- United States

- /

- Auto

- /

- NYSE:XPEV

Should Investors Reconsider XPeng After Its 79% Rally and Recent Product Launches?

Reviewed by Simply Wall St

Thinking about what to do with XPeng stock? You are not alone. Investors have been eyeing this electric vehicle player as it navigates market optimism, volatility, and global competition. Over the past year, XPeng’s stock has more than doubled, rising a remarkable 206%. Just this year, it has delivered an impressive 79.6% return, outpacing much of the sector and sparking plenty of “should I buy now?” conversations.

This rally has not been all smooth driving, however. XPeng saw a 6.8% dip over the last three months as worries about EV market growth and persistent competition weighed on sentiment. Recent weeks have brought a bounce, with the stock up 13.3% in the last month alone. Factors such as fresh product launches, new government incentives in China, and generally upbeat EV industry news have helped investors shake off some of the earlier concerns.

Still, valuation is the big question. Is XPeng truly worth the attention at this price? According to a standard set of six checks for undervaluation, XPeng only meets one, giving it a valuation score of 1. That suggests some caution but also opens the door for a deeper exploration of whether the market’s optimism is justified or if there is a disconnect between price and underlying value.

Let’s explore the different ways to evaluate XPeng’s worth. We will walk through key valuation methods, and before we wrap up, I will share a fresh perspective that may provide even clearer insight into XPeng stock value.

XPeng delivered 206.4% returns over the last year. See how this stacks up to the rest of the Auto industry.Approach 1: XPeng Cash Flows

A Discounted Cash Flow (DCF) model aims to estimate what a company is truly worth by forecasting its future cash flows and discounting those amounts back to today’s dollars.

For XPeng, the most recent free cash flow figure stands at a negative $5.46 billion, indicating significant outflows as the company invests in growth. However, projections appear more optimistic. By 2027, analysts expect free cash flow to recover to $9.24 billion. Looking a full decade into the future, the model estimates XPeng's annual free cash flow could reach nearly $18.47 billion by 2035, with cash flows climbing steadily over the years based on various analyst and internal estimates.

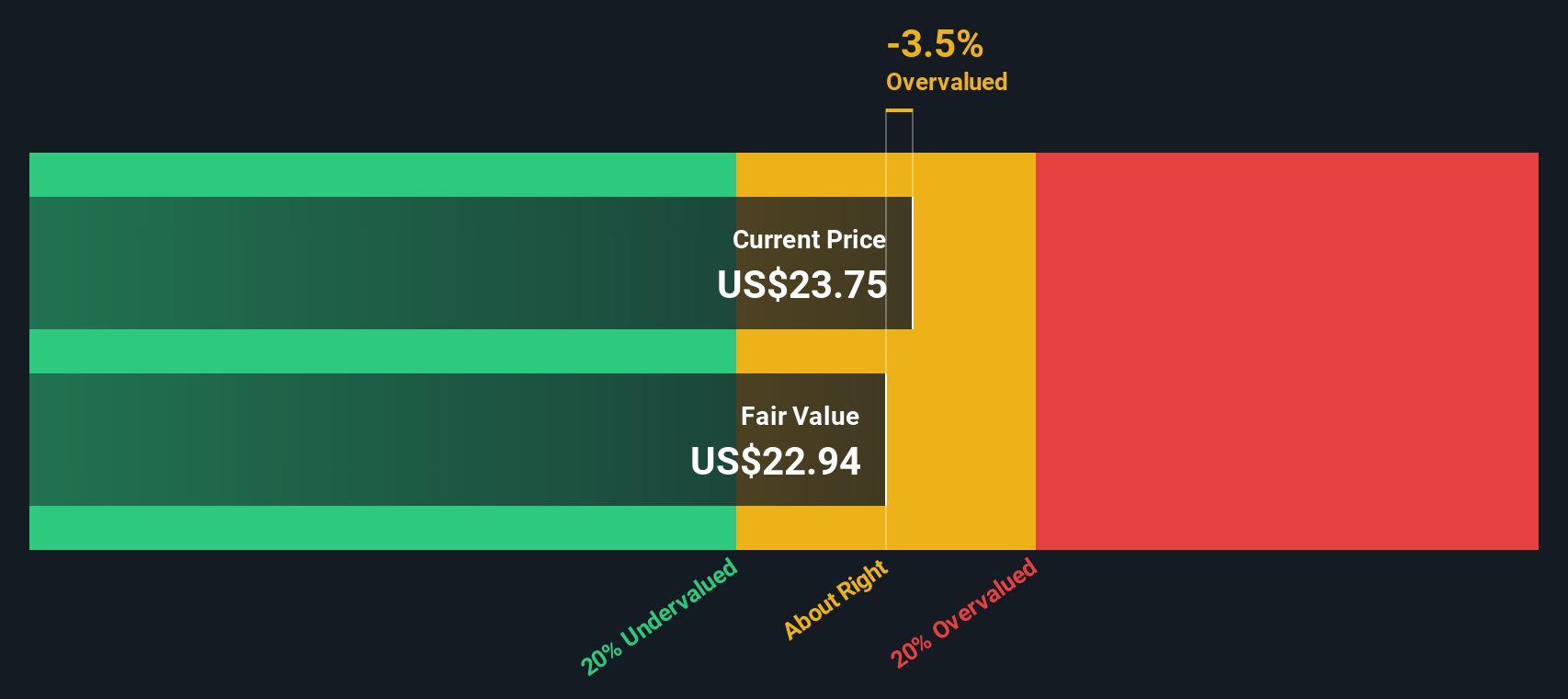

Taken together, these forecasts yield an estimated intrinsic value for XPeng stock of $18.48 per share. When compared to the current trading price, this valuation indicates the stock is 12.2% overvalued, rather than representing a bargain in today’s market.

Result: OVERVALUED

Approach 2: XPeng Price vs Sales

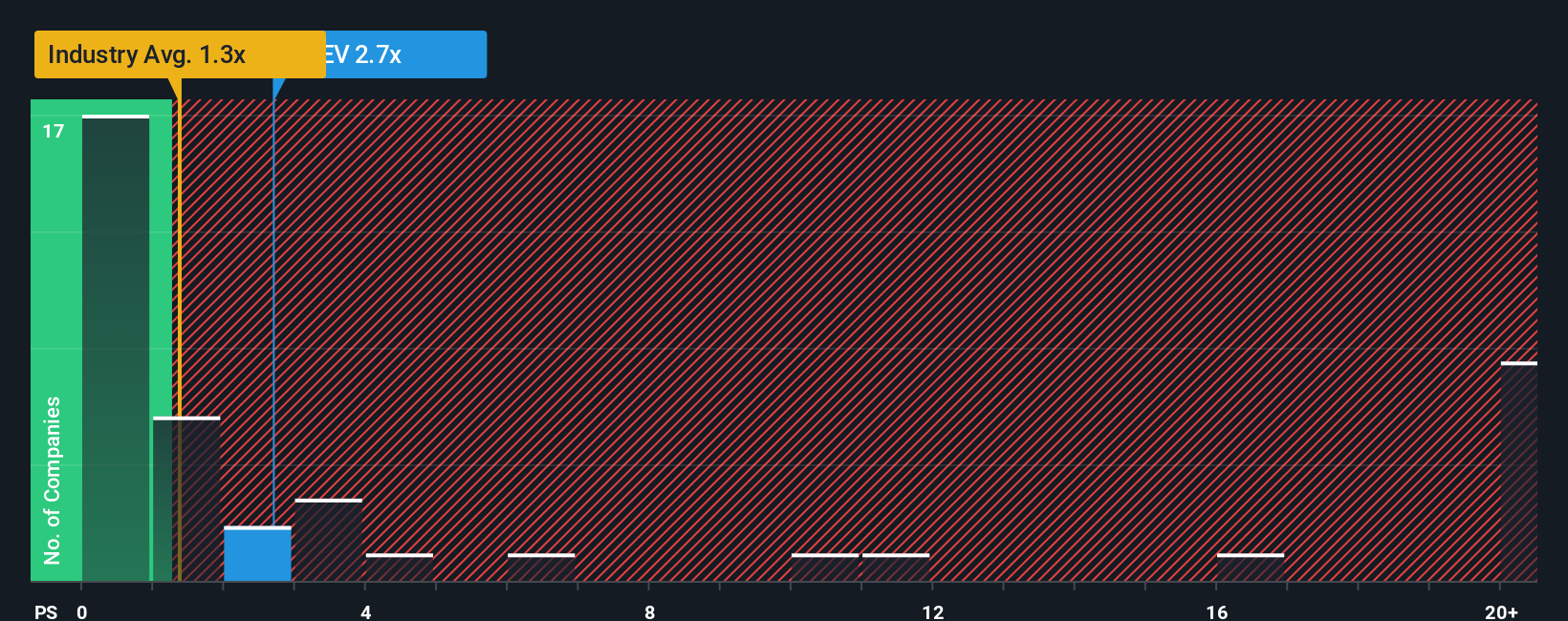

For companies like XPeng that are still working their way toward profitability, the Price-to-Sales (PS) ratio is often the most useful valuation tool. This metric helps investors judge how the market values the company’s actual revenues, sidestepping the swings that can come with unsteady earnings. Generally, higher growth potential and lower risk justify a higher PS ratio. However, these same factors also mean that comparisons should be made carefully, considering both industry standards and similar companies.

Currently, XPeng trades at a PS ratio of 2.4x. For context, the broader Auto industry average stands at 1.2x, while XPeng’s peers trade at a higher average of 3.1x. This places XPeng between the typical company and its direct competitors, reflecting its stage of growth and market outlook. In addition, the Fair Ratio for XPeng, which is Simply Wall St’s estimate of what’s justified for this specific company given its growth, margins, risks, and industry outlook, is 1.8x.

This means XPeng’s current multiple is slightly above its Fair Ratio, but not dramatically so. The difference suggests the stock is not trading at an outright bargain, but neither is it excessively overpriced by this metric.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your XPeng Narrative

Rather than just relying on the numbers, you can decide what XPeng is worth by building a Narrative. This is essentially a story you create about the company’s future, using your own view of its prospects, expected revenue, earnings, and margins. Narratives turn financial analysis into a personal forecast, connecting XPeng’s business story to hard numbers and then calculating an up-to-date Fair Value.

This approach is designed for everyone. Simply Wall St’s platform makes it easy to explore and share Narratives within a global community of investors. Narratives help you figure out whether XPeng is a buy, hold, or sell by immediately showing how your Fair Value stacks up against the latest price. Because they update automatically with new earnings and news, you always have a current perspective.

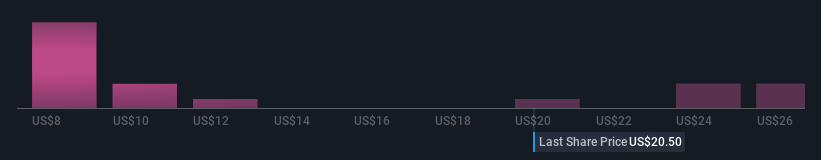

For example, you might craft a bullish Narrative for XPeng if you believe rapid AI adoption will drive strong profit growth, which could result in a fair value estimate of $35.64. In contrast, a more cautious investor might forecast ongoing margin pressure and see value at $18.05. Narratives give you the confidence to act on your own outlook by using dynamic data and your own reasoning.

Do you think there's more to the story for XPeng? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives