- United States

- /

- Banks

- /

- NasdaqGM:AMAL

Here's Why We Think Amalgamated Financial (NASDAQ:AMAL) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Amalgamated Financial (NASDAQ:AMAL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Amalgamated Financial with the means to add long-term value to shareholders.

Check out our latest analysis for Amalgamated Financial

How Fast Is Amalgamated Financial Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Amalgamated Financial has grown EPS by 28% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

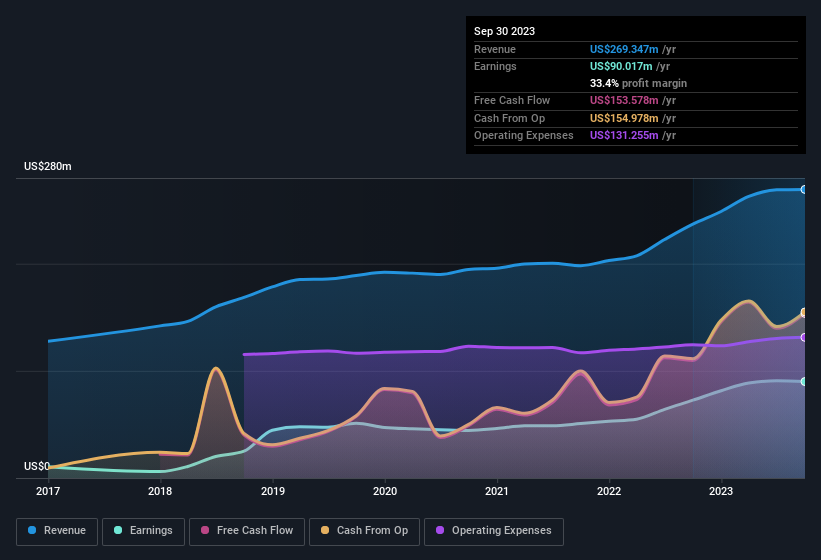

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Amalgamated Financial's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Amalgamated Financial achieved similar EBIT margins to last year, revenue grew by a solid 14% to US$269m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Amalgamated Financial's future profits.

Are Amalgamated Financial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that Amalgamated Financial insiders netted US$20k worth of shares over the last year. But the silver lining to that cloud is that Maryann Bruce, the Independent Director, spent US$30k buying shares at an average price of US$14.81. So, on balance, that's positive.

Should You Add Amalgamated Financial To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Amalgamated Financial's strong EPS growth. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; Amalgamated Financial is a strong candidate for your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Amalgamated Financial that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Amalgamated Financial, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AMAL

Amalgamated Financial

Operates as the bank holding company for Amalgamated Bank that provides commercial and retail banking, investment management, and trust and custody services in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026