- United States

- /

- Auto

- /

- NYSE:XPEV

Take Care Before Jumping Onto XPeng Inc. (NYSE:XPEV) Even Though It's 27% Cheaper

XPeng Inc. (NYSE:XPEV) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

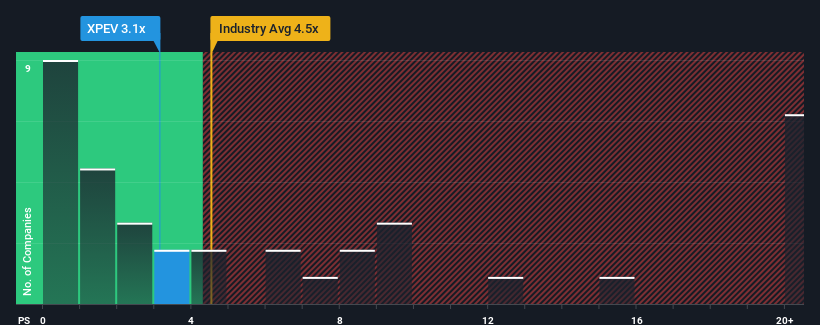

After such a large drop in price, XPeng may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.1x, since almost half of all companies in the Auto industry in the United States have P/S ratios greater than 4.5x and even P/S higher than 10x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for XPeng

What Does XPeng's Recent Performance Look Like?

XPeng could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think XPeng's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For XPeng?

XPeng's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next three years should generate growth of 60% each year as estimated by the analysts watching the company. With the industry only predicted to deliver 32% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that XPeng is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The southerly movements of XPeng's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at XPeng's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for XPeng that you should be aware of.

If these risks are making you reconsider your opinion on XPeng, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade XPeng, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.