- United States

- /

- Banks

- /

- NasdaqGS:CNOB

ConnectOne Bancorp (CNOB): Evaluating Valuation After Dividend Growth and Bullish 2025 Earnings Outlook

Reviewed by Kshitija Bhandaru

ConnectOne Bancorp (CNOB) is once again in the spotlight after fresh commentary pointed out its track record of raising dividends, with four increases in the last five years that average a 17% annual bump. With its current yield higher than both the industry and the S&P 500, plus expectations for robust earnings growth next year, this is a stock drawing new interest from investors seeking a blend of income and growth. It is not just about the headline numbers, either. What really has people talking is how these ongoing dividend boosts signal management’s confidence in ConnectOne’s future cash flows.

This backdrop has played out in the share price, which is up about 15% so far this year and has climbed more than 12% in the past three months. Over the past year, CNOB has returned just under 6%, and its five-year total return now tops 100%. That steady momentum, alongside news of superior dividend growth, keeps ConnectOne in the conversation among banks that have managed to buck sector headwinds.

But with all this in mind, is ConnectOne trading at a discount to its future potential, or has the market already factored in the growth story?

Most Popular Narrative: 11% Undervalued

The latest and most widely followed narrative suggests that ConnectOne Bancorp is trading below its fair value. This reflects optimism for significant upside in the stock as future earnings and profit margins are expected to surge.

The pipeline for commercial, SBA, construction, and residential loans is described as "strong," with loan growth opportunities and high current loan yields. This highlights potential for future revenue growth and improved earnings as the expanded footprint leverages secular economic and population growth in the New York and New Jersey regions.

Think the recent valuation surge is just hype? There is a bold financial thesis at play, centering on eye-catching future margins and aggressive expansion forecasts. Curious about the core assumptions, such as that ambitious future profit multiple? You will need to see how much growth is being factored in to justify this price target.

Result: Fair Value of $29.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased exposure to commercial real estate and integration risks from the recent merger could present challenges to ConnectOne's optimistic growth outlook.

Find out about the key risks to this ConnectOne Bancorp narrative.Another View: Market Comparison

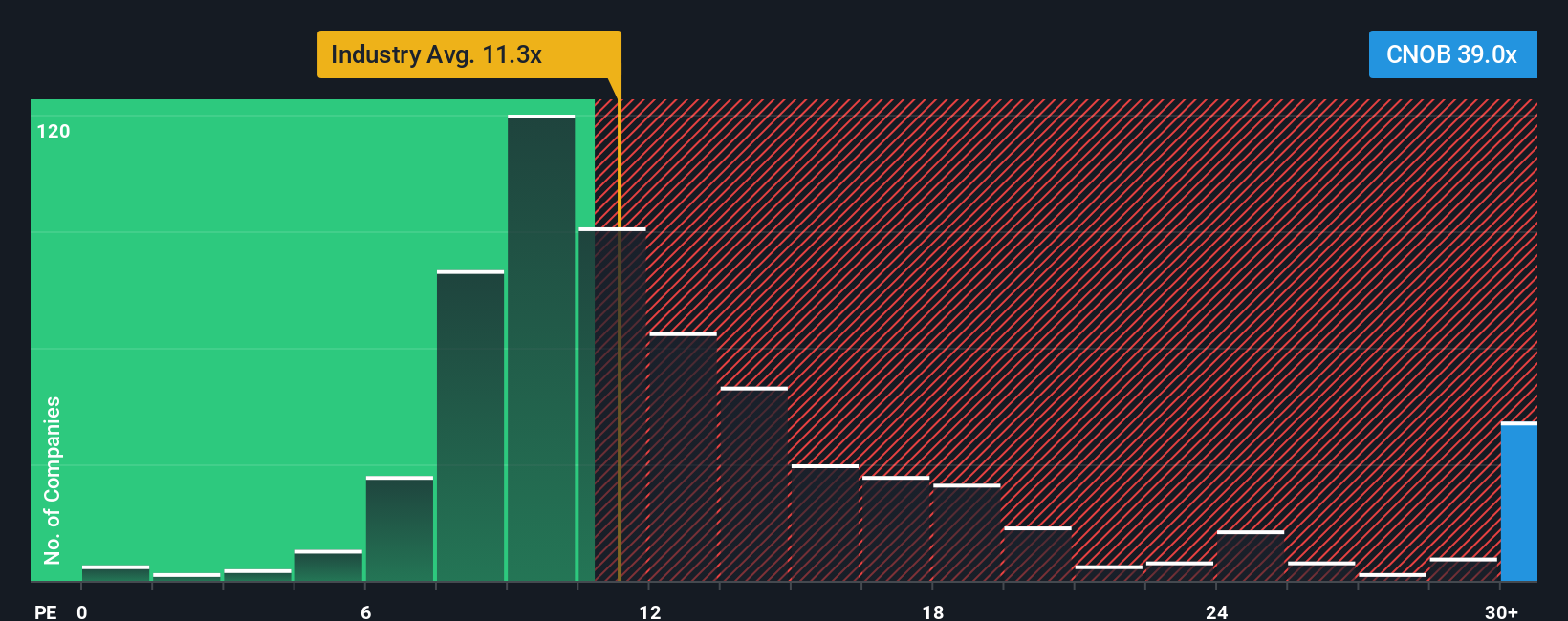

Looking at a different angle, a comparison to industry valuation suggests ConnectOne shares are trading at a much richer level than typical U.S. banks right now. Are investors banking on higher future growth or discounting the risks?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding ConnectOne Bancorp to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own ConnectOne Bancorp Narrative

If you want a different perspective or prefer to reach your own conclusions, consider doing your own analysis using the full data set. Building a narrative can take less than three minutes. Do it your way

A great starting point for your ConnectOne Bancorp research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Smart investors keep their edge by searching beyond the obvious, especially in markets overflowing with new trends and hidden gems. Missing this step could mean overlooking tomorrow’s strongest performers. Use these handpicked ideas to upgrade your portfolio:

- Find a steady stream of income and unlock new opportunities for growth by reviewing today’s top dividend stocks with yields > 3% delivering yields above 3%.

- Own a stake in breakthrough medicine and technology when you scan the best picks among healthcare AI stocks that are transforming health and care delivery with artificial intelligence.

- Get ahead of the curve with companies shaping digital finance by searching through the market’s standout cryptocurrency and blockchain stocks and blockchain innovators.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNOB

ConnectOne Bancorp

Operates as the bank holding company for ConnectOne Bank that provides commercial banking products and services for small and mid-sized businesses, local professionals, and individuals in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives