- United States

- /

- Banks

- /

- NasdaqGS:BSVN

3 Undiscovered US Gems with Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% drop, yet it remains up by 9.1% over the past year with an anticipated annual earnings growth of 14%. In this dynamic environment, identifying stocks with strong fundamentals and unique market positions can uncover hidden opportunities for investors seeking promising potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Bank7 (NasdaqGS:BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering a range of banking and financial services to both individual and corporate clients, with a market cap of $353.31 million.

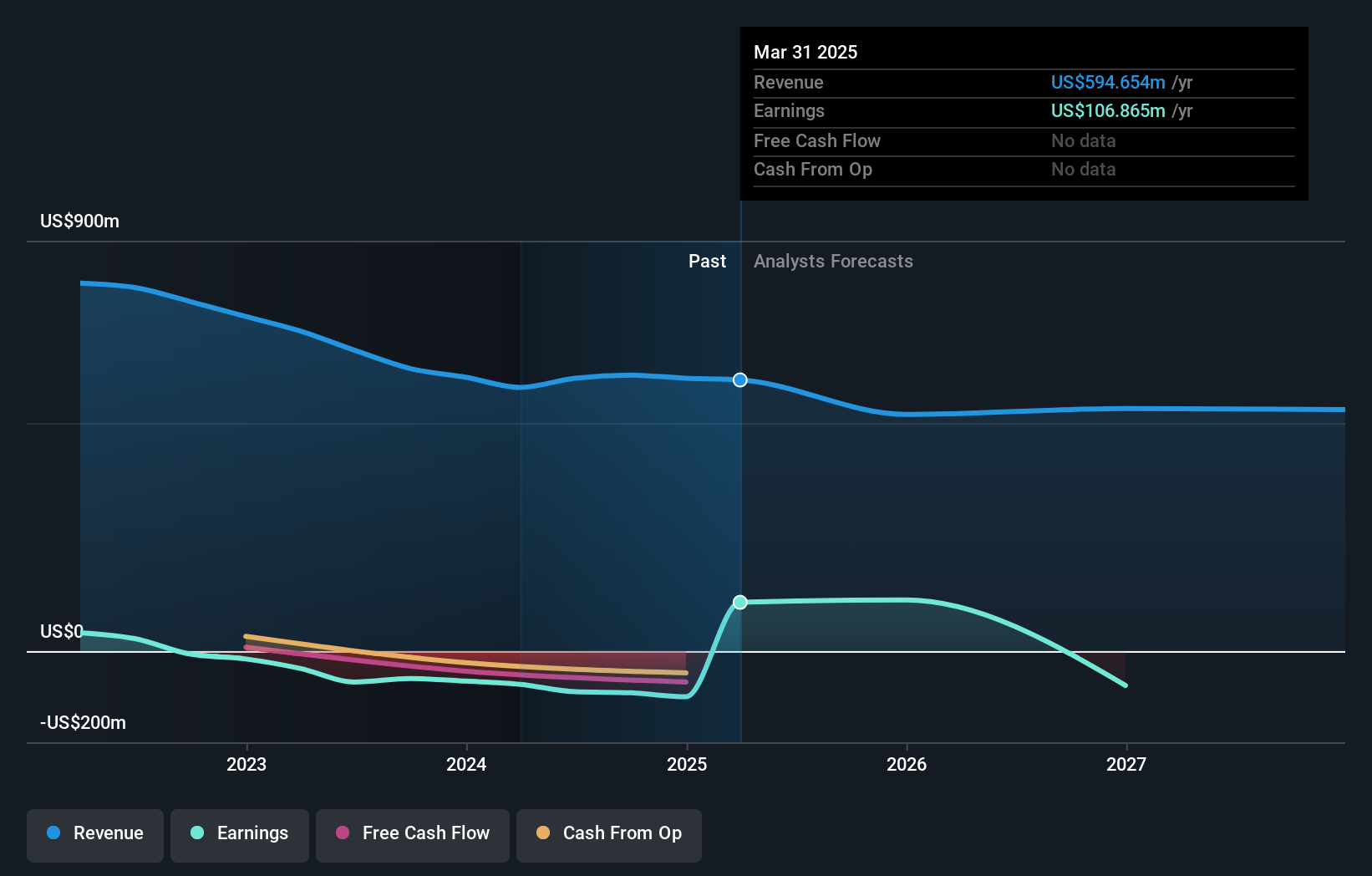

Operations: Bank7 generates revenue primarily from its banking operations, totaling $96.03 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

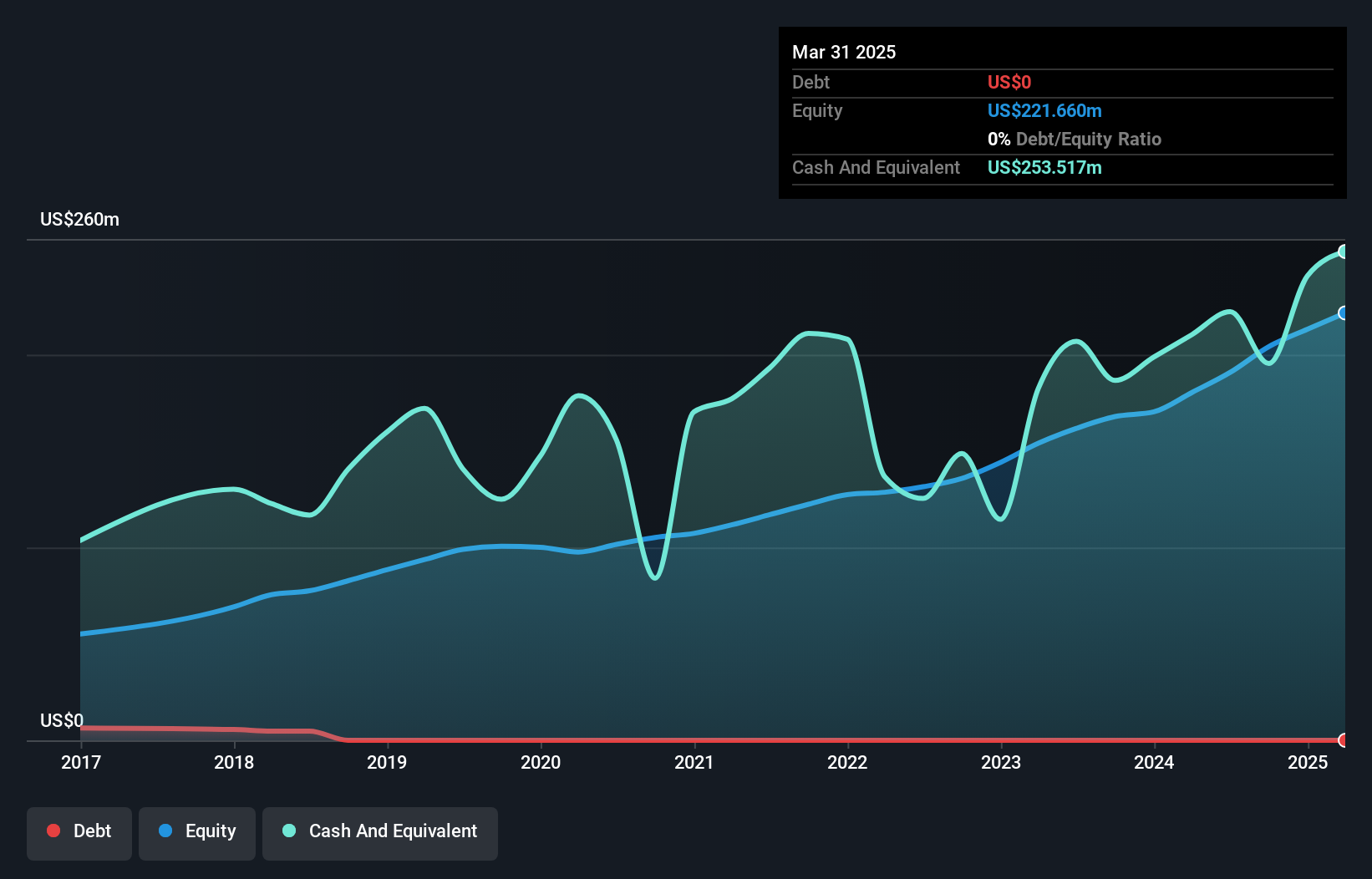

Bank7, with total assets of $1.8 billion and equity of $221.7 million, operates efficiently in high-growth markets like Oklahoma City and Texas, focusing on hospitality and C&I lending. The bank's disciplined capital strategy is bolstered by a sufficient allowance for bad loans at 0.4% of total loans and low-risk funding sources comprising 99% customer deposits. Despite earnings growth outperforming the industry at 49.4%, future revenue is expected to decline by 2.5% annually due to economic uncertainties in volatile sectors, although trading below fair value suggests potential upside if risks are managed well.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products across several countries, including Israel, Brazil, and the United States, with a market cap of $741.23 million.

Operations: The company generates revenue primarily from telematics services and products, with telematics services contributing $242.49 million and telematics products adding $93.77 million.

Ituran Location and Control, a small cap player in the telematics sector, shows promise with its strategic expansion into OEM partnerships and motorcycle telematics. Over the past five years, earnings have grown annually by 34%, reflecting high-quality past earnings. The company's debt to equity ratio has impressively reduced from 50% to just 0.06%, indicating robust financial management. With a price-to-earnings ratio of 13.8x, it trades below the US market average of 17.7x, suggesting good relative value for investors seeking growth opportunities in untapped markets despite potential risks like currency volatility and reliance on subscriber growth.

Sohu.com (NasdaqGS:SOHU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sohu.com Limited is an online media platform and gaming company offering products and services for PCs and mobile devices in China, with a market cap of $300.95 million.

Operations: Sohu.com generates revenue primarily through its online advertising and gaming segments. The company has experienced fluctuations in its net profit margin, which is a key indicator of profitability.

Sohu.com has shown a remarkable turnaround, reporting a net income of US$182.16 million for Q1 2025 compared to a net loss of US$24.97 million last year. The company boasts high-quality earnings and has significantly reduced its debt-to-equity ratio from 6.7% to 0.3% over five years, suggesting strong financial management. Despite these positives, future earnings are expected to decline sharply by an average of 110% annually over the next three years. With a price-to-earnings ratio of just 2.8x against the US market's 17.7x, Sohu offers intriguing value but faces challenges ahead in sustaining growth momentum.

- Delve into the full analysis health report here for a deeper understanding of Sohu.com.

Gain insights into Sohu.com's past trends and performance with our Past report.

Key Takeaways

- Discover the full array of 283 US Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSVN

Bank7

Operates as a bank holding company for Bank7 that provides banking and financial services to individual and corporate customers.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives