- United States

- /

- Banks

- /

- NasdaqCM:BHRB

Discovering 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 12% over the past year, with earnings expected to grow by 15% annually in the coming years. In this environment, identifying stocks that are not only resilient but also poised for growth can be key to uncovering potential opportunities within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Value Rating: ★★★★★★

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $953.14 million.

Operations: BHRB generates revenue primarily from its community banking segment, totaling $288.68 million. The company's market cap is valued at $953.14 million.

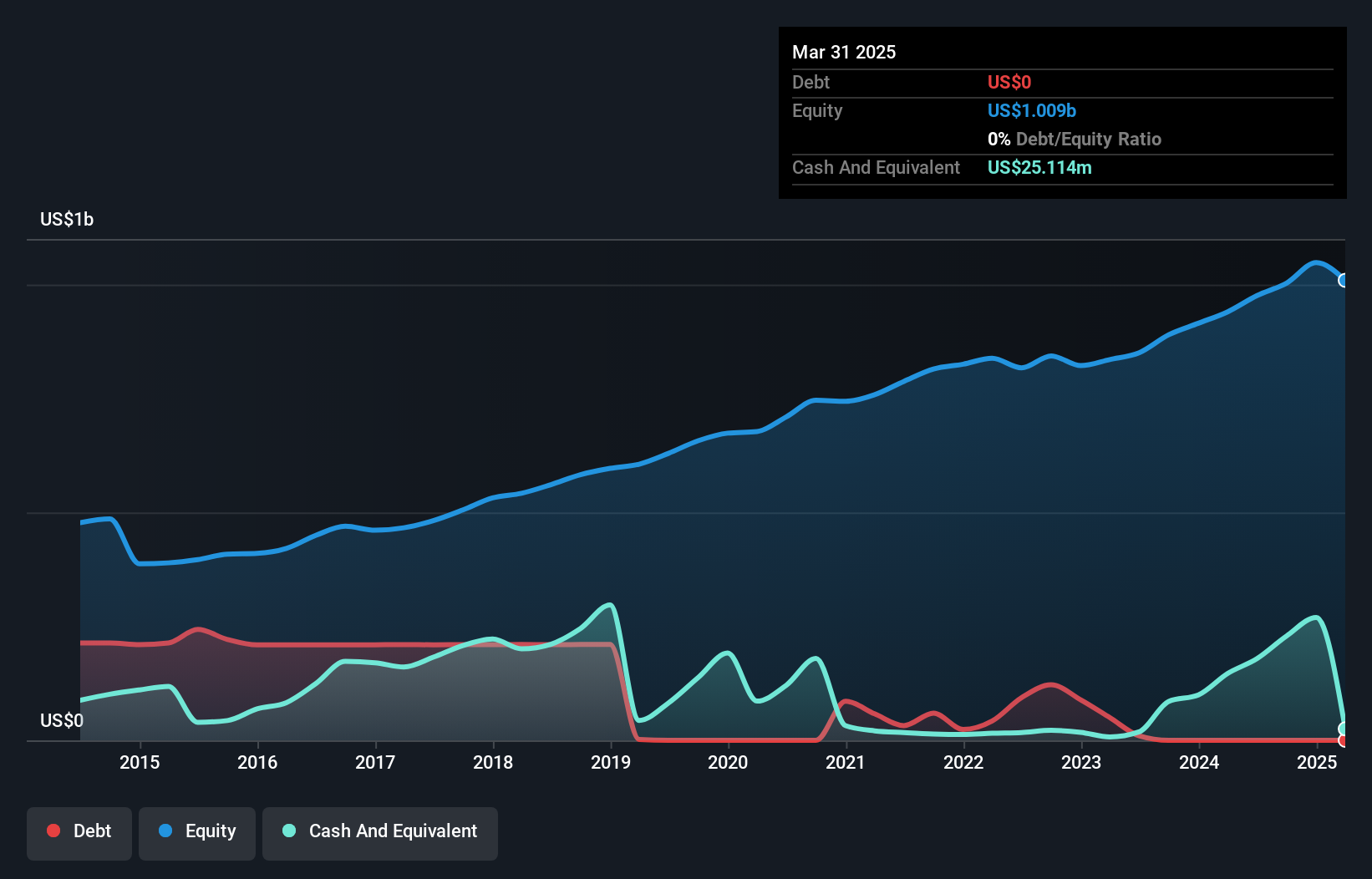

Burke & Herbert Financial Services, with assets totaling US$7.8 billion and equity of US$758 million, stands out for its robust financial health. Its total deposits reach US$6.5 billion against loans of US$5.6 billion, while maintaining a net interest margin of 3.1%. The company has an allowance for bad loans at 1.1% of total loans, indicating prudent risk management practices. Notably, earnings surged by 178% last year and are projected to grow annually by over 35%. Recently added to the S&P Regional Banks Select Industry Index, it announced a share repurchase program worth up to US$50 million in April 2025.

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. operates in the residential, renewable energy, agtech, and infrastructure sectors both in the United States and internationally with a market cap of $1.81 billion.

Operations: The company generates revenue from four segments: Residential ($777.40 million), Renewables ($277.57 million), Agtech ($163.82 million), and Infrastructure ($87.48 million).

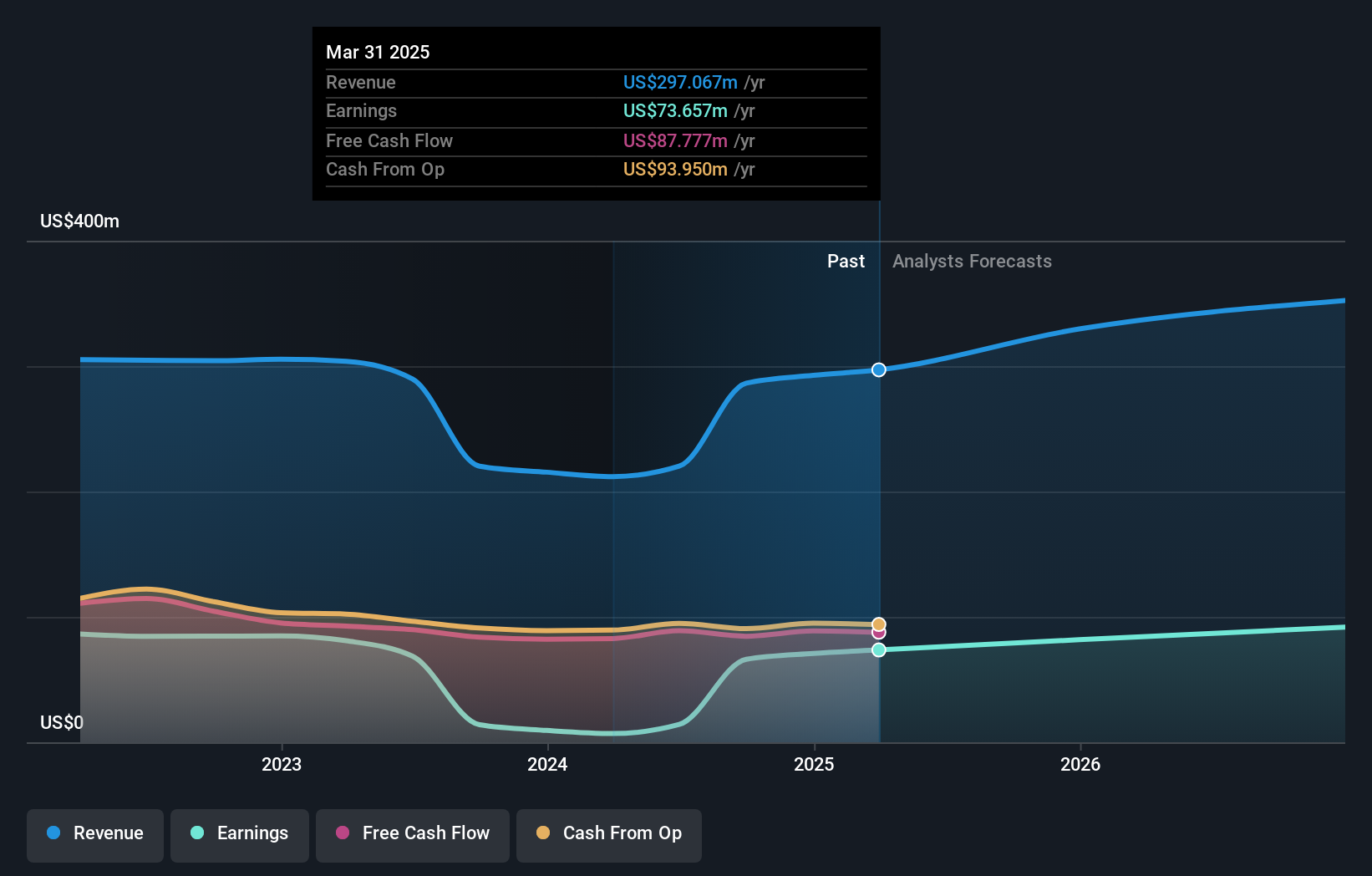

Gibraltar Industries, a nimble player in the building products sector, is making strategic moves by divesting its renewables business to focus on core segments like residential and infrastructure. Despite being dropped from several Russell indices, it remains debt-free and boasts high-quality earnings. The company repurchased 914,679 shares for US$60 million this year alone. Its earnings grew 16.7% last year, outpacing the industry average of -5.9%. Trading at 24.3% below estimated fair value, Gibraltar presents an intriguing opportunity with a forecasted annual growth rate of 11.43%.

Tompkins Financial (TMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tompkins Financial Corporation is a financial holding company offering a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning, wealth management, and insurance services with a market cap of $962.63 million.

Operations: The primary revenue streams for Tompkins Financial Corporation are banking, generating $237.57 million, and insurance services, contributing $40.94 million. Wealth management adds $20.66 million to the revenue mix.

Tompkins Financial, with assets totaling US$8.2 billion and equity of US$741.4 million, showcases a robust financial profile. Its total deposits stand at US$6.8 billion, while loans amount to US$6 billion, supported by a net interest margin of 2.8%. The company benefits from low-risk funding as customer deposits constitute 91% of liabilities. Despite an insufficient allowance for bad loans at 86%, the non-performing loan ratio remains appropriate at 1.2%. Recent earnings growth was impressive at 956%, surpassing industry averages significantly and reflecting high-quality past earnings that position it well within the competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of Tompkins Financial.

Assess Tompkins Financial's past performance with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 278 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burke & Herbert Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BHRB

Burke & Herbert Financial Services

Operates as the bank holding company for Burke & Herbert Bank & Trust Company that provides various community banking products and services in Virginia and Maryland.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives