- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

Three Insider-Favored Growth Companies To Watch

Reviewed by Simply Wall St

As the U.S. market navigates trade tensions and fluctuating indices, investors are keeping a close eye on growth companies that have demonstrated resilience. In this environment, stocks with substantial insider ownership can signal confidence in a company's long-term potential, making them particularly noteworthy for those seeking promising opportunities amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 16.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 62.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.1% | 44.4% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| BBB Foods (NYSE:TBBB) | 12.9% | 30.2% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.5% | 42.2% |

| Ryan Specialty Holdings (NYSE:RYAN) | 15.5% | 91% |

Underneath we present a selection of stocks filtered out by our screen.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $854.11 million.

Operations: The company generates revenue of $288.68 million from its community banking products and services in Virginia and Maryland.

Insider Ownership: 13.3%

Burke & Herbert Financial Services is experiencing substantial insider buying, with insiders acquiring more shares than they sold in the past three months. The company forecasts revenue growth of 12.3% per year and earnings growth of 35.1% annually, both outpacing the US market averages. Despite a significant one-off impact on financial results, recent earnings showed strong improvement with net income rising to US$27.2 million from US$5.21 million year-over-year.

- Click here and access our complete growth analysis report to understand the dynamics of Burke & Herbert Financial Services.

- According our valuation report, there's an indication that Burke & Herbert Financial Services' share price might be on the cheaper side.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $3.64 billion.

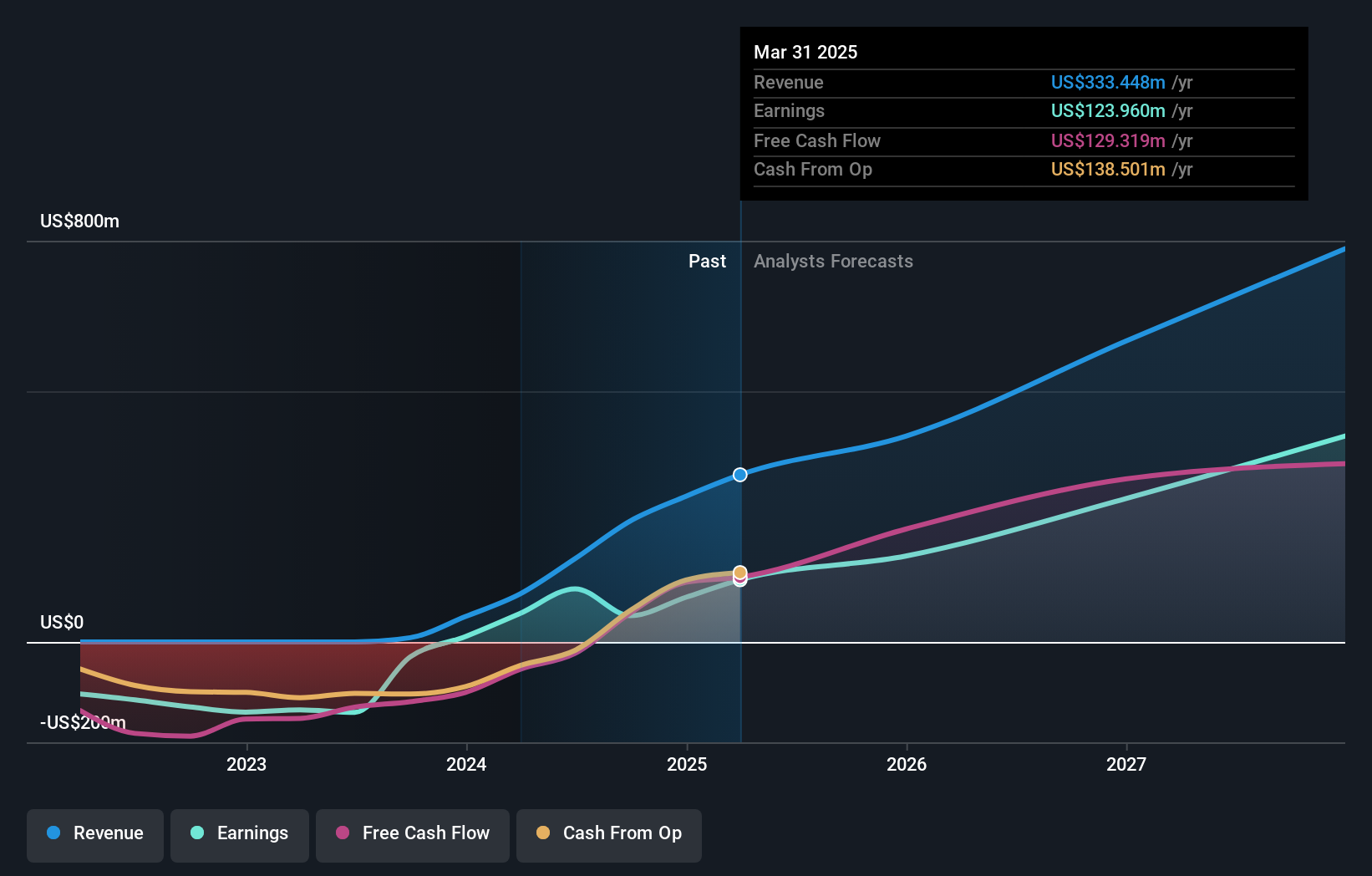

Operations: The company generates revenue of $333.45 million from its segment focused on the development and commercialization of pharmaceuticals.

Insider Ownership: 10.5%

Krystal Biotech is experiencing rapid growth, with earnings projected to increase by 32.5% annually, surpassing the US market average. Recent first-quarter results showed a substantial rise in net income to US$35.73 million from US$0.932 million year-over-year, although profit margins decreased from 59.6% to 37.2%. The European Commission's approval of VYJUVEK® for treating dystrophic epidermolysis bullosa marks a significant milestone, potentially driving further revenue growth forecasted at 26.1% annually.

- Click here to discover the nuances of Krystal Biotech with our detailed analytical future growth report.

- The analysis detailed in our Krystal Biotech valuation report hints at an deflated share price compared to its estimated value.

HCI Group (NYSE:HCI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HCI Group, Inc. operates in the United States through its subsidiaries, focusing on property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses with a market cap of $1.95 billion.

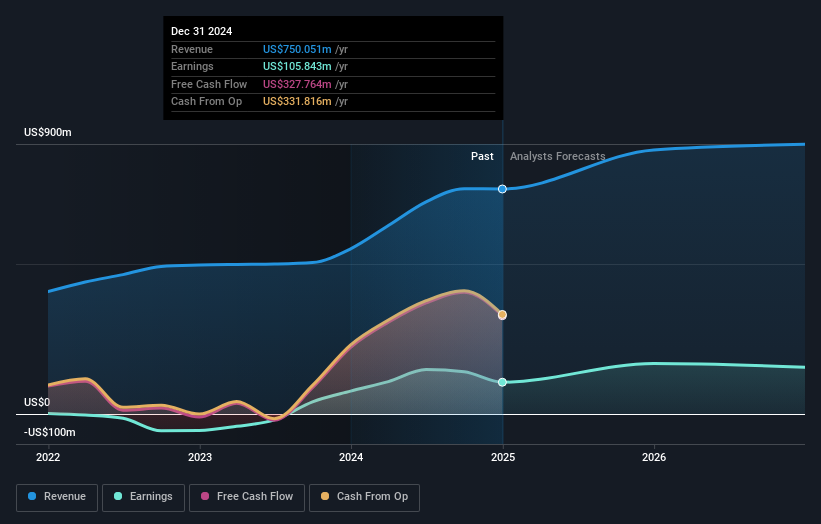

Operations: The company's revenue segments include $717.80 million from insurance operations, $42.11 million from reciprocal exchange operations, and $13.46 million from real estate.

Insider Ownership: 15.3%

HCI Group demonstrates significant growth potential with earnings projected to grow 25.2% annually, outpacing the US market average. Recent first-quarter results showed revenue rising to US$216.43 million from US$206.61 million, and net income increasing to US$69.68 million from US$47.61 million year-over-year. The company recently reorganized into two units: one focusing on insurance operations and another on technology solutions, enhancing its strategic focus in the property and casualty insurance sector.

- Delve into the full analysis future growth report here for a deeper understanding of HCI Group.

- Our expertly prepared valuation report HCI Group implies its share price may be lower than expected.

Key Takeaways

- Access the full spectrum of 189 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives