- United States

- /

- Banks

- /

- NasdaqGS:EBTC

Undiscovered Gems In The US Market For June 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally with key indices like the S&P 500 reaching significant milestones, investor confidence is bolstered by strong economic data and easing concerns over tariffs. In this environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that larger firms may not provide.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Enterprise Bancorp (EBTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Enterprise Bancorp, Inc. is the holding company for Enterprise Bank and Trust Company, offering community-focused commercial banking products and services, with a market cap of approximately $474.28 million.

Operations: Enterprise Bancorp generates revenue primarily through its banking segment, amounting to $172.24 million. The company's financial performance is reflected in its net profit margin trends over the periods provided.

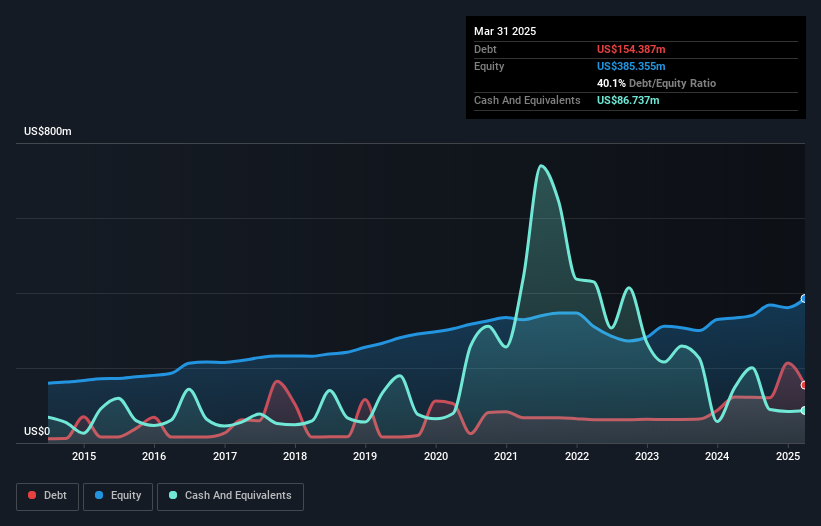

Enterprise Bancorp, with total assets of US$4.9 billion and equity of US$385.4 million, stands out in its sector due to its low-risk funding structure, primarily from customer deposits. The company boasts a net interest margin of 3.2% and has a robust allowance for bad loans at 0.7% of total loans, indicating sound financial health. Over the past year, earnings grew by 13.6%, surpassing the industry average growth rate of 5.5%. Trading at nearly half its estimated fair value suggests potential undervaluation, while recent earnings reports show net income reaching US$10.44 million compared to US$8.51 million last year.

Weyco Group (WEYS)

Simply Wall St Value Rating: ★★★★★★

Overview: Weyco Group, Inc. is a company that designs, markets, and distributes footwear for men, women, and children across various international markets including the United States, Canada, Australia, Asia, and South Africa with a market cap of $300.70 million.

Operations: Weyco Group generates revenue primarily through its wholesale segment, which accounts for $225.96 million, followed by retail at $37.55 million.

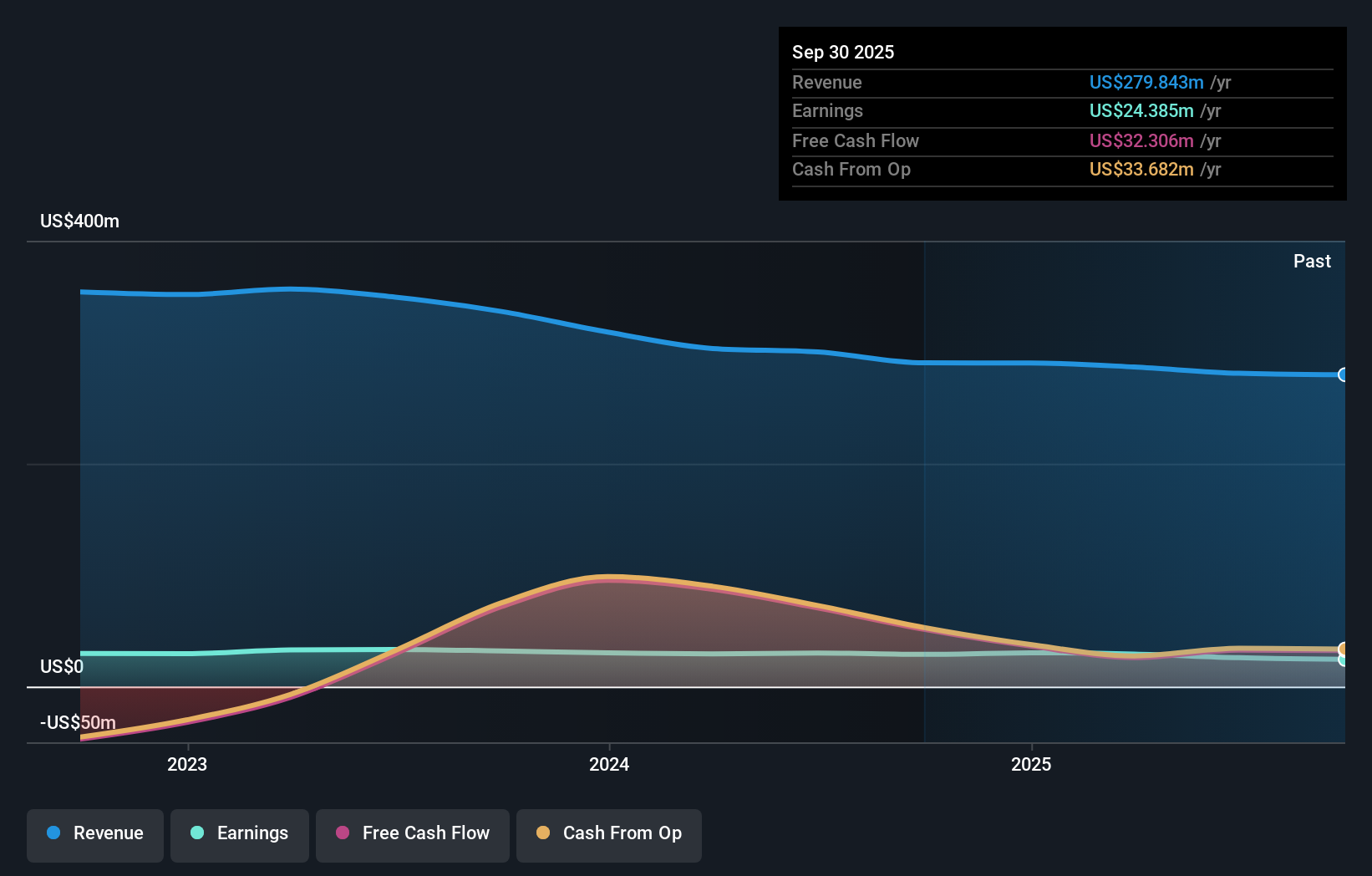

Weyco Group, a smaller player in the footwear industry, boasts a debt-free balance sheet and a price-to-earnings ratio of 10.3x, which is below the US market average of 17.8x. Despite facing negative earnings growth at -0.6% over the past year, it still outperformed the Retail Distributors industry's -28.4%. The company has also demonstrated strong free cash flow generation with US$51.34 million as of September 2024 and recently increased its dividend by 4% to US$0.27 per share for June 2025 payout. However, Weyco faces challenges in board compliance with Nasdaq rules following a director's resignation but is actively seeking solutions to regain compliance by August 2025.

- Click to explore a detailed breakdown of our findings in Weyco Group's health report.

Gain insights into Weyco Group's past trends and performance with our Past report.

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs and wireline services to exploration and production companies in the United States, with a market cap of $255.58 million.

Operations: Ranger Energy Services generates revenue primarily from its High Specification Rigs segment, contributing $343.90 million, followed by Wireline Services at $94.60 million and Processing Solutions and Ancillary Services at $130.90 million.

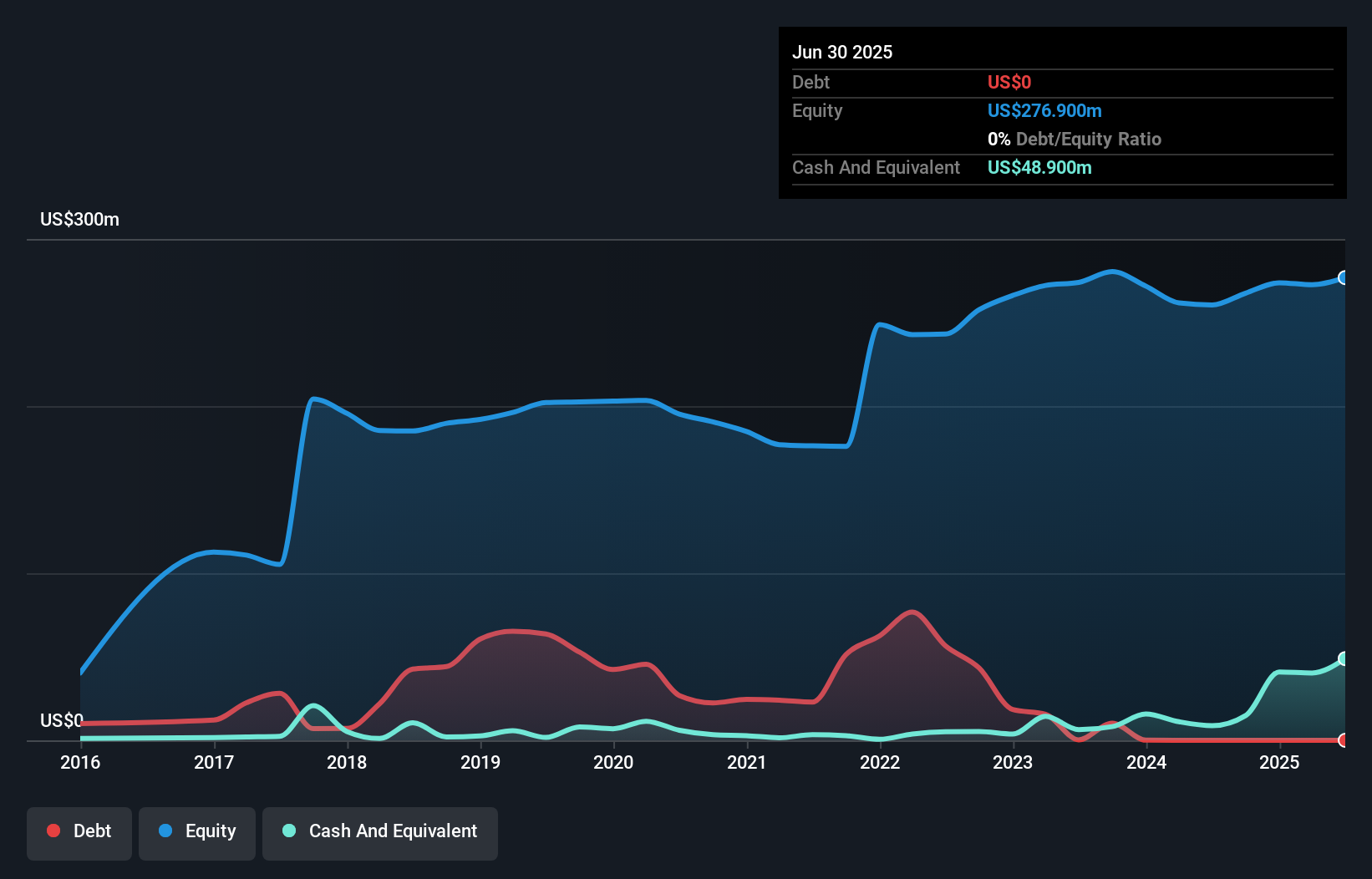

Ranger Energy Services, a nimble player in the energy services sector, is capturing attention with its solid financial footing and strategic moves. Over the past year, earnings grew by 17.9%, outpacing the industry's 9.6% growth rate. The company is debt-free now, contrasting sharply with a debt-to-equity ratio of 22.4% five years ago, showcasing prudent financial management. Recently trading at 79.3% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite flat revenue at US$135 million in Q1 2025 compared to last year, net income improved to US$0.6 million from a loss of US$0.8 million previously reported.

- Take a closer look at Ranger Energy Services' potential here in our health report.

Assess Ranger Energy Services' past performance with our detailed historical performance reports.

Summing It All Up

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBTC

Enterprise Bancorp

Operates as the holding company for Enterprise Bank and Trust Company that provides community focused commercial banking products and services.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026