- United States

- /

- Software

- /

- NYSE:SMWB

3 US Stocks Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market seeks to recover from last week's downturn, with major indices showing mixed futures, investors are keenly observing opportunities that may arise in this fluctuating environment. In such conditions, identifying stocks trading below their estimated value can present potential investment opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $23.80 | $46.25 | 48.5% |

| Capital Bancorp (NasdaqGS:CBNK) | $27.85 | $53.44 | 47.9% |

| Business First Bancshares (NasdaqGS:BFST) | $28.20 | $55.07 | 48.8% |

| West Bancorporation (NasdaqGS:WTBA) | $24.02 | $46.82 | 48.7% |

| Afya (NasdaqGS:AFYA) | $16.005 | $31.50 | 49.2% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.80 | $63.87 | 48.6% |

| Smith Douglas Homes (NYSE:SDHC) | $30.52 | $60.48 | 49.5% |

| Datadog (NasdaqGS:DDOG) | $126.09 | $243.25 | 48.2% |

| WEX (NYSE:WEX) | $179.08 | $345.87 | 48.2% |

| Marcus & Millichap (NYSE:MMI) | $40.63 | $78.74 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Dime Community Bancshares (NasdaqGS:DCOM)

Overview: Dime Community Bancshares, Inc. serves as the holding company for Dime Community Bank, offering a range of commercial banking and financial services, with a market cap of approximately $1.47 billion.

Operations: The company generates revenue primarily through its Community Banking segment, which accounts for $313.74 million.

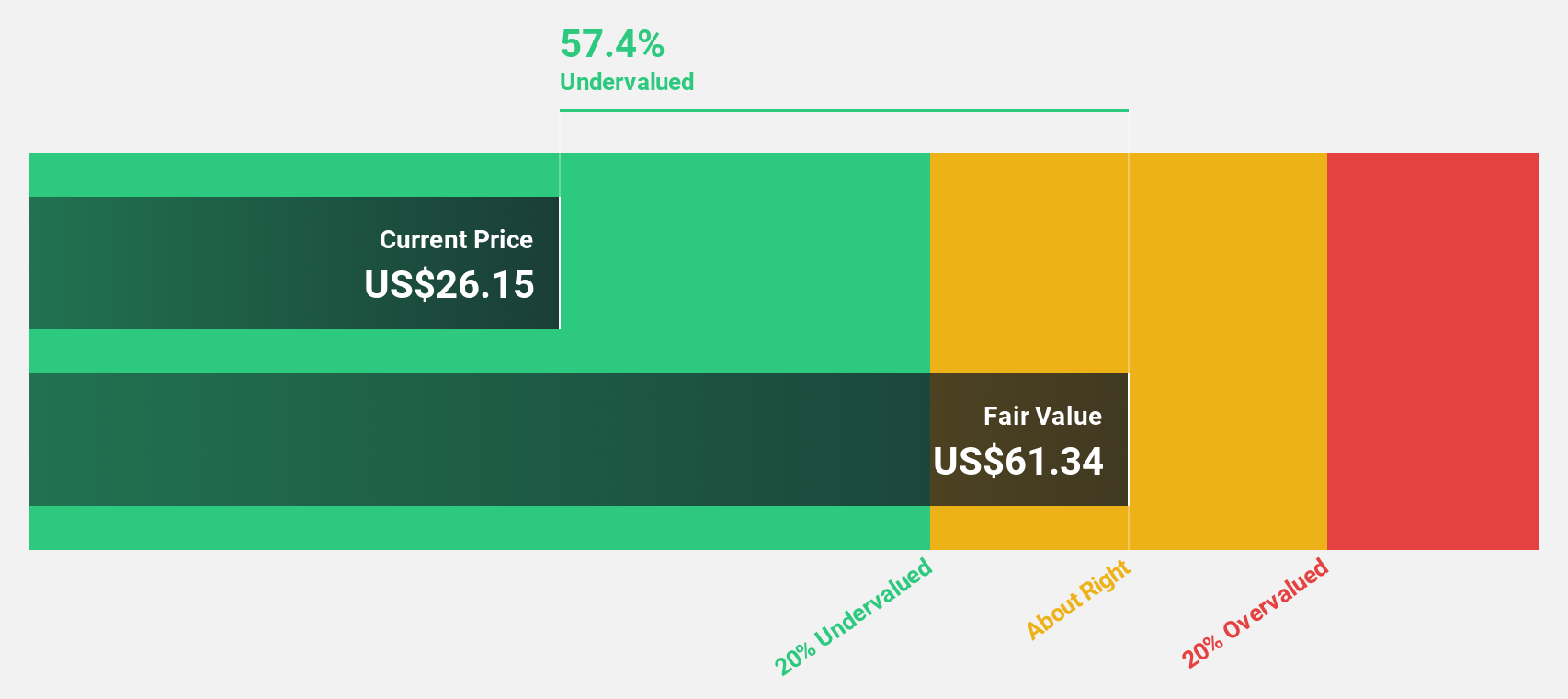

Estimated Discount To Fair Value: 23.4%

Dime Community Bancshares appears undervalued with a current trading price of US$33.7, below its estimated fair value of US$44.01, suggesting a potential opportunity based on discounted cash flow analysis. However, recent dilution from a $125 million equity offering could impact shareholder value despite projected earnings growth of 51% annually outpacing the broader market. The company maintains a reliable dividend yield and forecasts robust revenue growth at 26.6% per year, although profit margins have declined recently.

- Our expertly prepared growth report on Dime Community Bancshares implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Dime Community Bancshares with our detailed financial health report.

Despegar.com (NYSE:DESP)

Overview: Despegar.com, Corp. is an online travel company offering various travel and related products to leisure and corporate travelers via its websites and mobile apps in Latin America and the United States, with a market cap of approximately $1.35 billion.

Operations: The company's revenue is primarily generated from its Packages, Hotels & Other Travel Products segment at $477.31 million, followed by the Air segment at $263.15 million and Financial Services at $50.81 million.

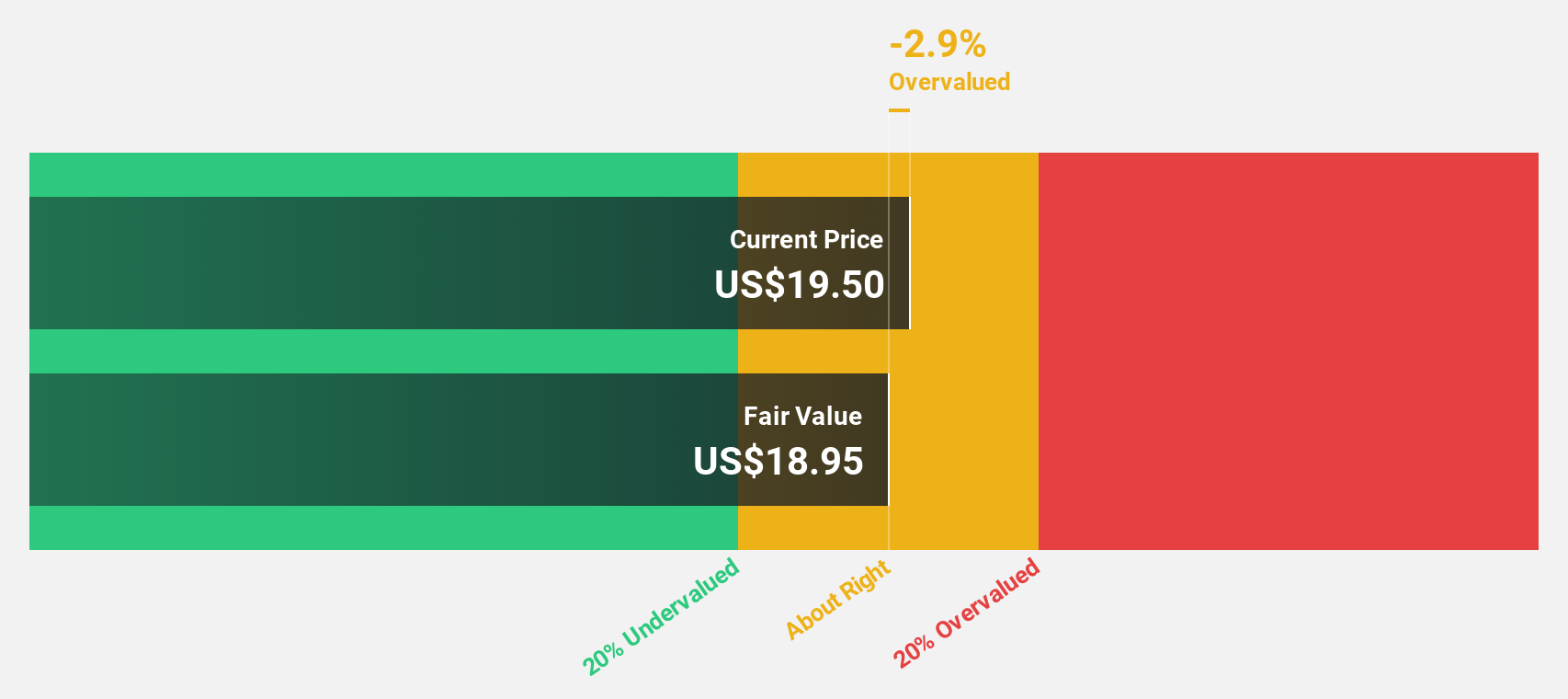

Estimated Discount To Fair Value: 10.6%

Despegar.com is trading at US$17.37, below its estimated fair value of US$19.44, indicating a potential undervaluation based on cash flows. Despite past shareholder dilution, the company shows promising growth prospects with earnings expected to increase by 41.49% annually and revenue anticipated to grow faster than the US market at 11.4%. Recent strategic initiatives like partnerships with Karisma Hotels and Nubank enhance its market position and offer new revenue streams, supporting long-term growth potential.

- Our earnings growth report unveils the potential for significant increases in Despegar.com's future results.

- Click to explore a detailed breakdown of our findings in Despegar.com's balance sheet health report.

Similarweb (NYSE:SMWB)

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions globally, with a market cap of approximately $939.95 million.

Operations: The company generates revenue primarily from its online financial information providers segment, amounting to $241.08 million.

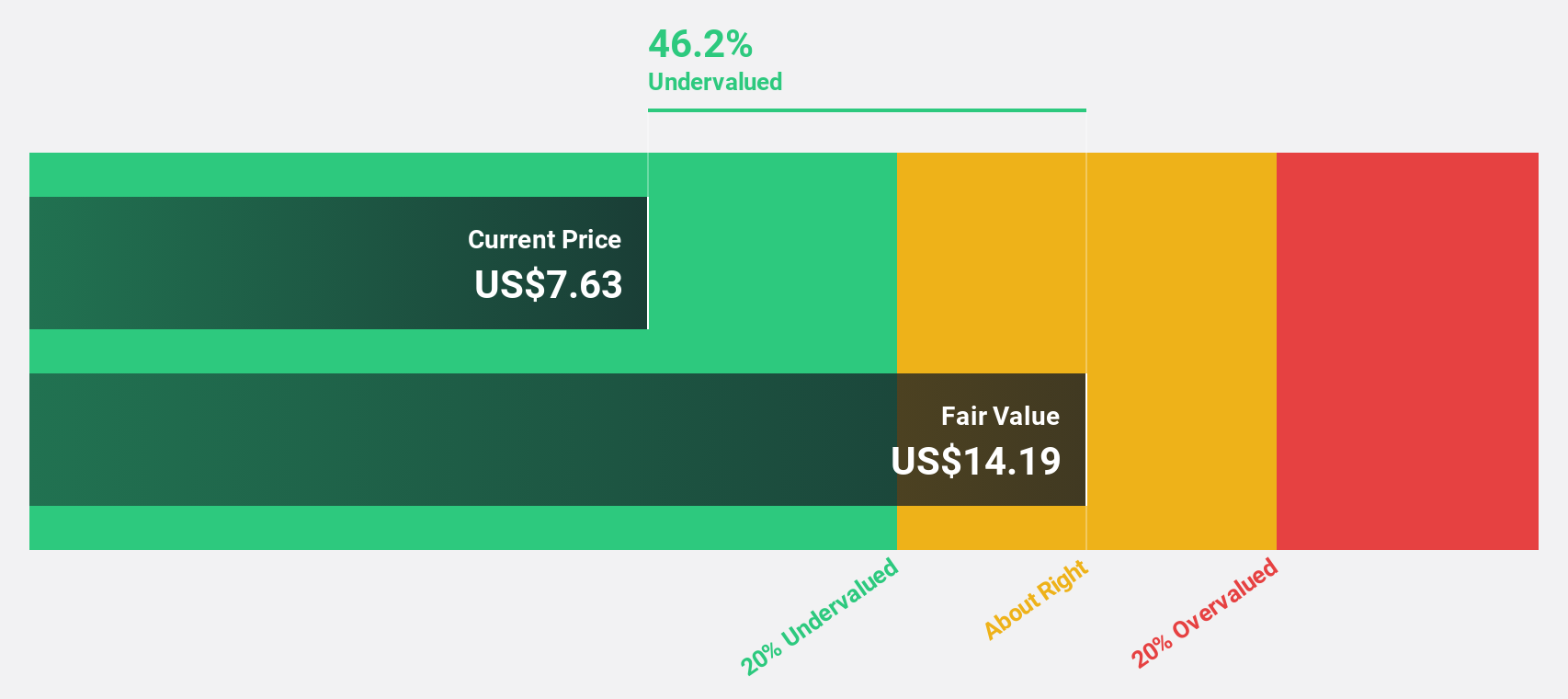

Estimated Discount To Fair Value: 37.5%

Similarweb, trading at US$11.51, is significantly undervalued compared to its estimated fair value of US$18.42. Despite past shareholder dilution, the company exhibits strong growth potential with earnings forecasted to grow substantially and profitability expected within three years. Recent earnings reports show improved performance with a reduced net loss and revenue growth of 15% year-over-year for Q3 2024, reinforcing its position as an attractive prospect based on cash flow valuation metrics.

- The growth report we've compiled suggests that Similarweb's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Similarweb.

Where To Now?

- Click here to access our complete index of 199 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMWB

Similarweb

Provides digital data and analytics for power critical business decisions in the United States, Europe, the Asia Pacific, the United Kingdom, Israel, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives