Led by the pressures of suppliers and the Chinese COVID-19 policy, NIO Inc.'s (NYSE:NIO) announced that they are halting production. In March, NIO delivered close to 10k vehicles, however investors may see a drop in future deliveries depending on how long the halt lasts.

In this article, we will review when was NIO forecasted to breakeven, and explore what a production halt may mean for the company.

For a quick overview, here are the key takeaways of our analysis:

- Pressured by lack of parts from suppliers and spread control government policy, NIO halted production.

- The estimated timeframe of the halt is difficult to estimate as the country tries to control the spread.

- NIO is predicted to become profitable by 2024, but production halts may impact when this happens.

To get a complete fundamental picture of NIO, visit our daily report on the company.

The halt in production is highly impacted by the Chinese "Zero COVID" policy, which imposes strict measures in order to control the pandemic. This has intensified population testing and lockdowns, such as what we see in Shanghai's districts. While the government is doing its best to balance controlling the pandemic with allowing industry to operate, we cannot know how the situation will unfold.

The three possible scenarios are: successful control of the spread, virus spread with heavy measures, or gradual easing of measures as the virus spreads. While the current doctrine implies heavy measures, this may change if the economic price becomes too high for the country.

The lack of component parts from partners is also a factor in the production halt. This is a reminder of just how dependent supply chains are. Procurement and alternatives may be expensive, and the company might have to make due with their systems in-place after resuming production.

There is no information yet on the estimated length of the production halt. While most investors hope that this is a short-lived situation, which can be made up for by extended production in the future, this may not turn out to be the case. Anything above a 1-month halt can have noticeable differences for shareholders, and we will reassess when the company is expected to breakeven.

Check out our latest analysis for NIO

Estimating Time to Profitability

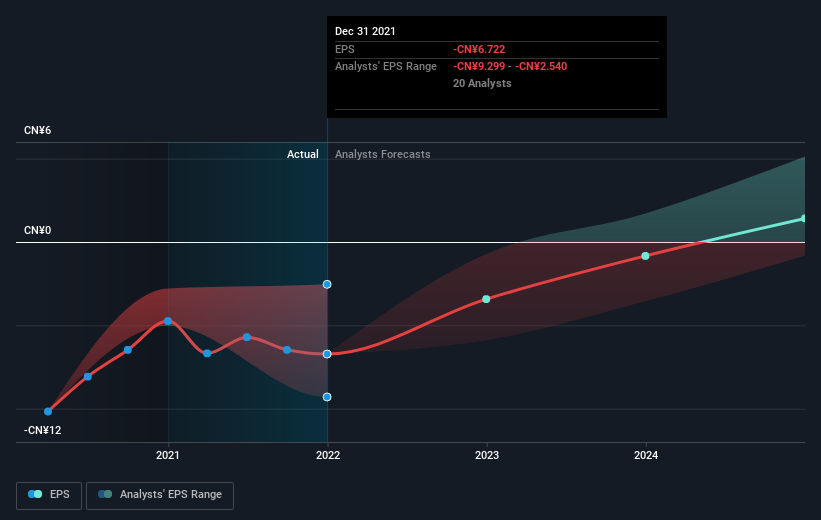

According to the 25 industry analysts covering NIO, the average estimate is that breakeven is near.

They expect the company to post a final loss in 2023, before turning a profit of CN¥2.5b in 2024. Therefore, the company is expected to breakeven roughly 2 years from today.

How fast will the company have to grow each year in order to reach the breakeven point by 2024?

Working backwards from analyst estimates, it turns out that they expect the company to grow 77% year-on-year, on average, which implies full sales and expanding future production capacity.

We can see that the high implied growth rate is already a challenge of itself, and these added supply chain disruptions may push the breakeven timeframe further.

While sales and growth are great, breaking into profitability is indeed an important milestone, because it is the final step of business model validation.

Profitability signals that the company can create value in the market, and just as importantly, that it has the ability to retain some of that value for shareholders. Many factors impact the company's ability to actually produce a profit, which includes the company's spending approach and discipline, the dedication (or lack of) to shareholders, government taxes and regulations, the pressure on profit margins from competitors and suppliers, etc.

Breaking even is also important in order to ensure that the company has enough capacity to become self-sufficient. By looking at the balance sheet, we discover that NIO does not have any significant financial risks, mostly on account of their CN¥52.4b (US$8.23b) cash position, and a relatively low average negative cash flow.

Conclusion

Supply chain disruptions may become a significant issue in the Chinese economy, and the situation is currently unpredictable. While the current COVID strain has highly infectious properties, we do not know the tolerance threshold of public policy, which has not undergone a widespread infection wave yet.

Because of the interdependence of companies across the supply chain, we can expect more companies and plants to shut down in a bid to contain the spread.

For NIO, this will likely result in noticeable production delays, and it may take longer than investors would hope in order to normalize the situation.

Next Steps:

This article is not intended to be a comprehensive analysis on NIO, so if you are interested in understanding the company at a deeper level, take a look at NIO's company page on Simply Wall St. We've also compiled a list of important factors you should further research:

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on NIO’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives