- United States

- /

- IT

- /

- NYSE:DOCN

High Growth Tech Stocks To Explore In January 2025

Reviewed by Simply Wall St

The United States market has shown robust performance with a 3.1% increase over the last week and a 24% rise over the past year, while earnings are projected to grow by 15% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability, aligning well with these positive market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 55.24% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 50.44% | 122.48% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Zai Lab (NasdaqGM:ZLAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zai Lab Limited focuses on developing and commercializing therapies for oncology, autoimmune disorders, infectious diseases, and neuroscience, with a market capitalization of approximately $2.82 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $355.75 million. Its focus on developing therapies across multiple medical fields supports its diversified business model.

Zai Lab's recent strides in drug development, particularly with the NMPA's acceptance of the New Drug Application for KarXT and FDA approval of COBENFY, underscore its potential in addressing significant unmet medical needs in schizophrenia treatment. These developments not only highlight Zai Lab's commitment to innovation but also position it favorably within the biotech sector, which is critical given the 30.5% annual revenue growth and forecasted shift to profitability within three years. Furthermore, Zai Lab's R&D investment aligns with its strategic focus on expanding its pipeline and enhancing drug efficacy and safety profiles, pivotal for long-term growth in a competitive industry landscape marked by rapid technological advancements and regulatory dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Zai Lab.

Evaluate Zai Lab's historical performance by accessing our past performance report.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles in the United States and internationally, with a market cap of approximately $3.92 billion.

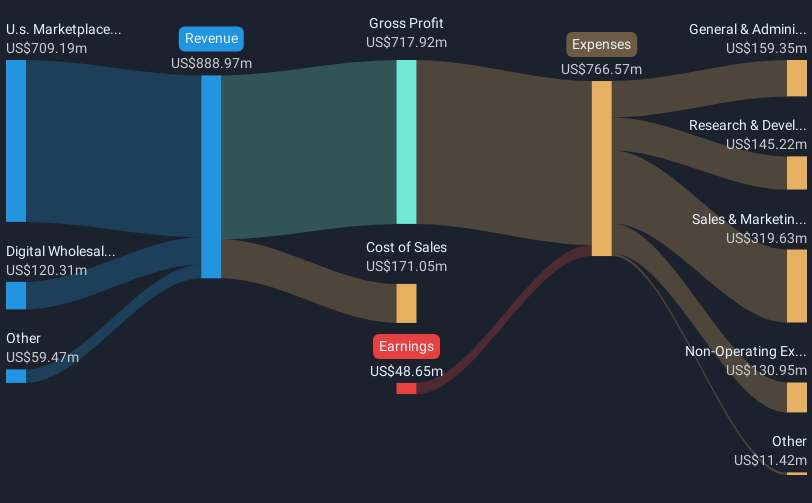

Operations: The company generates revenue primarily through its U.S. Marketplace segment, contributing $709.19 million, and its Digital Wholesale segment, adding $120.31 million. The business focuses on facilitating vehicle transactions via an online platform in both domestic and international markets.

CarGurus, transitioning towards profitability, is expected to see its earnings surge by 42.4% annually. Despite a current unprofitable status, the firm's strategic investments in digital solutions like the new Digital Deal in Canada highlight its innovative approach to enhancing dealer and consumer connections. This initiative not only capitalizes on growing digital retail trends but also supports an anticipated revenue growth of 14.8% per year, outpacing the US market average of 9%. Moreover, CarGurus has actively repurchased shares worth $146.11 million under its buyback program since last year, underscoring confidence in its financial strategy and future market position.

- Click to explore a detailed breakdown of our findings in CarGurus' health report.

Understand CarGurus' track record by examining our Past report.

DigitalOcean Holdings (NYSE:DOCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DigitalOcean Holdings, Inc. operates a cloud computing platform globally through its subsidiaries and has a market capitalization of $3.33 billion.

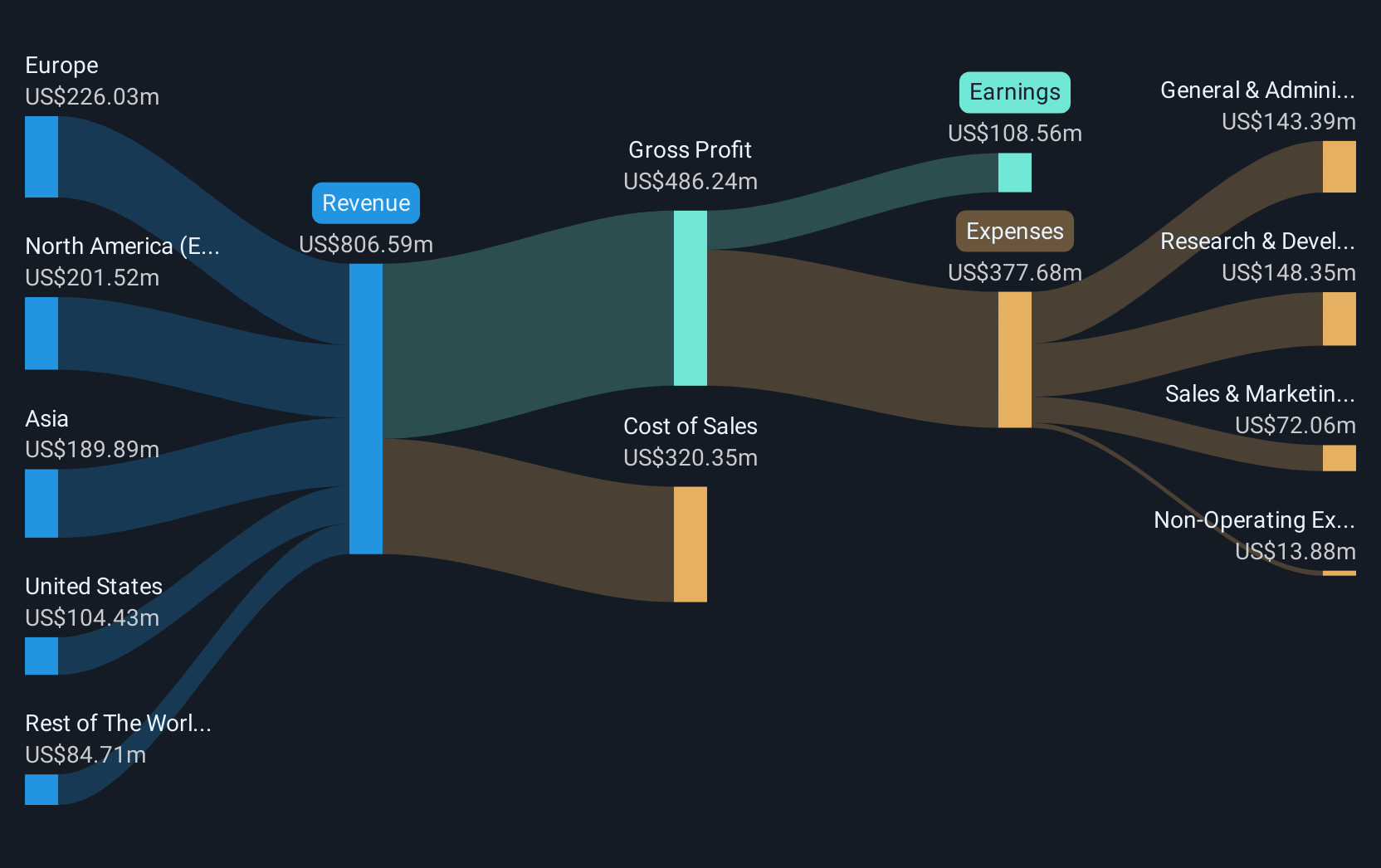

Operations: DigitalOcean Holdings generates revenue primarily from its Internet Software & Services segment, amounting to $756.56 million. The company operates across North America, Europe, Asia, and other international markets.

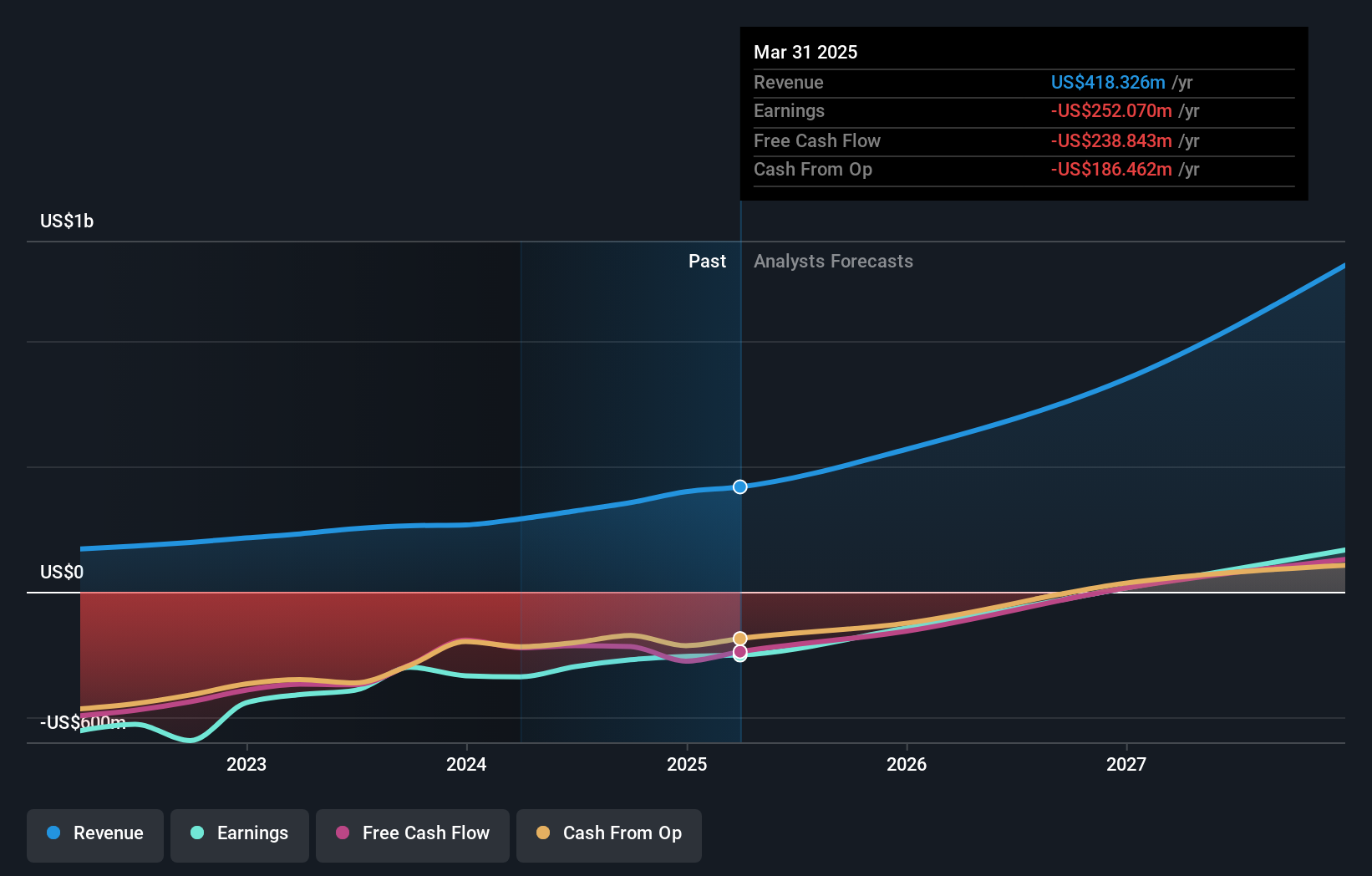

DigitalOcean Holdings, emerging in the tech landscape, recently showcased its innovative edge at the UBS Global Technology and AI Conference. The company's strategic deployment of Bare Metal GPUs caters to high-demand AI/ML workloads, ensuring robust performance for intensive tasks. This move complements their earlier enhancement to Managed MongoDB storage solutions, highlighting a commitment to scalable and efficient cloud services. Financially, DigitalOcean reported a significant uptick in quarterly sales to $198.48 million and net income rising to $32.95 million, reflecting strong operational execution. Additionally, their recent share repurchase of 297,827 shares for $11.37 million signals confidence in sustained growth amidst competitive tech advancements.

- Click here to discover the nuances of DigitalOcean Holdings with our detailed analytical health report.

Assess DigitalOcean Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 229 US High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Reasonable growth potential and fair value.