- United States

- /

- Auto

- /

- OTCPK:NRDE

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of mixed performance, with tech stocks facing pressure and bond yields rising, investors are closely watching for opportunities that align with current economic conditions. Penny stocks, often associated with smaller or emerging companies, continue to attract interest due to their potential for significant growth despite their outdated moniker. By focusing on those penny stocks that exhibit strong financial health and a clear path forward, investors may uncover promising opportunities in this unique segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.26 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.84525 | $6.14M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.5235 | $10.57M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.33 | $12.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.36 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9599 | $86.33M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

International Isotopes (OTCPK:INIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: International Isotopes Inc. operates in the nuclear medicine sector by manufacturing and selling calibration and reference standards, cobalt-60 products, sodium iodide I-131 drug products, and radiochemicals for clinical research and life sciences both in the United States and internationally, with a market cap of $23.51 million.

Operations: The company's revenue is derived from three main segments: Cobalt Products generating $1.74 million, Theranostics Products contributing $8.07 million, and Nuclear Medicine Standards, including Radiological Services, accounting for $3.34 million.

Market Cap: $23.51M

International Isotopes Inc., with a market cap of US$23.51 million, faces challenges typical of penny stocks, including high volatility and unprofitability. Despite a recent improvement in quarterly earnings to US$0.15 million from a loss last year, the company remains unprofitable with losses increasing over five years at 7.5% annually. Short-term assets cover short-term liabilities (US$5.2M vs US$3.3M), but not long-term liabilities (US$9.4M). The company's cash runway exceeds three years if current free cash flow levels are maintained, though debt levels are high with an 89.5% net debt to equity ratio.

- Click to explore a detailed breakdown of our findings in International Isotopes' financial health report.

- Evaluate International Isotopes' historical performance by accessing our past performance report.

Nu Ride (OTCPK:NRDE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nu Ride Inc. currently does not have significant operations and has a market cap of $23.50 million.

Operations: Nu Ride Inc. has not reported any revenue segments.

Market Cap: $23.5M

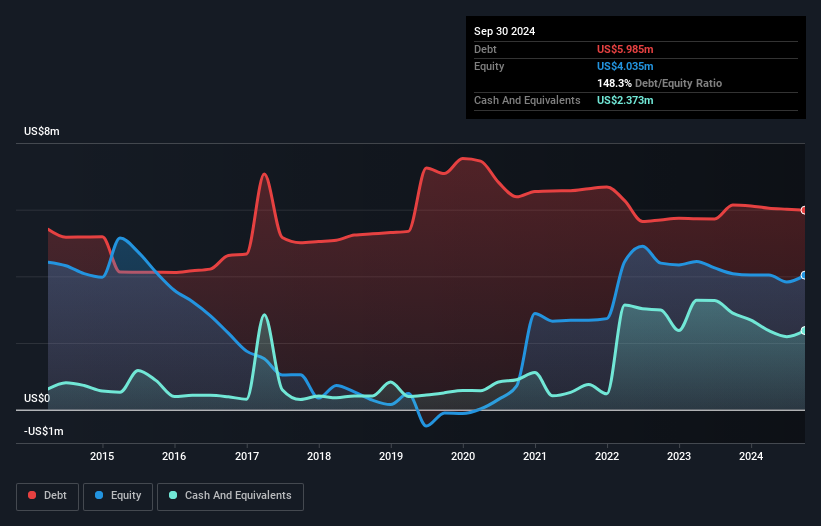

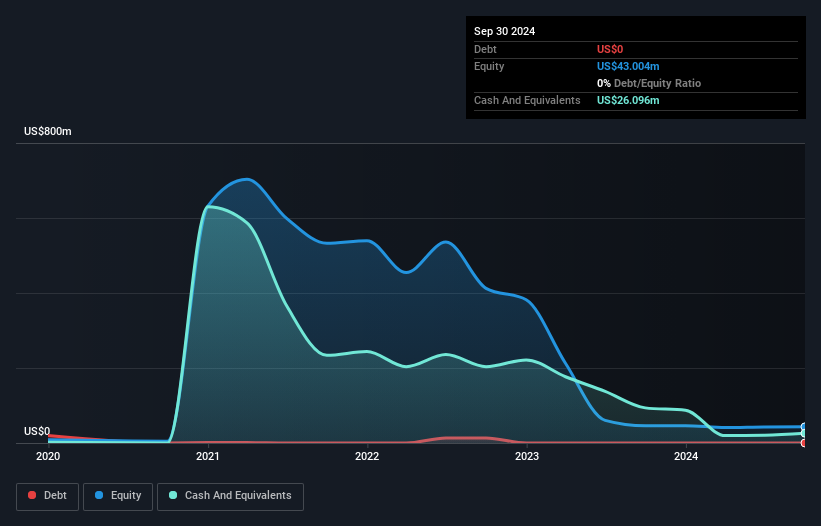

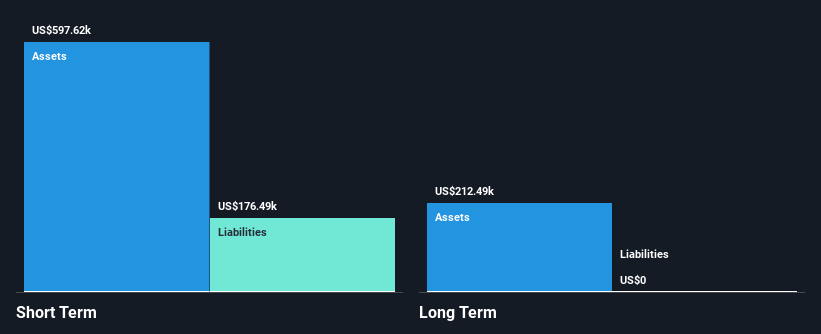

Nu Ride Inc., with a market cap of US$23.50 million, is pre-revenue and faces typical penny stock challenges such as high volatility and unprofitability. Recent earnings showed improvement, reporting a net income of US$0.338 million for the third quarter compared to a significant loss last year. The company is debt-free but has less than one year of cash runway based on current free cash flow levels. Short-term assets (US$58.3M) comfortably cover short-term liabilities (US$15.2M), yet the board's inexperience may pose governance risks with an average tenure of 0.8 years.

- Navigate through the intricacies of Nu Ride with our comprehensive balance sheet health report here.

- Explore historical data to track Nu Ride's performance over time in our past results report.

REMSleep Holdings (OTCPK:RMSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: REMSleep Holdings, Inc. is engaged in the development and distribution of products aimed at assisting individuals with sleep apnea globally, with a market cap of $14.78 million.

Operations: The company's revenue is primarily derived from its respiratory products segment, totaling $0.13 million.

Market Cap: $14.78M

REMSleep Holdings, Inc., with a market cap of US$14.78 million, is pre-revenue and grapples with high volatility and unprofitability. The company reported a net loss for the third quarter of US$0.28 million against minimal sales figures, highlighting ongoing financial challenges. Despite having no long-term liabilities and being debt-free, REMSleep has less than a year of cash runway at current burn rates. Recent delays in launching the Deltawave nasal pillows mask due to regulatory compliance further impact its financial outlook as it awaits product arrival by January 2025 end under supplier constraints.

- Take a closer look at REMSleep Holdings' potential here in our financial health report.

- Review our historical performance report to gain insights into REMSleep Holdings' track record.

Make It Happen

- Unlock our comprehensive list of 735 US Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Ride might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:NRDE

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives