- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng Inc. (NYSE:XPEV) is Being Pulled Down by the Lockdowns but the Business is Executing on Growth

Key takeaways:

- The company grew revenue 153% y/y and is expected to keep growing at a 35% annual rate.

- Like other Chinese ADRs, XPeng is at risk of being delisted if the US and Chinese governments do not agree on audit access.

- The company is positioned in a large market with relatively few EV competitors.

XPeng Inc. (NYSE:XPEV) seems to be executing on growth. The company released its latest quarterly results this week and seems to be progressing on their business vision. In this article, we will review that progress and examine the possible risk factors for investors wanting a stake in the company.

Check out our latest analysis for XPeng

After filing the quarterly results, the stock remained mostly flat, around -1.2%.

Here are the highlights from this quarter's earnings:

- Revenues of US$1,176b in line with expectations and a 153% increase y/y, 12.9% decrease q/q.

- Quarterly deliveries 34,561, a 159% increase y/y, but less than previous quarter deliveries of 41.751

- Gross margin increased by 1% to 12.2%

- Net loss increased to US$268.3m

- With a cash balance of US$6,58b, the company can keep making losses for about 6 more years before it needs to break into profit.

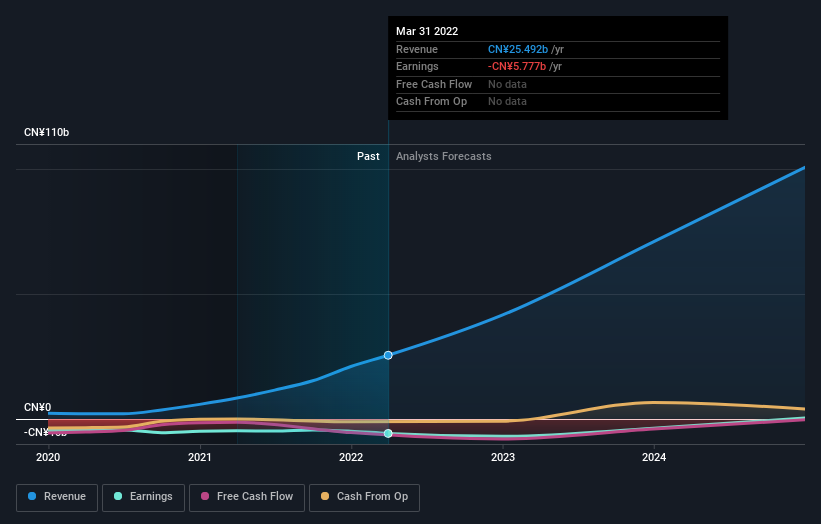

In the chart below, we can see how the company progressed on a trailing twelve-month basis.

Check out our latest analysis for XPeng

XPeng is still in the early stages of growth, and what makes the company even more attractive is that it is positioned in a very large and unsaturated market - China.

There are competitors in the Chinese EV space, like NIO (NYSE:NIO) and Li Auto (NASDAQ:LI), but as they develop and differentiate, the companies will find their fit in the market.

Analysts expect revenue to grow 63% in 2022, and about 35% annually after that. This shows that the company is growing at a high rate, and will likely attract more investors as it keeps operating.

After the earnings, analysts have cut their price target 11% to US$43 per share, suggesting that the declining revenue was a more crucial indicator than the forecast reduction in losses. If we look at the spread of price targets, we see that the most optimistic analysts give it a price target of US$64 per share, while the most pessimistic values it at US$27.

Major Risk Factors

It is important to note that the deliveries aren't slowing down because of demand or operations, but because a large part of China is still under hard quarantine, which makes conducting business significantly slower. This is likely a temporary, although possibly an extended situation.

There are two ways business goes back to full force, one, if the government changes its approach, and two, if COVID-19 is no longer a risk. For investors, it would be best if the situation is resolved sooner, but while the authorities are concerned about the economic situation, it is hard to estimate if they will change their approach.

The US and China have been increasing tensions in the investment landscape, and negotiations are underway regarding the accessibility to audit Chinese ADR's from US inspectors. The US has started enforcing audit requirements for Chinese stocks, and threatens delisting from exchanges should the Chinese fail to allow physical audits of the companies.

The Securities and Exchange Commission (SEC) has published a list of companies that need to be audited or risk delisting from US exchanges.

XPeng Inc., is on that list, which gives investors a whole new dimension of risk to consider.

Conclusion

XPeng is expanding in the Chinese EV space - the company has limited competition and is positioned in a large market. Latest results were pinned down by the difficulty of doing business amid the hard lockdowns, but the company is set to recover once the situation subsides.

Investors are dealing with a lot more risk factors than with western companies, since the US and China have to come to an agreement regarding company audits, otherwise many Chinese companies risk being delisted from US exchanges.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple XPeng analysts - going out to 2024, and you can see them free on our platform here.

It is also worth noting that we have found 2 fundamental warning signs for XPeng that you need to take into consideration.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives