunately for some shareholders, the 2seventy bio, Inc. (NASDAQ:TSVT) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

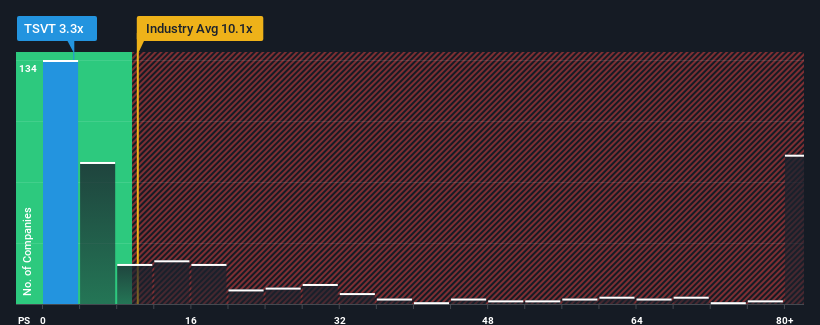

After such a large drop in price, 2seventy bio may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.1x and even P/S higher than 64x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for 2seventy bio

How 2seventy bio Has Been Performing

2seventy bio could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on 2seventy bio will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like 2seventy bio's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 69%. This means it has also seen a slide in revenue over the longer-term as revenue is down 5.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 115% per annum growth forecast for the broader industry.

In light of this, it's understandable that 2seventy bio's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does 2seventy bio's P/S Mean For Investors?

2seventy bio's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of 2seventy bio's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for 2seventy bio with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TSVT

2seventy bio

A cell and gene therapy company, focuses on the research, development, and commercialization of treatments for cancer in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives