- United States

- /

- Banks

- /

- NasdaqGS:CHCO

A Look at City Holding (CHCO) Valuation After Regional Bank Rally on Sector Optimism

Reviewed by Kshitija Bhandaru

City Holding (CHCO) shares climbed as regional banks benefited from upbeat third-quarter results across major financial institutions. Optimism increased after the Fed signaled a potential pause in quantitative tightening, which provided a tailwind for bank stocks.

See our latest analysis for City Holding.

Even with a 2.11% share price return year-to-date, City Holding has stayed resilient while the banking sector navigates shifting monetary policy and upbeat earnings from industry giants. The steady 1-year total shareholder return of 1.3% and a robust 131.7% return over five years reflect a story of long-term gains, though momentum has cooled lately as investors weigh both recent rallies and valuation considerations.

If you’re curious to see what other under-the-radar names might be seeing insider confidence and fast growth, now is a great time to explore fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets and long-term performance still strong, the question remains: Is City Holding undervalued, or is the market already factoring in future growth prospects?

Price-to-Earnings of 14.3x: Is it justified?

City Holding’s current price-to-earnings (P/E) ratio stands at 14.3x, which is above the P/E average for both its banking peers and the broader US Banks industry. With the last close at $119.82, the stock trades at a premium compared to the sector’s norms. This raises questions about whether investors are justified in paying up for its earnings stream.

The price-to-earnings (P/E) ratio compares a company's stock price to its earnings per share. It serves as a widely used indicator of market sentiment and valuation. For banks, a lower P/E can sometimes signal undervaluation, while a higher multiple may reflect higher growth or profitability expectations. In this context, City Holding’s elevated ratio implies the market anticipates either outperformance or lower risk relative to its peers.

However, City Holding’s P/E of 14.3x exceeds the US Banks industry average of 11.7x and is also above the peer average of 13.5x. It even surpasses the estimated fair P/E ratio of 10.3x, which represents the level the market could revert toward if expectations normalize. This leaves little room for valuation upside unless earnings growth accelerates meaningfully or the company’s premium becomes justified by outsize performance.

Explore the SWS fair ratio for City Holding

Result: Price-to-Earnings of 14.3x (OVERVALUED)

However, slower revenue growth and recent declines in net income create uncertainty. This could challenge the current premium valuation for City Holding.

Find out about the key risks to this City Holding narrative.

Another View: Discounted Cash Flow Tells a Different Story

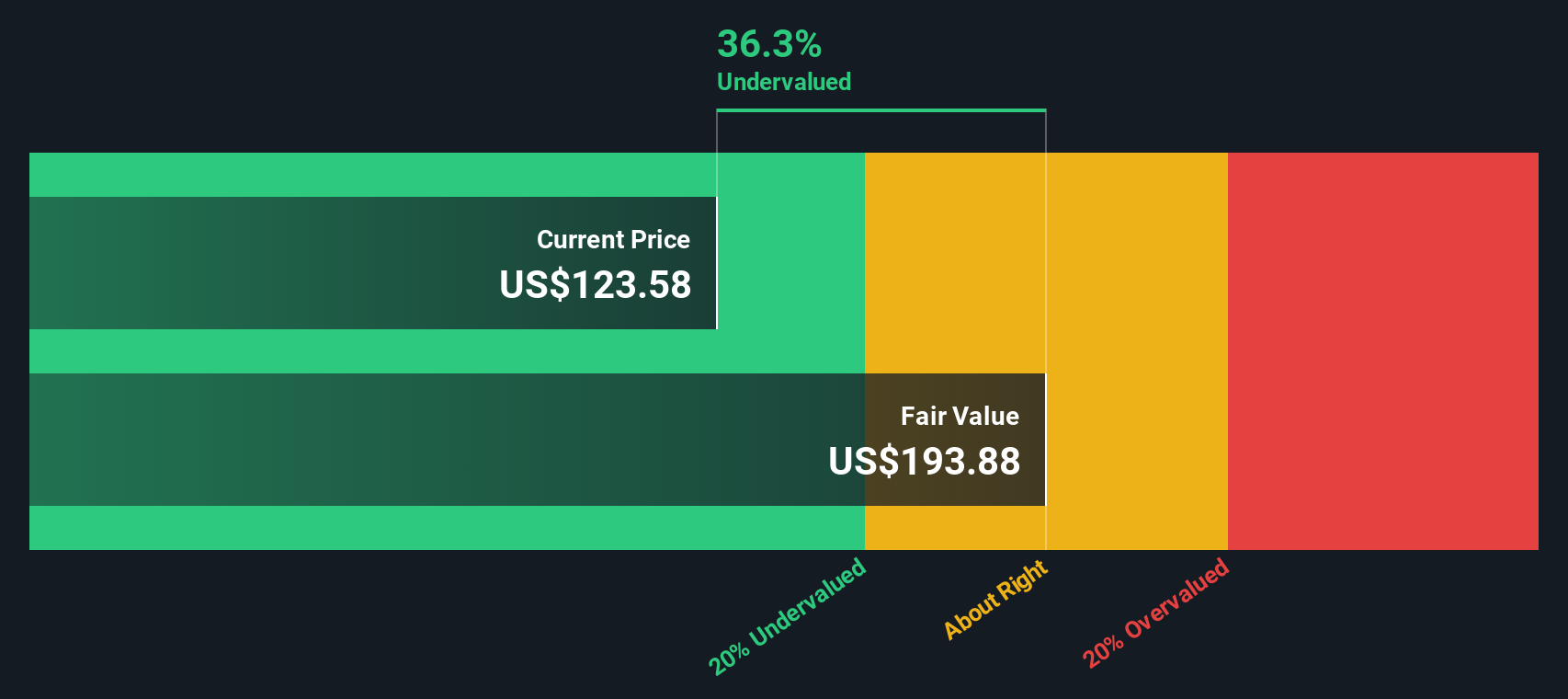

While traditional valuations show City Holding trading at a premium to its sector, our DCF model suggests something else. According to the SWS DCF model, shares could be significantly undervalued, currently priced almost 38% below the estimated fair value. Could the market be underestimating long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out City Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own City Holding Narrative

If these figures do not quite match your perspective or you enjoy drawing your own conclusions, you can easily build your own narrative in just a few minutes, and Do it your way.

A great starting point for your City Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Challenge yourself to think bigger and refresh your watchlist with new investment perspectives and sectors you may not have considered.

- Take advantage of high-yield potential by targeting income with these 18 dividend stocks with yields > 3%, which offers strong dividend returns and reliable payout histories.

- Tap into new frontiers by considering the innovation behind these 24 AI penny stocks, providing exposure to businesses accelerating artificial intelligence advancements across industries.

- Access strong value plays by reviewing these 874 undervalued stocks based on cash flows for companies trading below their cash flow potential and holding untapped upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHCO

City Holding

Operates as a financial holding company for City National Bank of West Virginia that provides banking, trust and investment management, and other financial solutions in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives