- United States

- /

- Banks

- /

- NasdaqGS:CTBI

Discovering Hidden Gems In The US Market

Reviewed by Simply Wall St

In the current U.S. market landscape, major stock indexes have experienced a decline as concerns over AI valuations resurface and investors closely scrutinize earnings reports amidst limited government economic data due to the ongoing shutdown. With small-cap stocks often overlooked in favor of larger, more prominent companies, now may be an opportune time to explore lesser-known opportunities that could offer unique potential within this volatile environment. Identifying a promising stock requires examining factors such as financial health, growth potential, and resilience in navigating economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 55.71% | 1.47% | -2.43% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 3.81% | 3.17% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 142.38% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Community Trust Bancorp (CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. serves as the bank holding company for Community Trust Bank, Inc., with a market cap of $938.67 million.

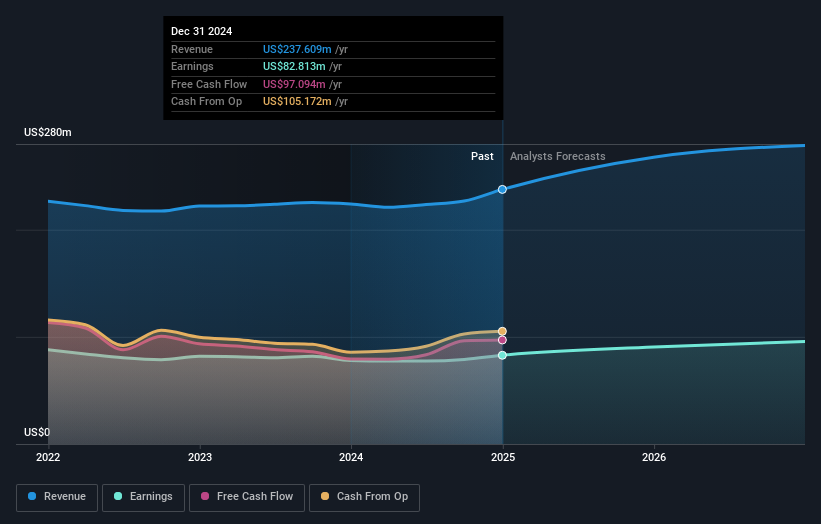

Operations: Community Trust Bancorp, Inc. generates revenue primarily through its banking operations, focusing on interest income from loans and securities. The company's financial performance is influenced by its ability to manage costs associated with deposits and other funding sources.

Community Trust Bancorp, with total assets of US$6.6 billion and equity of US$831.4 million, stands out in the banking sector for its robust financial health. The bank's liabilities are primarily low-risk, with customer deposits making up 93%, reducing reliance on external borrowing. It boasts a sufficient allowance for bad loans at 240% and maintains non-performing loans at just 0.5%. Earnings have grown by 18.1% over the past year, outpacing industry growth of 17.8%. Trading significantly below estimated fair value adds to its appeal as an investment opportunity in this niche market segment.

- Unlock comprehensive insights into our analysis of Community Trust Bancorp stock in this health report.

Gain insights into Community Trust Bancorp's past trends and performance with our Past report.

Donegal Group (DGIC.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Donegal Group Inc. is an insurance holding company offering commercial and personal lines of property and casualty coverages, with a market cap of $670.45 million.

Operations: The company generates revenue primarily from commercial lines ($551.73 million) and personal lines ($379.20 million) of property and casualty insurance.

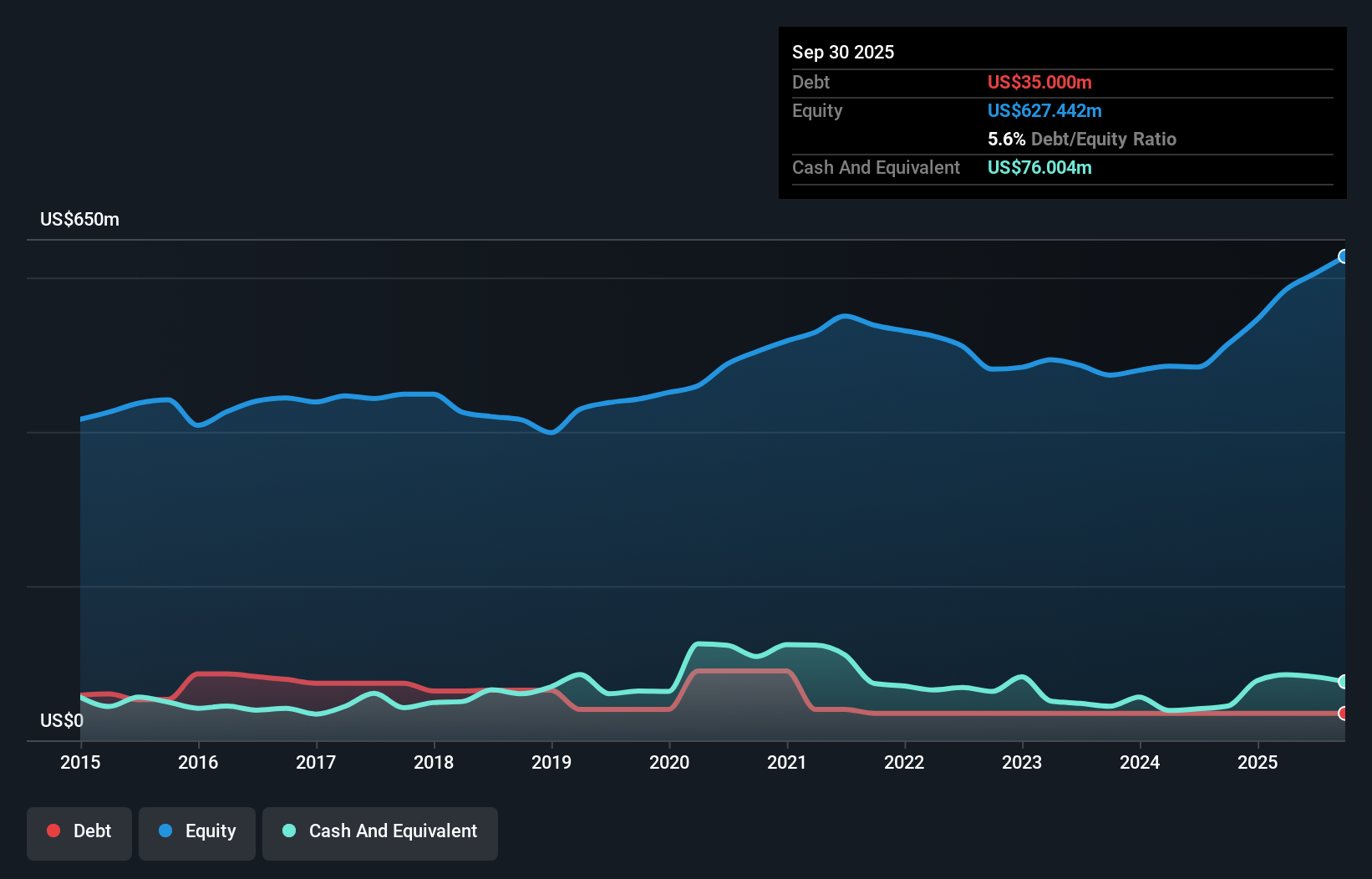

Donegal Group, a US-based insurance holding company, is navigating a strategic pivot towards expanding its commercial lines. This shift might affect profitability as it moves away from higher-margin personal lines, potentially reducing earnings stability. The company boasts high-quality earnings and impressive interest coverage at 84 times EBIT. Its debt-to-equity ratio has improved significantly from 17.9% to 5.6% over five years, reflecting financial prudence. Despite these strengths, the company's net income for Q3 rose to $20 million from $16 million last year on slightly lower revenue of $246 million compared to $252 million previously, highlighting ongoing challenges in revenue growth amidst rising costs and competitive pressures in the industry.

TrustCo Bank Corp NY (TRST)

Simply Wall St Value Rating: ★★★★★★

Overview: TrustCo Bank Corp NY, with a market cap of $722.56 million, operates as the holding company for Trustco Bank, offering personal and business banking services to individuals and businesses.

Operations: TrustCo Bank Corp NY generates revenue primarily through its community banking segment, which reported $181.46 million. The company's market cap stands at $722.56 million, indicating its scale in the financial sector.

TrustCo Bank Corp NY, with total assets of US$6.3 billion and equity of US$692 million, has shown robust growth with earnings up 19.9% over the past year, surpassing industry averages. Its liabilities are predominantly low-risk customer deposits, making up 97% of funding sources. The bank's allowance for bad loans is sufficient at 0.4% of total loans, ensuring stability in its loan portfolio. Trading at a notable discount to estimated fair value by 25.7%, it seems well-positioned for value seekers. Recent buybacks saw the company repurchase shares worth US$16.22 million this year, reflecting confidence in its financial health and future prospects.

- Get an in-depth perspective on TrustCo Bank Corp NY's performance by reading our health report here.

Turning Ideas Into Actions

- Click here to access our complete index of 299 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives