- United States

- /

- Renewable Energy

- /

- NYSE:SPRU

Analysts Have Lowered Expectations For XL Fleet Corp. (NYSE:XL) After Its Latest Results

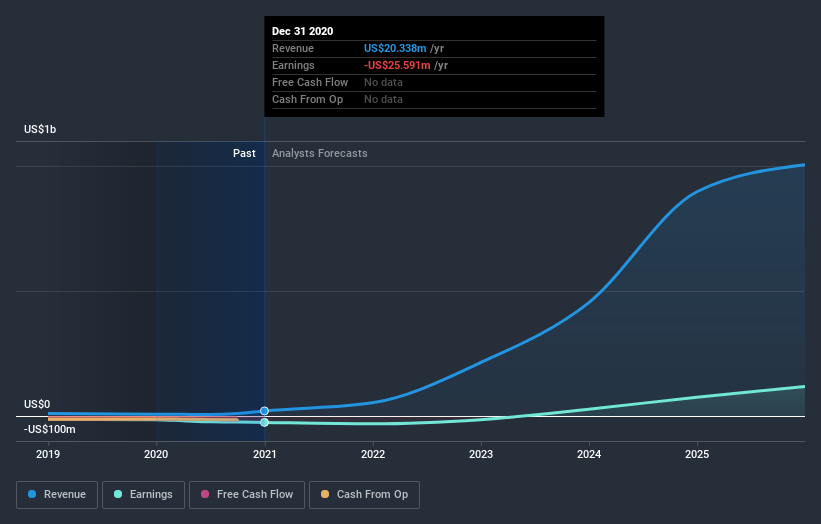

XL Fleet Corp. (NYSE:XL) just released its latest yearly report and things are not looking great. It was a pretty negative result overall, with revenues of US$20m missing analyst predictions by 5.0%. Worse, the business reported a statutory loss of US$0.30 per share, much larger than the analysts had forecast prior to the result. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for XL Fleet

Following the latest results, XL Fleet's two analysts are now forecasting revenues of US$52.8m in 2021. This would be a sizeable 160% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 22% to US$0.23. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$68.2m and losses of US$0.22 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The consensus price target fell 45% to US$16.50, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The period to the end of 2021 brings more of the same, according to the analysts, with revenue forecast to display 160% growth on an annualised basis. That is in line with its 182% annual growth over the past year. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 14% annually. So it's pretty clear that XL Fleet is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. They also downgraded their revenue estimates, although industry data suggests that XL Fleet's revenues are expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of XL Fleet's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on XL Fleet. Long-term earnings power is much more important than next year's profits. We have analyst estimates for XL Fleet going out as far as 2025, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with XL Fleet , and understanding this should be part of your investment process.

If you decide to trade XL Fleet, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:SPRU

Spruce Power Holding

Owns and operates distributed solar energy assets in the United States.

Adequate balance sheet and fair value.