- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Sets New Delivery Record with 23,917 Smart EVs, Launches P7+ Sedan in November

Reviewed by Simply Wall St

Dive into the specifics of XPeng here with our thorough analysis report.

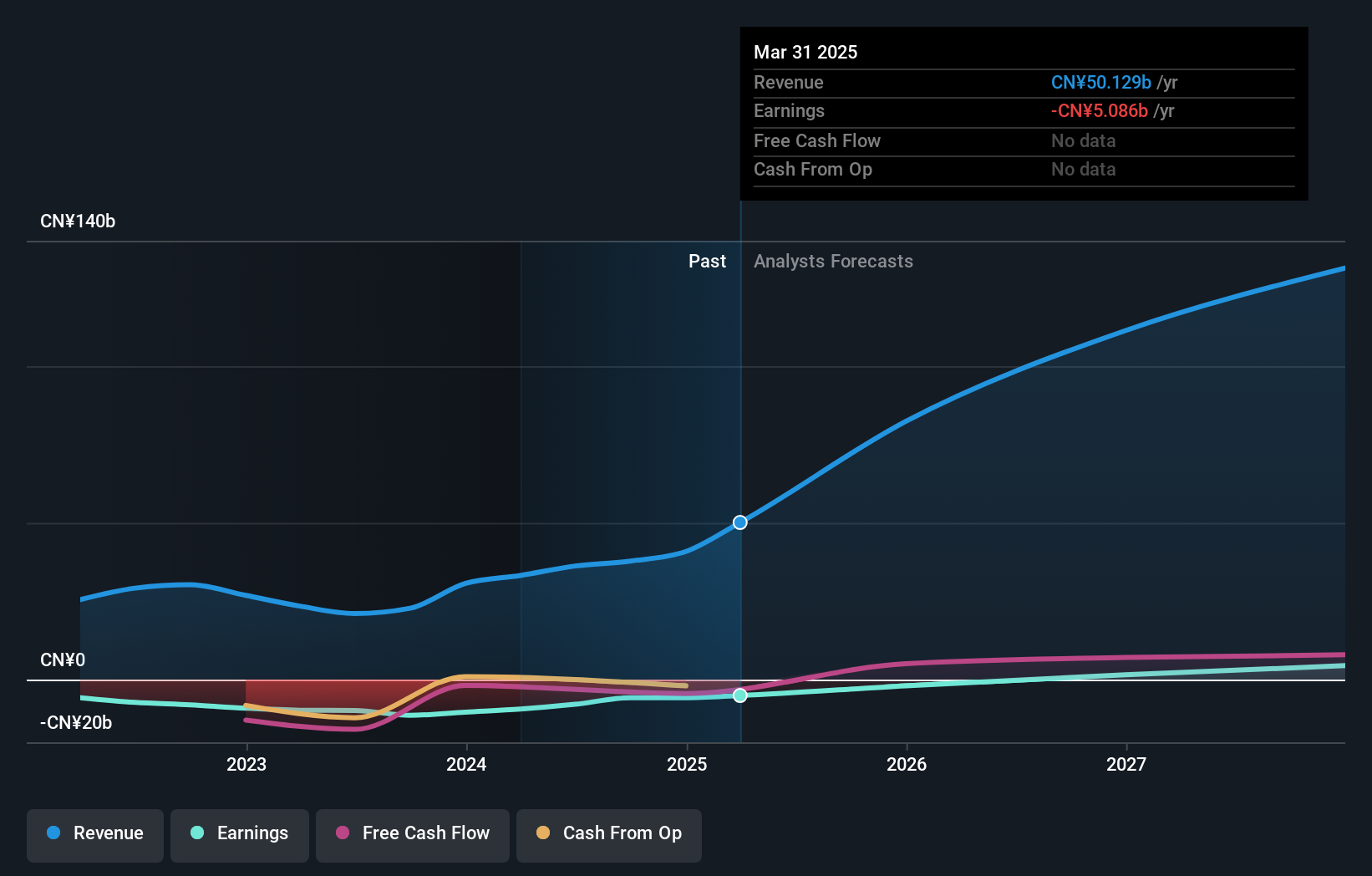

Core Advantages Driving Sustained Success for XPeng

XPeng's impressive expected revenue growth of 26% annually, surpassing the US market average, underscores its market positioning. The company's strategic focus on product innovation is evident, with recent launches like the MONA M03 and the upcoming XPENG P7+ enhancing its competitive edge. Additionally, XPeng's financial health is solid, with more cash than total debt, and earnings forecasted to grow by 63.79% per year. This financial stability is complemented by strong customer relationships, as highlighted by improved retention rates. While XPeng is considered expensive based on its Price-To-Sales Ratio compared to peers, this valuation may reflect its growth potential and market capture capabilities. Explore the current health of XPeng and how it reflects on its financial stability and growth potential.

Strategic Gaps That Could Affect XPeng

XPeng faces challenges such as increasing losses at 21.7% annually and a negative Return on Equity of 23.19%. The company's unprofitability is a concern, compounded by shareholder dilution with a 9.9% increase in shares outstanding. Additionally, XPeng's valuation, deemed expensive, could indicate financial challenges when compared to industry standards. These factors highlight the need for XPeng to address cost structures and enhance operational efficiencies to maintain its competitive position. To learn about how XPeng's valuation metrics are shaping its market position, check out our detailed analysis of XPeng's Valuation.

Potential Strategies for Leveraging Growth and Competitive Advantage

XPeng's expansion into new markets like Europe, particularly through strategic alliances such as with Motor Distributors Limited in Ireland, presents significant growth opportunities. The company's focus on digital transformation and AI-driven innovations, like the XPENG Turing chip, positions it well to capitalize on regulatory changes and consumer trends. These initiatives not only enhance market position but also align with the growing demand for sustainable and intelligent mobility solutions. See what the latest analyst reports say about XPeng's future prospects and potential market movements.

Competitive Pressures and Market Risks Facing XPeng

XPeng must navigate economic headwinds and supply chain vulnerabilities, which pose risks to its operational stability. The company's awareness of these external factors, as discussed in recent earnings calls, highlights its proactive approach to mitigating potential threats. Regulatory challenges also remain a concern, potentially impacting its ability to operate in certain markets. These pressures underscore the importance of strategic agility in maintaining XPeng's growth trajectory. To gain deeper insights into XPeng's historical performance, explore our detailed analysis of past performance.

Explore the current health of XPeng and how it reflects on its financial stability and growth potential.Conclusion

XPeng's projected annual revenue growth of 26% and its strategic focus on innovation, exemplified by new product launches, position it to outperform the US market average. However, the company's financial challenges, including increasing annual losses and a negative return on equity, highlight the need for improved operational efficiency. While its Price-To-Sales Ratio suggests it is expensive compared to peers and the broader US auto industry, this may reflect investor confidence in its growth potential and market expansion strategies, such as its foray into Europe. XPeng's ability to navigate these financial and operational hurdles will be crucial to maintaining its competitive edge and achieving sustainable growth.

Turning Ideas Into Actions

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade XPeng, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives