- United States

- /

- Auto

- /

- NYSE:THO

THOR Industries (THO): Revisiting Valuation After Recent Share Price Momentum and Earnings Recovery Signs

Reviewed by Simply Wall St

THOR Industries (THO) has quietly outperformed the broader market this year, and with the stock hovering near 101 dollars after a mixed few months, investors are rechecking the long term RV demand story.

See our latest analysis for THOR Industries.

After a choppy few months, the latest 30 day share price return of 2.86 percent and a solid 3 year total shareholder return of 40.33 percent suggest underlying momentum is still intact, even as sentiment resets around cyclical RV demand.

If THOR’s ride has you thinking more broadly about autos, this could be a good moment to explore other auto manufacturers that might fit your watchlist next.

With THOR trading modestly below analyst targets and showing improving earnings growth, investors face a familiar crossroads: is this a reasonably priced entry into a recovering RV cycle, or is the market already anticipating the next leg of growth?

Price to earnings of 19x, is it justified?

On a price to earnings ratio of 19 times earnings and a last close near 101 dollars, THOR screens as modestly valued rather than obviously cheap.

The price to earnings multiple compares what investors pay per share to the company’s annual earnings per share, a common yardstick for mature, profitable manufacturers like THOR. At 19 times, the market is assigning a premium over the SWS fair price to earnings ratio of 17.3 times. This implies investors are paying up somewhat for earnings that have just begun to reaccelerate after several weaker years.

Against peers, that 19 times multiple sits below the US peer average of 24.1 times but slightly above the global auto industry average of 18.1 times, highlighting a nuanced middle ground. The current valuation suggests investors are not chasing the stock at any price. However, if sentiment cools, the price to earnings ratio could drift closer to the 17.3 times level implied by the fair ratio.

Explore the SWS fair ratio for THOR Industries

Result: Price to earnings of 19x (ABOUT RIGHT)

However, investors still face risks from a prolonged consumer spending slowdown or higher financing costs, either of which could stall RV demand and pressure margins.

Find out about the key risks to this THOR Industries narrative.

Another View, what does fair value say?

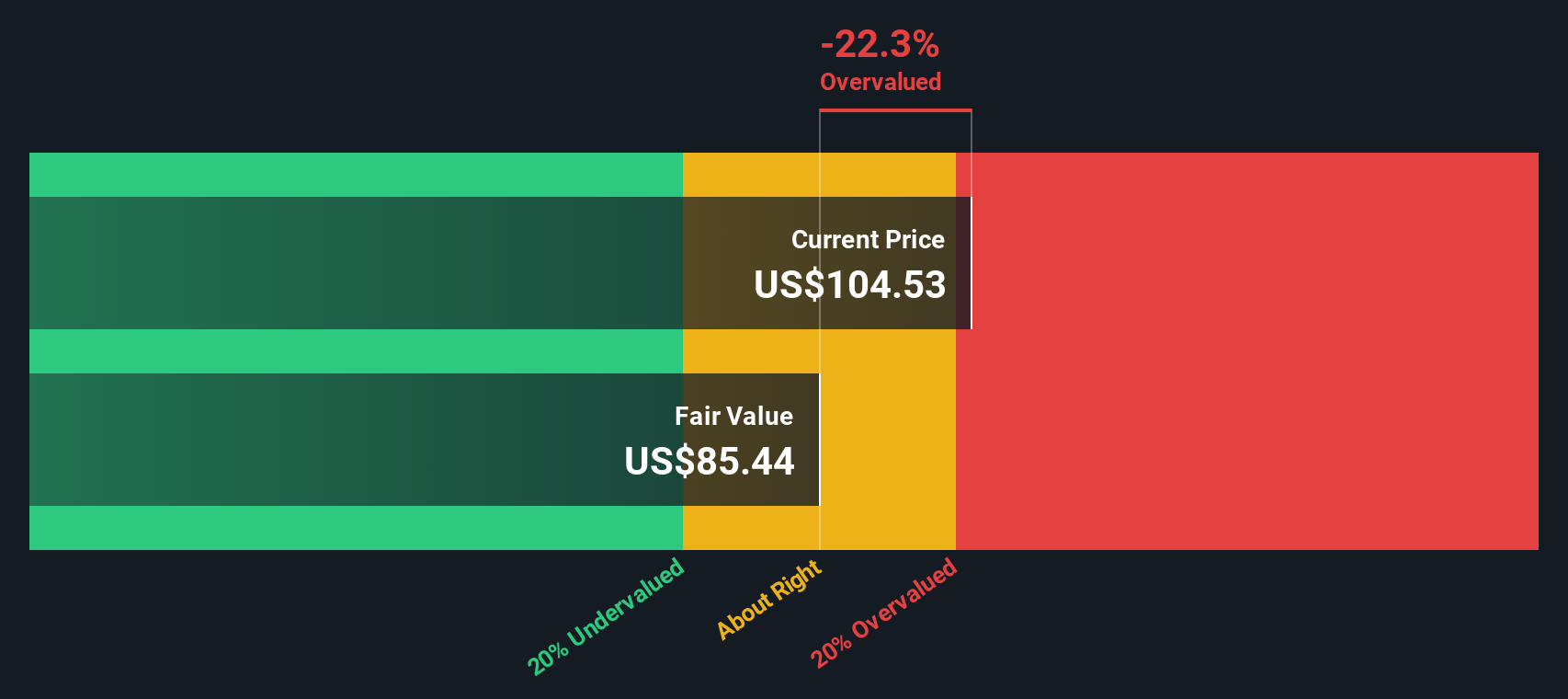

Our DCF model points to a fair value of about 105.80 dollars per share, around 4 percent above the current 101.47 dollars price. It hints at modest undervaluation and raises the question: is the market still underestimating a normalized RV earnings recovery?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out THOR Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own THOR Industries Narrative

If your view differs from this, or you would rather dig into the numbers yourself, you can shape a fresh perspective in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding THOR Industries.

Looking for more investment ideas?

Before you move on, put your research to work by scanning fresh opportunities on Simply Wall Street’s powerful screener so you are not leaving potential returns on the table.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets stay unpredictable.

- Explore potential mispriced opportunities through these 906 undervalued stocks based on cash flows that may offer meaningful upside as sentiment and fundamentals realign.

- Research the evolving AI landscape with these 26 AI penny stocks that focus on cutting edge innovation and the potential for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)