- United States

- /

- Banks

- /

- NasdaqCM:CWBC

Community West Bancshares (CWBC): Current Share Price at $20.70 Ahead of Upcoming Earnings

Reviewed by Simply Wall St

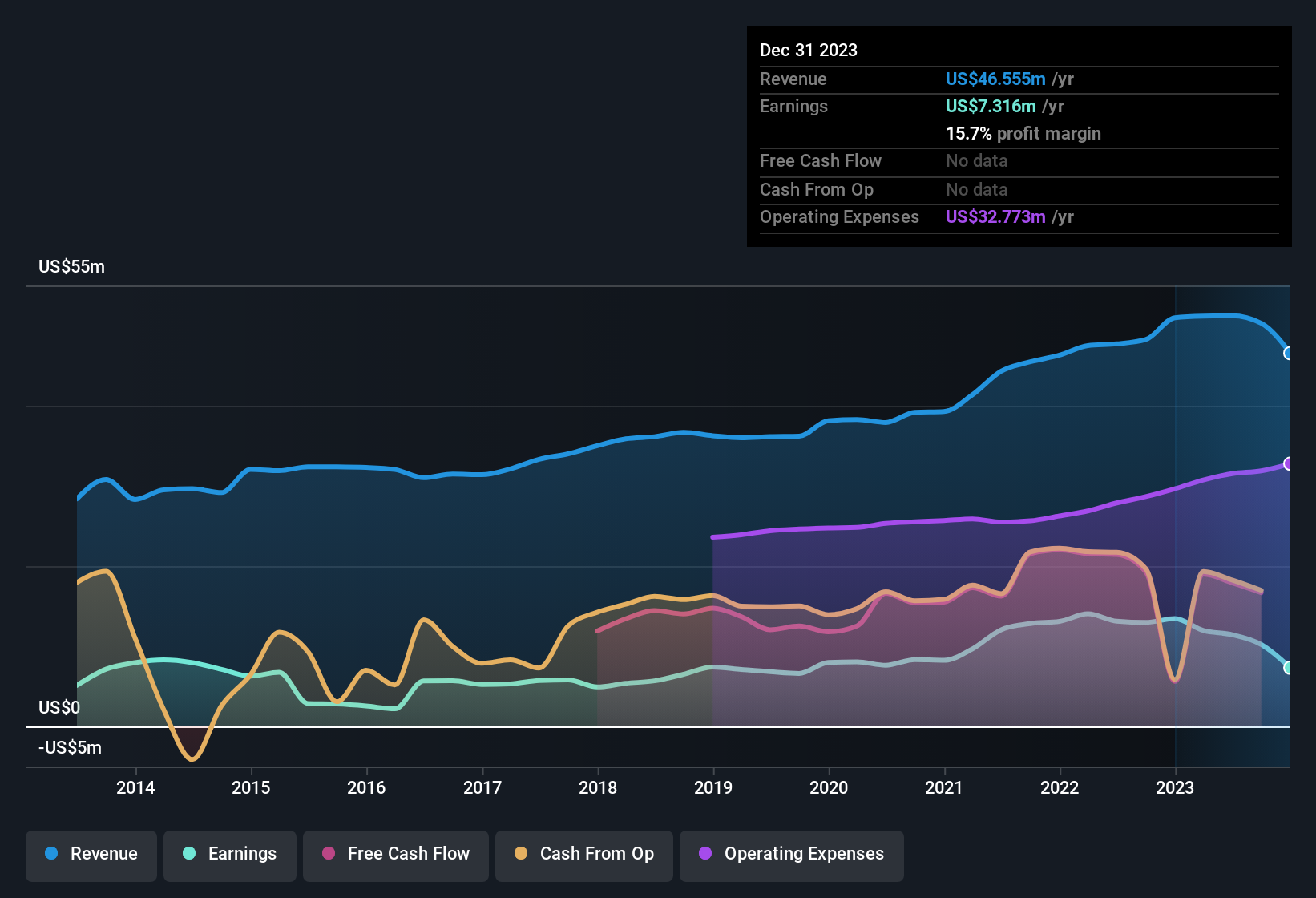

Community West Bancshares (CWBC) operates as a bank, serving customers with a range of financial services. There were no specific disclosures providing revenue or EPS figures for the most recent period, and no new risk or reward indicators were highlighted in the latest filings. In the absence of headline financial results, investors may look to historical data and broader banking sector trends to understand CWBC’s current performance landscape.

See our full analysis for Community West Bancshares.The next section compares the latest results with the market’s most widely held narratives, revealing which views align with the numbers and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Market Stability Shown in News Flow

- Recent news coverage around Community West Bancshares remains neutral to cautiously positive, with a steady operational profile and disciplined loan management praised in industry sources, but without key figures or segment breakdowns released in filings.

- Consistency in financial headlines heavily supports the narrative that CWBC stands out as a stable regional bank, especially when broader sector headlines highlight volatility.

- Market commentary underscores CWBC’s reputation for solid fundamentals and steady management, which aligns closely with the idea that investors are currently favoring “safe haven” banks.

- Ongoing steady coverage provides a reassuring contrast to more troubled peers and reinforces CWBC's image as a defensive financial holding even as the sector faces loan and funding pressures.

Cautious Attitudes Prevail Online

- Sentiment in social media and investor forums trends modestly positive, with investors noting CWBC’s conservative lending stance and limited appetite for outsized risk, but no speculative or meme-driven excitement is apparent based on available commentary.

- Most investors frame CWBC as a defensive play in an unsettled sector, with cautious optimism linked to the bank’s risk controls and perceived insulation from major shocks.

- Online comments recognize sector challenges such as commercial real estate exposure and interest rate risk but highlight CWBC’s prudent management of these issues as setting it apart from less conservative banks.

- The wait-and-see approach prevalent among forums reflects underlying trust in CWBC, which resonates with ongoing demand for yield and security without speculative risk-taking.

Share Price Signals Value Perception

- With the current share price at $20.70, there is no explicit analyst price target or DCF fair value disclosed in filings, making the price an anchor for market sentiment rather than a data point for valuation tension.

- Investors in narrative discussions tend to see the present price as in line with the company's “under-the-radar growth” story, maintaining a base-case positive thesis even amidst sector-wide stress.

- Unlike higher-profile peers with more pronounced valuation premiums or discounts, CWBC’s steady share price reflects a balance between cautious optimism about its prospects and restraint until a clear growth catalyst emerges.

- Some value-focused investors discuss potential for selective upside if the company delivers incremental growth or becomes a beneficiary of broader banking M&A or sector rotation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Community West Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With limited recent financial disclosures and no clear growth catalyst, Community West Bancshares faces challenges standing out in a sector that is seeking steady performers.

If you want more consistent and reliable growth potential, check out stable growth stocks screener (2085 results) to discover companies with stronger histories of stable earnings and revenues.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CWBC

Community West Bancshares

Operates as the bank holding company for the Central Valley Community Bank that provides various commercial banking services to small and middle-market businesses and individuals in California.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)