- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV): Examining Valuation After Trump’s Tariff Threat Sparks Sharp Stock Slide

Reviewed by Kshitija Bhandaru

XPeng (NYSE:XPEV) shares slid sharply after President Donald Trump discussed the possibility of imposing much higher tariffs on Chinese imports. This sparked a broad selloff across US-listed Chinese stocks, including XPeng and its sector peers.

See our latest analysis for XPeng.

Despite XPeng posting record vehicle deliveries in September and logging a massive 81.99% share price return so far this year, the latest 8% daily dip shows how quickly momentum can swing when broader sentiment turns, especially in the face of tariff headlines and uncertainty. Over the longer term, total shareholder returns remain impressive, up 151% for investors over three years, but volatility is on the rise as the market sorts out what is next for Chinese EV makers in the US.

If you’re curious about how other auto stocks are faring in this shifting landscape, it could be a great time to explore See the full list for free.

With sentiment rapidly changing and shares under pressure despite record-breaking growth, the question now is whether XPeng’s current price represents a rare value play or if future gains are already reflected by the market.

Most Popular Narrative: 20% Undervalued

XPeng's current price of $21.02 sits well below the narrative's fair value estimate of $26.29, pointing to a sizable upside if ambitious profit targets are reached. The market is clearly weighing short-term turbulence against bold projections of future growth and margin expansion.

XPeng's rapid in-house development and deployment of proprietary AI hardware (Turing AI SoC) and vision-based ADAS is expected to significantly advance its vehicle autonomy and smart cockpit solutions. This aligns with surging consumer demand for intelligent, software-centric vehicles and sets the stage for higher-margin software revenue and enhanced gross and net margins.

Want to know why this fair value towers above today’s price? The most popular narrative is hinging on XPeng’s technology leadership, new launches, and a major margin turnaround. Which rapid improvements and bullish industry shifts are baked into these projections? See for yourself; some numbers might surprise you.

Result: Fair Value of $26.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and fierce price competition in the Chinese EV market could limit XPeng's path to sustainable profitability, which may challenge the bullish outlook.

Find out about the key risks to this XPeng narrative.

Another View: Multiples Tell a Different Story

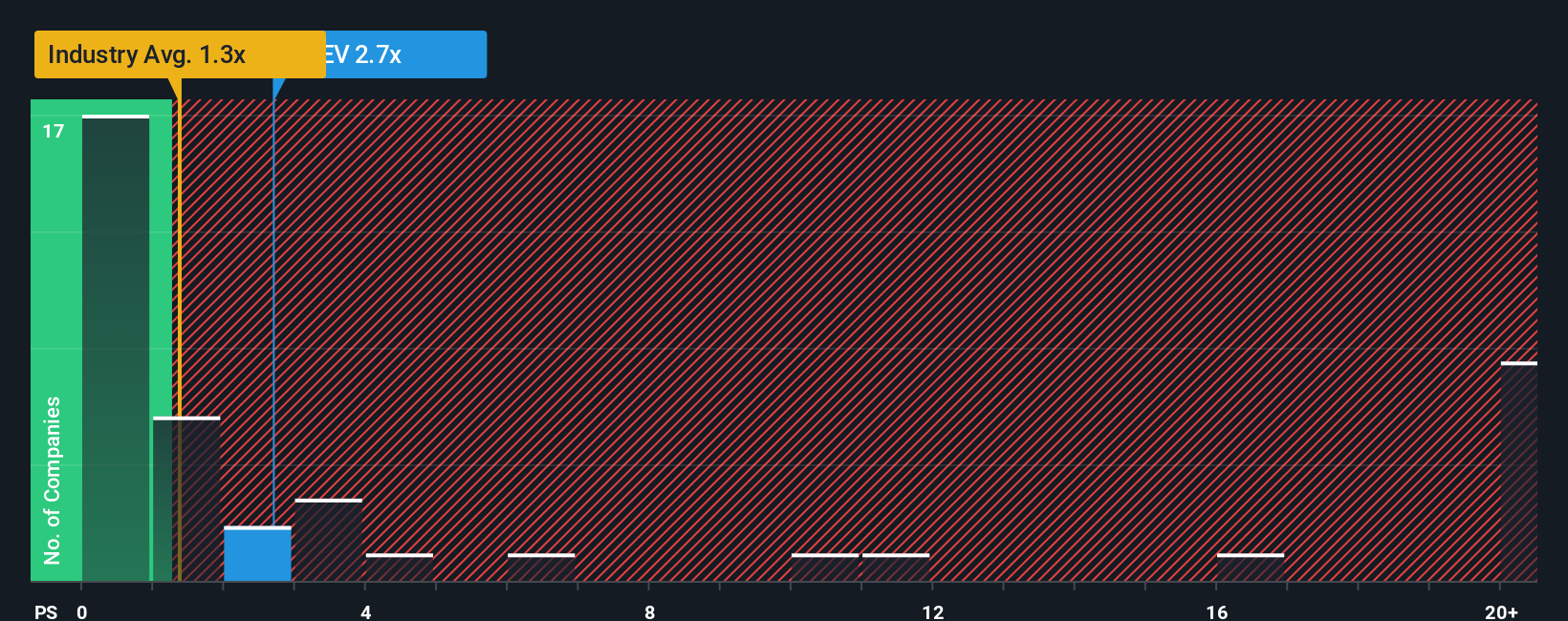

Looking at valuation from a different angle, XPeng’s price-to-sales ratio stands at 2.4x. This is higher than the US Auto industry average of 1.3x and its own fair ratio of 2.1x. This premium means the stock may already be pricing in optimistic growth, raising the risk for investors if those expectations are missed.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you think there's a different angle or want to dig into the numbers yourself, crafting your own narrative takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Looking for More Investment Ideas?

Never settle for just one opportunity when you could uncover your next winner. Gain an edge by checking out stocks shaking up the most exciting trends today:

- Uncover companies set to benefit from the rapid rise of artificial intelligence by checking out these 24 AI penny stocks who are driving tomorrow’s innovations right now.

- Capture overlooked value by putting these 893 undervalued stocks based on cash flows on your radar. Find quality businesses trading below their worth based on future cash flows.

- Boost your passive income with reliable yields by spotting these 19 dividend stocks with yields > 3% offering over 3% and robust balance sheets for income you can count on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives