- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV): Evaluating Valuation After Record August Deliveries and Nationwide P7 Launch

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) has just caught the market’s attention, announcing a record-shattering 37,709 Smart EV deliveries in August. That is a 169% jump compared to last year, and even edges out last month’s record by another 3%. Alongside this, the company launched its new P7 model at the end of August, rolling out deliveries nationwide without missing a beat. For investors wading through electric vehicle stocks, the latest news is a timely reminder that XPeng is not simply keeping up; it is setting new benchmarks for growth in an increasingly competitive landscape.

This wave of momentum is hard to ignore. Over the first eight months of the year, XPeng has racked up more than 271,000 unit deliveries, up 252% from the prior year. The stock has delivered a 142% total return over the past twelve months, with gains this year outpacing most competitors. Earlier bumps in performance now seem distant as the company leverages both operational and product milestones to build investor confidence and may be setting up for the next leg of growth.

After these milestones and a strong price run this year, is XPeng undervalued, or is the market already pricing in all this future growth? Let us look at the numbers.

Most Popular Narrative: 21.7% Undervalued

According to the most popular narrative, XPeng is currently trading at a considerable discount to its estimated fair value. This positions the stock as undervalued in light of its projected growth trajectory.

XPeng's rapid in-house development and deployment of proprietary AI hardware (Turing AI SoC) and vision-based ADAS are expected to significantly advance its vehicle autonomy and smart cockpit solutions. This aligns with surging consumer demand for intelligent, software-centric vehicles and sets the stage for higher-margin software revenue as well as enhanced gross and net margins.

Want to know what’s fueling this growth story? The secret lies in bold forecasts, aggressive expansion, and a valuation model banking on major shifts in profitability and margins. Curious about which assumptions could make this stock surge past its current price? Unpack the key equations driving a fair value far above where it trades today.

Result: Fair Value of $26.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent net losses and fierce domestic competition could limit XPeng’s earnings momentum. This may make sustained profitability harder to achieve in the near term.

Find out about the key risks to this XPeng narrative.Another View: Are the Numbers Telling a Different Story?

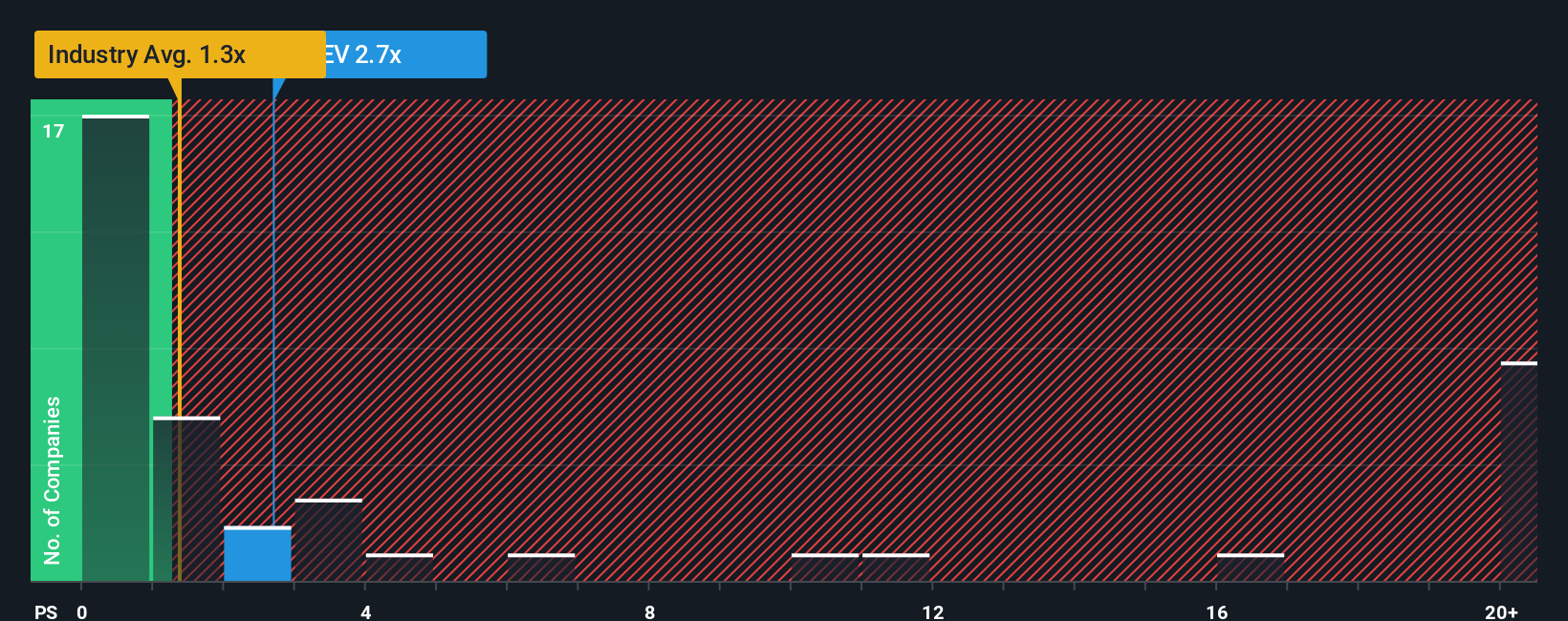

While the popular fair value model sees upside, a look through the lens of the price-to-sales ratio draws a different conclusion. By this metric, XPeng’s shares appear pricier than the industry average, which casts doubt on that undervalued label. Which approach should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you have a different perspective or want to chart your own course through the latest numbers, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding XPeng.

Looking for more investment ideas?

Don’t stop at XPeng. Expand your investing playbook and get inspired by unique opportunities that others might be missing right now.

- Find strong potential in worthy up-and-comers with penny stocks with strong financials, as they combine market agility with solid fundamentals for outsized growth.

- Spot innovation at the heart of tomorrow’s breakthroughs with quantum computing stocks, featuring companies pioneering quantum computing advances and transformative tech.

- Secure steady income and peace of mind by searching for dividend stocks with yields > 3%, aimed at stocks offering reliable yields exceeding 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion