- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB): Is There Untapped Value in the Latest Valuation Analysis?

Reviewed by Kshitija Bhandaru

Columbia Banking System (COLB) shares saw steady movement today, with returns over the past month showing a modest dip of 1% and a 4% climb over the past 3 months. Trading closed at $25.66 per share.

See our latest analysis for Columbia Banking System.

Looking beyond the modest dip over the past month, Columbia Banking System’s one-year total shareholder return of 4.3% reflects steady progress, with five-year total returns up a robust 63.8%. While short-term momentum is cooling, the longer-term picture points to consistent value for patient investors.

If you’re keeping an eye on banks and want to discover other companies showing impressive momentum and fundamentals, it is a perfect moment to broaden your scope with fast growing stocks with high insider ownership

With long-term gains and solid financial growth, the big question is whether Columbia Banking System’s current valuation underestimates its future potential or if the market has already priced in the company’s expected growth trajectory.

Most Popular Narrative: 10.8% Undervalued

Columbia Banking System’s fair value, according to the most widely followed narrative, is positioned at $28.77, notably above the recent close of $25.66. The gap between market price and consensus valuation puts a spotlight on the company's recent acquisitions and earnings expectations.

The planned acquisition and integration of Pacific Premier is expected to significantly expand Columbia's customer base and market reach in high-growth Western U.S. regions. This expansion may increase loan and deposit growth as both population and economic activity rise in these areas, which is likely to positively impact revenue and long-term earnings.

Want to see what’s fueling this punchy valuation? The secret sauce is all about staggering growth forecasts and bold profit margin ambitions. Wondering just how aggressive the analyst projections are? The numbers behind this narrative could surprise even seasoned investors. Dive in to uncover the assumptions shaping this fair value calculation.

Result: Fair Value of $28.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some risks remain, including integration challenges from recent mergers and ongoing reliance on Western U.S. markets. These factors could impact future growth.

Find out about the key risks to this Columbia Banking System narrative.

Another View: What Do Multiples Say?

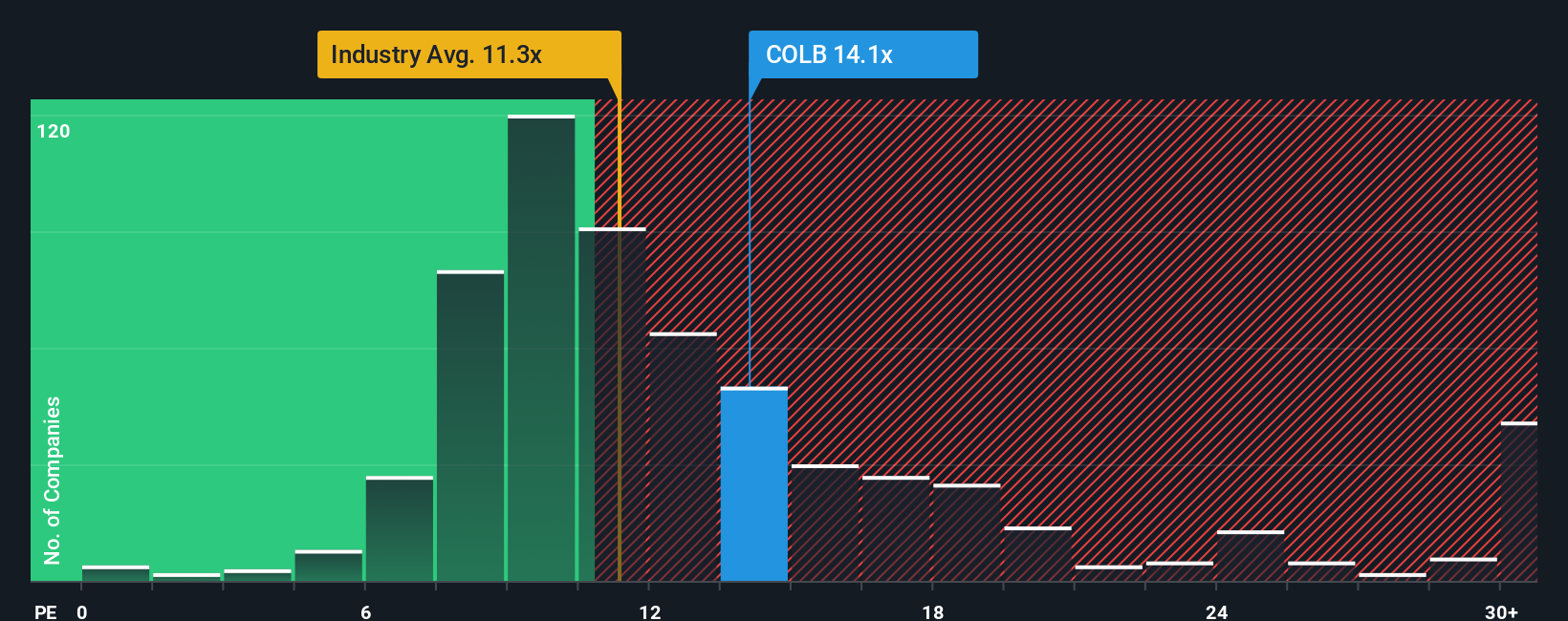

Taking a look at the price-to-earnings ratio, Columbia Banking System trades at 14.5x, which is higher than the US Banks industry average of 11.6x and its peer average of -6.7x. However, compared to the fair ratio of 17.8x, shares might still hold some upside if the market moves closer to that benchmark. Does this signal untapped value or hint at valuation risks for the cautious investor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Columbia Banking System Narrative

If you see things differently or want a hands-on approach, you can quickly craft your own view and narrative using the data in just a few minutes. So why not Do it your way

A great starting point for your Columbia Banking System research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Ideas?

Why stop here when so many compelling opportunities are just a click away? With the right insights, you could be seizing an advantage others might miss.

- Uncover the appeal of steady portfolio growth with the power of compounding by tapping into these 18 dividend stocks with yields > 3% offering yields above 3% from quality businesses.

- Spot tomorrow’s breakthroughs ahead of the crowd by checking out these 25 AI penny stocks which are fueling innovation across artificial intelligence and shaping transformative new industries.

- Boost your strategy by targeting value with these 897 undervalued stocks based on cash flows screened for strong cash flows and attractive entry points that others often overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives