- United States

- /

- Chemicals

- /

- NYSE:MTX

Exploring Three Undervalued Small Caps With Notable Insider Action

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has seen a 13% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying stocks that are potentially undervalued and exhibit notable insider activity can be an effective strategy for investors seeking opportunities in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 42.56% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 28.01% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 45.17% | ★★★★☆☆ |

| Southside Bancshares | 10.5x | 3.6x | 38.94% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 39.86% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 33.07% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 4.66% | ★★★★☆☆ |

| Standard Motor Products | 12.7x | 0.5x | -2384.13% | ★★★☆☆☆ |

| Farmland Partners | 9.1x | 9.2x | -11.03% | ★★★☆☆☆ |

| Vital Energy | NA | 0.3x | -31.80% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

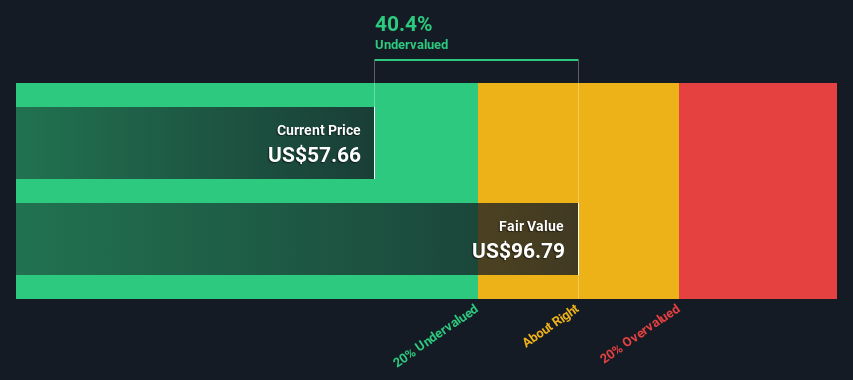

Citizens Financial Services (CZFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens Financial Services operates primarily in the community banking sector, with a market capitalization of approximately $0.29 billion.

Operations: Citizens Financial Services generates revenue primarily through its community banking operations, with a recent quarterly revenue of $99.93 million. The company has consistently reported a gross profit margin of 100%, indicating no cost of goods sold in their financials. Over time, the net income margin has shown variability, with a notable decline to 19.70% in early 2024 before rebounding to around 28% by mid-2025. Operating expenses have been increasing steadily, reaching $62.56 million in the latest quarter, driven largely by general and administrative expenses at approximately $49.74 million.

PE: 10.6x

Citizens Financial Services, a company with insider confidence shown through recent share purchases, reported first-quarter net charge-offs of US$156,000, significantly lower than last year's US$667,000. Despite having a low allowance for bad loans at 89%, their net interest income rose to US$23 million from US$20.96 million in the previous year. The company completed a modest buyback of 4,761 shares for US$0.25 million by March 2025 and announced dividends payable in June 2025, reflecting stable cash flow management amidst industry challenges.

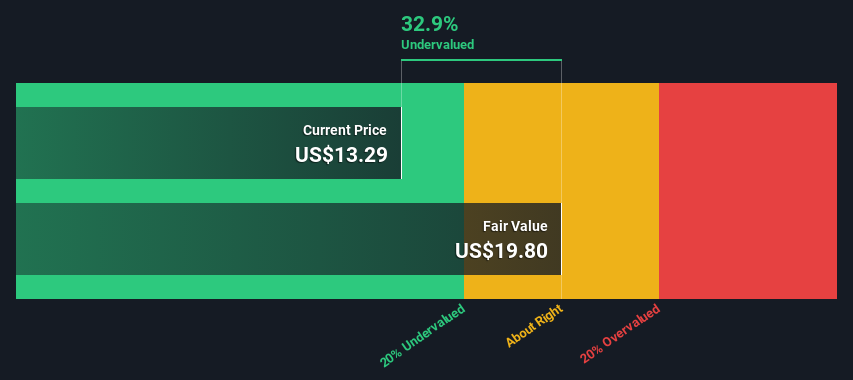

LendingClub (LC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LendingClub operates as a financial services company providing personal loans and banking services, with a market capitalization of approximately $1.02 billion.

Operations: Lending Club Bank is the primary revenue generator with $1.17 billion, while Lending Club Corporation contributes $44.62 million. The company has experienced fluctuations in its net income margin, which was -0.052% in 2014 and reached 0.042% by 2025, indicating varied financial performance over time. Operating expenses have been a significant component of costs, including sales and marketing as well as general and administrative expenses.

PE: 27.6x

LendingClub, a smaller company in the financial sector, has shown insider confidence with Michael Zeisser purchasing 20,000 shares worth US$257,600 in June 2025. Despite facing higher risk due to reliance on external borrowing for funding and recent net charge-offs of US$48.9 million for Q1 2025, LendingClub's earnings are projected to grow significantly at 46.23% per year. The company's strategic acquisition of a new San Francisco headquarters suggests potential asset appreciation and long-term growth prospects.

- Get an in-depth perspective on LendingClub's performance by reading our valuation report here.

Gain insights into LendingClub's historical performance by reviewing our past performance report.

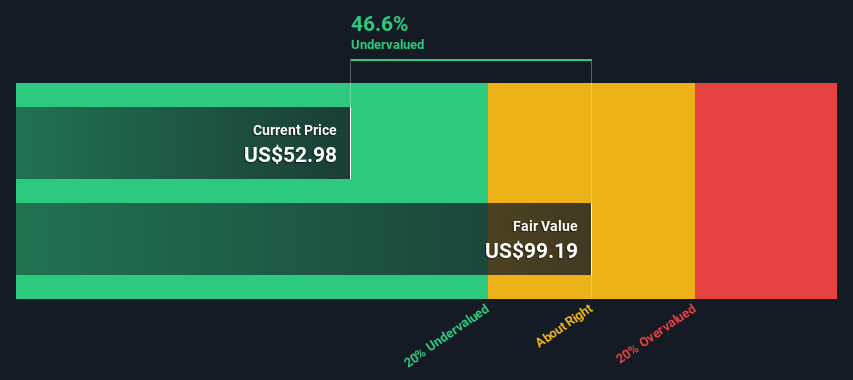

Minerals Technologies (MTX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Minerals Technologies is a company specializing in engineered solutions and consumer specialties, with a market cap of approximately $2.31 billion.

Operations: Minerals Technologies generates revenue primarily from its Consumer & Specialties segment at $1.11 billion and Engineered Solutions segment at $964.20 million. The gross profit margin has shown fluctuations, reaching a high of 28.31% in 2017 and a low of 21.88% in late 2022, before recovering to around 25.60% by mid-2025. Operating expenses have consistently impacted profitability, with significant non-operating expenses contributing to periods of negative net income margins as seen in early and mid-2025.

PE: -77.7x

Minerals Technologies, a smaller player in the market, has caught attention with its recent financial moves. From January to March 2025, they repurchased 199,138 shares for US$14.29 million under a buyback plan announced in October 2024. Despite reporting a net loss of US$144 million for Q1 2025 and lowering guidance due to restructuring charges, insider confidence remains evident through share purchases. The company declared a regular quarterly dividend of $0.11 per share payable on June 12, reflecting steady shareholder returns amidst challenging times. With earnings forecasted to grow significantly at over 172% annually and operating cash flow covering debt adequately, Minerals Technologies presents potential growth opportunities despite current setbacks.

- Delve into the full analysis valuation report here for a deeper understanding of Minerals Technologies.

Gain insights into Minerals Technologies' past trends and performance with our Past report.

Key Takeaways

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 77 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)