- United States

- /

- Auto

- /

- NYSE:THO

Shareholders Will Probably Hold Off On Increasing THOR Industries, Inc.'s (NYSE:THO) CEO Compensation For The Time Being

Key Insights

- THOR Industries will host its Annual General Meeting on 15th of December

- CEO Bob Martin's total compensation includes salary of US$750.0k

- The overall pay is 1,017% above the industry average

- Over the past three years, THOR Industries' EPS grew by 1.9% and over the past three years, the total shareholder return was 20%

Performance at THOR Industries, Inc. (NYSE:THO) has been reasonably good and CEO Bob Martin has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 15th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for THOR Industries

Comparing THOR Industries, Inc.'s CEO Compensation With The Industry

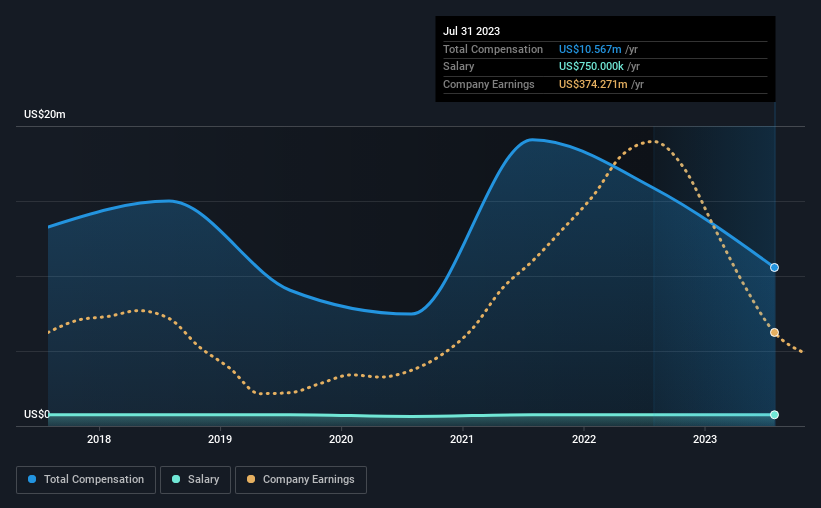

Our data indicates that THOR Industries, Inc. has a market capitalization of US$5.7b, and total annual CEO compensation was reported as US$11m for the year to July 2023. Notably, that's a decrease of 33% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$750k.

For comparison, other companies in the American Auto industry with market capitalizations ranging between US$4.0b and US$12b had a median total CEO compensation of US$946k. Accordingly, our analysis reveals that THOR Industries, Inc. pays Bob Martin north of the industry median. Furthermore, Bob Martin directly owns US$29m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$750k | US$750k | 7% |

| Other | US$9.8m | US$15m | 93% |

| Total Compensation | US$11m | US$16m | 100% |

Speaking on an industry level, nearly 17% of total compensation represents salary, while the remainder of 83% is other remuneration. It's interesting to note that THOR Industries allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at THOR Industries, Inc.'s Growth Numbers

THOR Industries, Inc. has seen its earnings per share (EPS) increase by 1.9% a year over the past three years. Its revenue is down 32% over the previous year.

We generally like to see a little revenue growth, but it is good to see a modest EPS growth at least. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has THOR Industries, Inc. Been A Good Investment?

With a total shareholder return of 20% over three years, THOR Industries, Inc. shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for THOR Industries that investors should think about before committing capital to this stock.

Switching gears from THOR Industries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)