- United States

- /

- Banks

- /

- NasdaqGS:CARE

It Looks Like Carter Bankshares, Inc.'s (NASDAQ:CARE) CEO May Expect Their Salary To Be Put Under The Microscope

The results at Carter Bankshares, Inc. (NASDAQ:CARE) have been quite disappointing recently and CEO Litz Van Dyke bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 23 June 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Carter Bankshares

How Does Total Compensation For Litz Van Dyke Compare With Other Companies In The Industry?

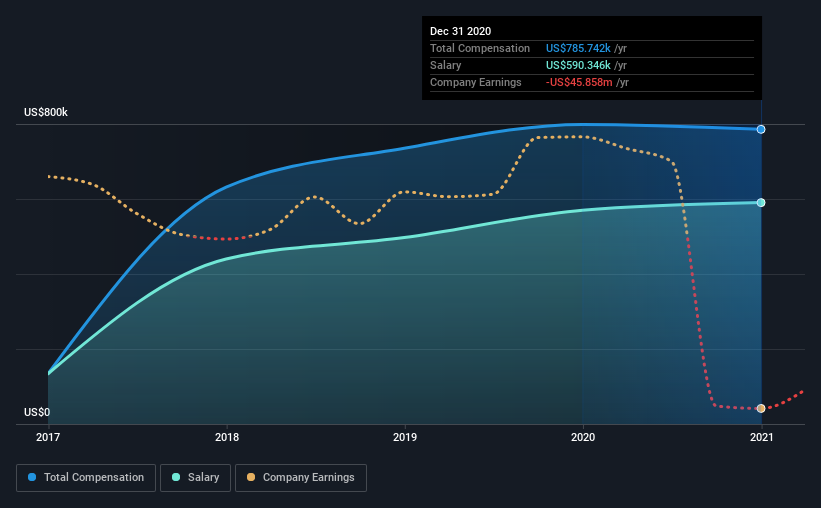

Our data indicates that Carter Bankshares, Inc. has a market capitalization of US$385m, and total annual CEO compensation was reported as US$786k for the year to December 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is US$590.3k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$1.1m. So it looks like Carter Bankshares compensates Litz Van Dyke in line with the median for the industry. Furthermore, Litz Van Dyke directly owns US$270k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$590k | US$570k | 75% |

| Other | US$195k | US$229k | 25% |

| Total Compensation | US$786k | US$799k | 100% |

On an industry level, around 43% of total compensation represents salary and 57% is other remuneration. According to our research, Carter Bankshares has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Carter Bankshares, Inc.'s Growth

Over the last three years, Carter Bankshares, Inc. has shrunk its earnings per share by 69% per year. It saw its revenue drop 5.2% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Carter Bankshares, Inc. Been A Good Investment?

With a three year total loss of 17% for the shareholders, Carter Bankshares, Inc. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

Whatever your view on compensation, you might want to check if insiders are buying or selling Carter Bankshares shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Carter Bankshares, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CARE

Carter Bankshares

Operates as the bank holding company for Carter Bank & Trust that provides various retail and commercial banking products and insurance services in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives