- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Unveils Next-Gen P7 Electric Sedan Blending AI And Innovation

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) recently unveiled the next-generation XPENG P7, marking a significant design and technology evolution aimed at maintaining its international expansion momentum. Over the last quarter, XPeng's on-market total returns showcased a notable 31% gain. This surge coincided with several key corporate announcements, including a potential IPO for its flying car unit, emphasizing the company's aggressive growth strategy. Concurrently, the broader market experienced a positive upswing, with major indices like the S&P 500 and Nasdaq Composite extending winning streaks, supported by dissipating trade tensions and encouraging economic data, enhancing the tailwind for tech-oriented stocks like XPeng.

Buy, Hold or Sell XPeng? View our complete analysis and fair value estimate and you decide.

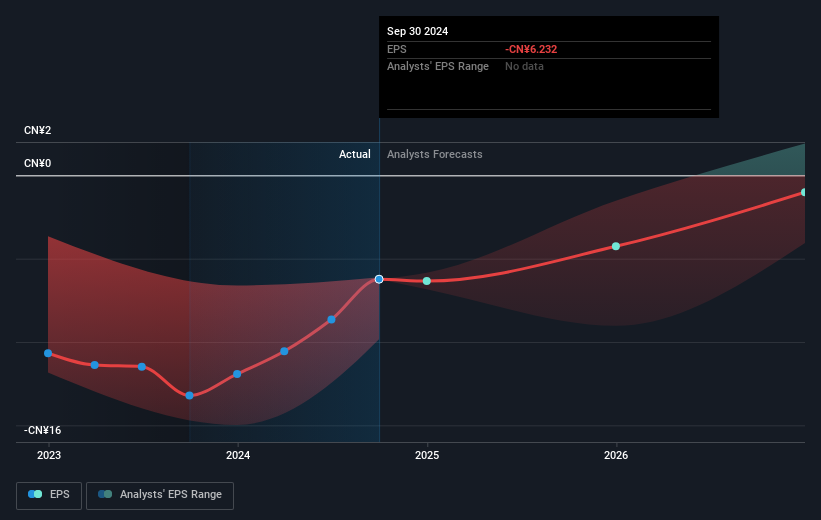

The unveiling of XPeng's next-generation P7 could further bolster its growth narrative, particularly with its strategic focus on intelligent technology and international expansion. This emphasis on innovation, while promising in the long run, might compress short-term profit margins due to increased research and development and expansion expenses. Over the longer term, XPeng experienced a very large total return of 161.70% over the past year, significantly outperforming the broader US market that returned 10.6% for the same period. This performance aligns with investor optimism around its aggressive expansion plans and AI-driven product launches.

In terms of market positioning, XPeng also exceeded the US Auto industry return of 76.3% over the past year. Key developments, such as the potential IPO for its flying car unit, could boost revenue and earnings forecasts by attracting new investments and enhancing technological capabilities. As per analyst consensus, XPeng's current share price of US$22.64 reveals a 13.7% discount to the price target of US$19.91. This discount suggests market expectations are higher than those projected by analysts, reflecting differing perceptions about the company's future growth prospects amid its technological advancements and international engagements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives