- United States

- /

- Banks

- /

- NasdaqGS:COLB

Evaluating Columbia Banking System After Its Recent Share Price Dip in 2025

Reviewed by Bailey Pemberton

If you are wondering whether Columbia Banking System is worth your investment dollars right now, you are certainly not alone. Deciding what to do with any stock can feel like stepping into a moving river, and Columbia’s recent price movements have definitely caused a ripple or two. The stock is coming off a five-year climb of 63.5%, but those gains have cooled, as demonstrated by a 3.3% drop over just the last week and a slightly negative return for the year to date. It is the kind of pattern that often signals changing risk perceptions or market sentiment, particularly as investors react to broader market developments and evolving expectations for regional banks.

So, does this cooling-off period offer a window of opportunity, or is it simply the calm before another storm? The answer might lie in the numbers. Based on our valuation framework, Columbia Banking System scores a 3 out of 6 for being undervalued. This means it checks the box for three key value indicators. While that is not a perfect score, it suggests there could be meaningful value here if we dig a little deeper.

To make sense of this score and what it could mean for your portfolio, it is worth exploring how the various valuation methods stack up against each other. In the sections ahead, we will walk through each of these approaches and, ultimately, share a perspective that is even more insightful than any single method alone.

Why Columbia Banking System is lagging behind its peers

Approach 1: Columbia Banking System Excess Returns Analysis

The Excess Returns model is designed to measure how effectively a company generates value above the cost of its equity capital. In other words, it considers how much profit Columbia Banking System is able to generate on its book value after accounting for what it costs to attract investors' money.

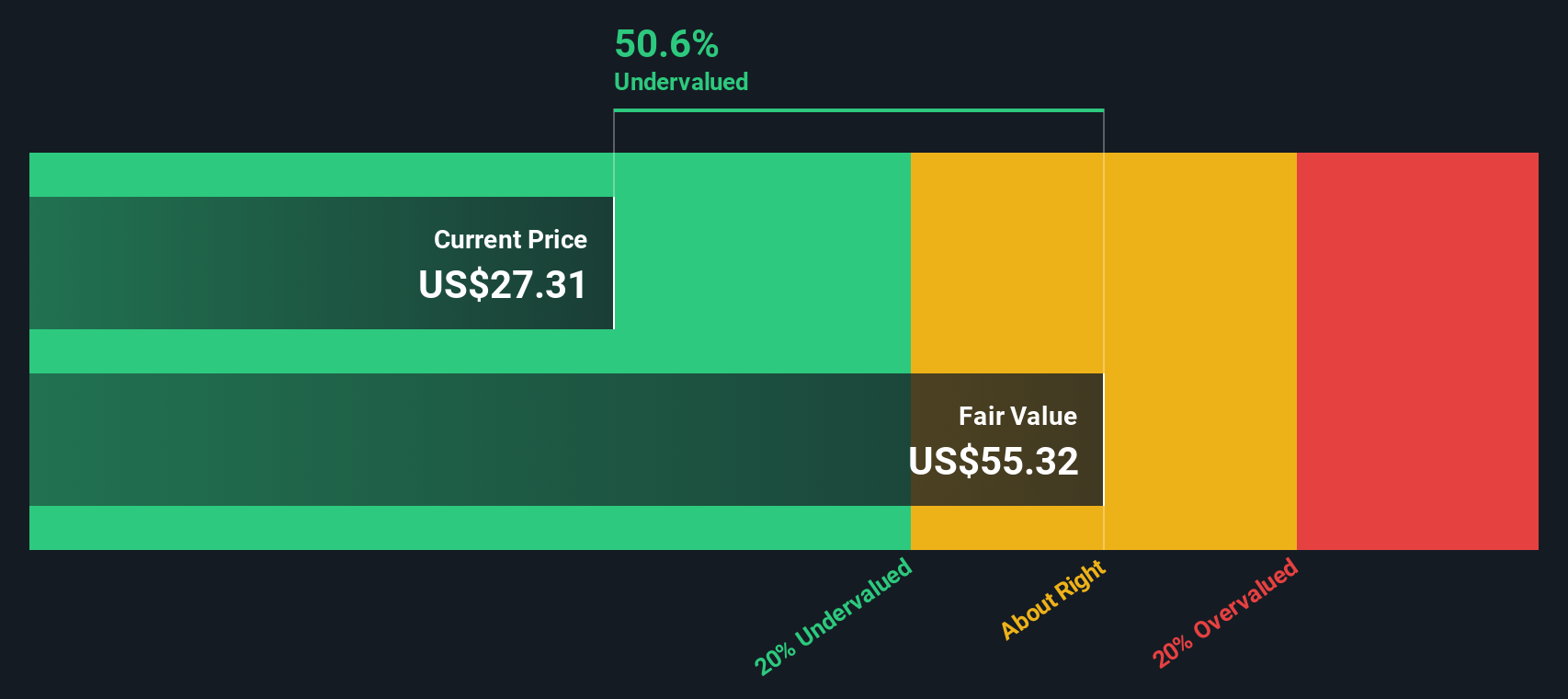

For Columbia Banking System, the numbers paint a promising picture. The company’s current book value per share stands at $25.41, with a stable earnings per share (EPS) of $3.02, according to future Return on Equity estimates averaged from eight analysts. The average return on equity is 11.03%, while the cost of equity is $1.92 per share. The result is an annual excess return of $1.10 per share, indicating Columbia consistently earns more on its investments than it costs to fund them. Projections place the stable book value at $27.38 per share, based on weighted forecasts from nine analysts.

Translating these fundamentals into an intrinsic value, the Excess Returns model calculates the stock’s fair value at $55.46 per share. Relative to the current share price, this represents a 53.6% discount. This suggests the market is pricing Columbia Banking System well below its intrinsic worth.

Result: UNDERVALUED

Our Excess Returns analysis suggests Columbia Banking System is undervalued by 53.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Columbia Banking System Price vs Earnings

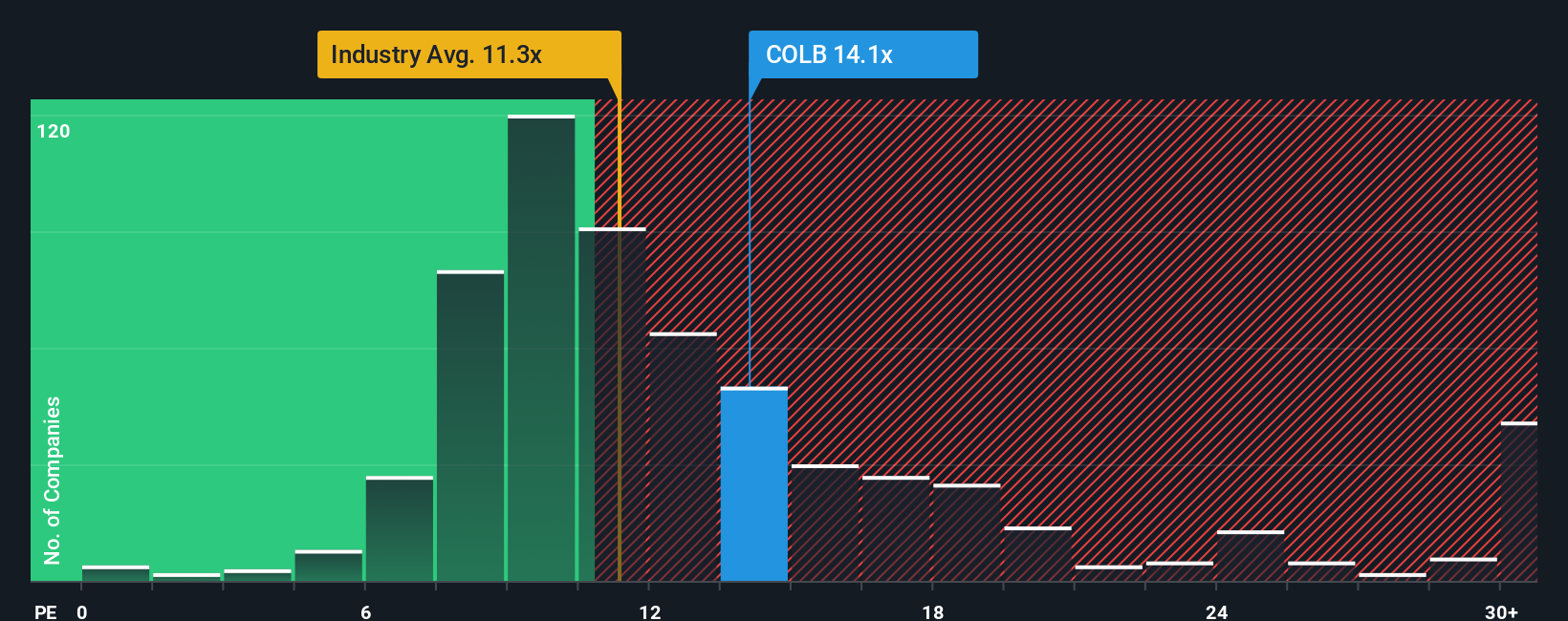

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it connects a company’s share price directly to its bottom line. When a company like Columbia Banking System is consistently profitable, the PE ratio helps illustrate how much investors are willing to pay for each dollar of earnings. This makes it a practical gauge of perceived value.

Growth expectations and market risk both play major roles in what counts as a "normal" or "fair" PE ratio. Higher future growth or lower risk often justifies a higher PE multiple, while slower growth or greater risk tends to bring that number down. Columbia Banking System currently trades on a PE ratio of 14.6x. That is a bit above the industry average of 11.5x for the Banks sector, and well above its peer group average of -6.6x. This suggests some unique circumstances or recent unprofitability among peers.

Simply Wall St’s proprietary "Fair Ratio" adds a new layer of analysis. Unlike simple comparisons to peers or the broader industry, the Fair Ratio incorporates factors like Columbia’s expected earnings growth, risk profile, profitability, industry conditions, and market cap. For Columbia Banking System, the Fair Ratio is 17.7x, which is higher than its actual PE. Because the current PE is lower than the Fair Ratio, this signals an undervaluation based on the company’s fundamentals and outlook, not just a comparison to the averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Columbia Banking System Narrative

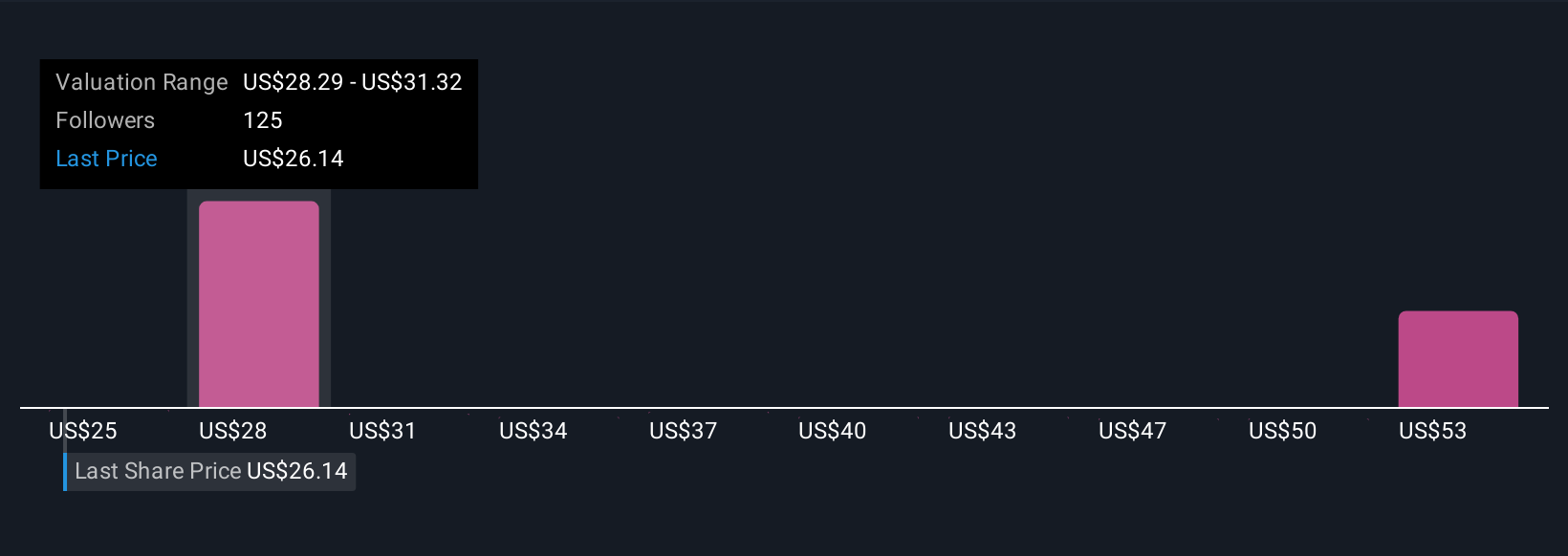

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is essentially your personal investment story—the logic, expectations, and forecasts you believe best fit a company’s future. Rather than only relying on past numbers or static valuations, Narratives connect your perspective on Columbia Banking System (such as its revenue growth, earnings, and profit margins) to a projected fair value, making your investment thesis more concrete and actionable.

Narratives bridge the gap between "what you believe" and "what the numbers say" by letting you input future assumptions, see how they shape fair value, and then compare your result to the current share price, all in a dynamic and easy to use format available on Simply Wall St’s Community page. Millions of investors leverage Narratives daily to decide when to buy or sell, automatically updating their scenarios as new news and fresh results come in.

For example, with Columbia Banking System, one Narrative projects a bullish price target of $35.00, expecting robust expansion and margin gains, while another forecasts a bearish fair value of just $25.00, citing integration risks and regional headwinds. Narratives help you easily map your own view, sense-check analyst assumptions, and adapt your decisions as the story evolves.

Do you think there's more to the story for Columbia Banking System? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives