- United States

- /

- Auto

- /

- NYSE:NIO

NIO Inc. (NYSE:NIO) is Just Beginning its High Growth Phase, but Investors are Currently Pricing-In Political Risk

NIO Inc.'s (NYSE:NIO) just dropped 12.2% and pre-market indicators show that it may extend the drop further. While no one should try to catch falling knives, we wonder if NIO will be a good stock once the price stabilizes. For that reason, today we will go through some key fundamentals for the company.

Overview

NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China. The company is listed in the NYSE, and news broke out recently that they are seeking to also list on the Hong Kong and Singapore stock exchanges.

The listing will not issue new stock or dilute shareholders, rather, they will attempt to lower their cost of equity by attracting regional investors that might have difficulties connecting to the NYSE - in effect, they hope that this will help rise the stock price and evade possible delisting threats in the U.S.

View our latest analysis for NIO

The company does not seem to be in financial distress, but they may have growth projects planned, for which they will need the additional cash for which they will need the additional cash - a low cost of equity and higher stock price can go a long way to boosting planned projects. Considering their CN¥16.7b (US$2.6b) debt, it is likely a good choice to raise more equity instead of debt in order to reduce short term financial obligations.

NIO is continuing its production and model expansion in China, it unveiled the ET5 - it's new mid-size sedan, and is expecting to pick up general production in the second half of 2022. You might want to put a reminder in your calendar to see how the company is managing deliveries.

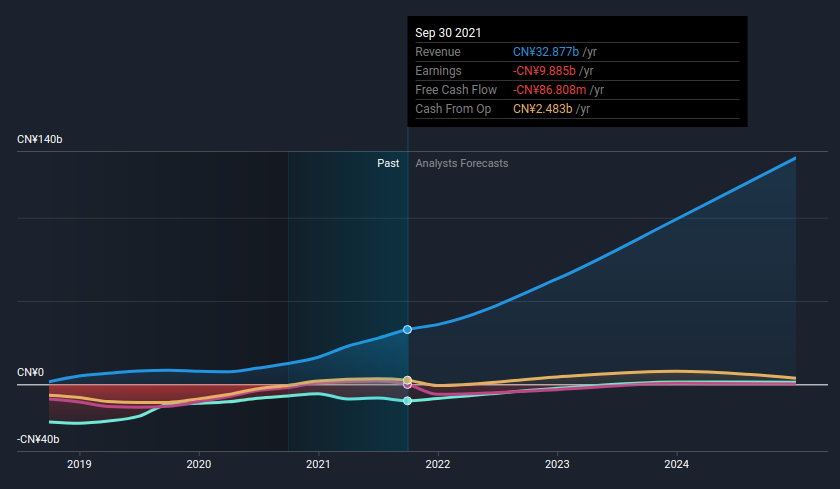

It is clear that the company is just beginning its high growth/production phase. Analysts expect to see a ramping up of sales by the end of 2024, when the company is expected to 4x sales, from the current CN¥32.8b to CN¥135.9b.

The chart below shows why so many investors and analysts are optimistic on the stock (click to see the interactive chart):

Growth is important for a business to scale, however investors need profits or more specifically Free Cash Flows. That is why we will now evaluate when can NIO become profitable.

When Will NIO Become Profitable

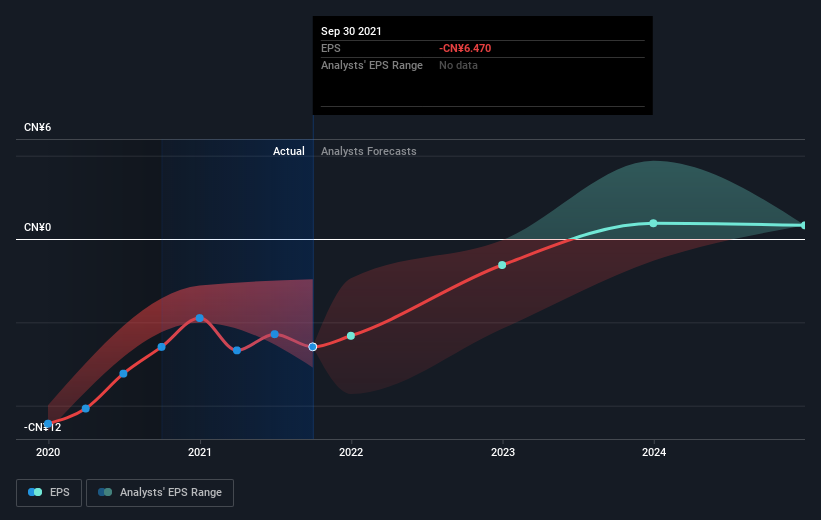

The US$23b market-cap company posted a loss in its most recent financial year of CN¥5.6b and the latest trailing-twelve-month loss of CN¥9.9b leading to an even wider gap between loss and breakeven. This is not necessarily concerning, as the company is still developing and has a cash runway of CN¥43.4b, which will allow them to continue operations for more than 3 years.

However, profitability is imperative for at least 2 reasons. One to give investors an actual reason for buying the stock, and two in order to validate their business model.

NIO is still managing a relatively light operation, but they plan to enter and increase their own production centers, which will be a key development to see if management can turn NIO into a successful business, or one that is struggling to keep the lights on.

According to the 25 industry analysts covering NIO, the consensus is that breakeven is near. They expect the company to post a final loss in 2022, before turning a profit of CN¥1.4b in 2023.

The company is therefore projected to breakeven just over a year from today.

How fast will the company have to grow each year in order to reach the breakeven point by 2023?

Working backwards from analyst estimates, it turns out that they expect the company to grow 94% year-on-year, on average, which signals high confidence from analysts.

If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Considering that NIO is in a high growth phase, a high forecast growth rate is not unusual.

Additionally, if you look at the previous graph, you can see that the company has some free cash flows, which further gives confidence that the company will converge profits upwards.

Key Takeaways and Next Steps:

NIO is just beginning its ascend into the Chinese market, which arguably has high demand for higher-end EVs. The company is expected to triple sales by the end of 2024, and become profitable by 2023. Management seems to be successfully executing their vision thus far, so investors have confidence on the fundamentals.

One significant risk factor is the possible heating up of tensions between the east and the west. While no one wants a slump in the economy, there are some possibilities that financial institutions separate and investors seem to be factoring that risk in the current stock price - much more than the fundamental performance of the stock. Unfortunately, this is a discrete risk (will or won't happen), and those are hard to measure.

This article is not intended to be a comprehensive analysis on NIO, so if you are interested in understanding the company at a deeper level, take a look at NIO's company page on Simply Wall St. We've also put together a list of essential aspects you should further research:

- Valuation: What is NIO worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether NIO is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on NIO’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you're looking to trade NIO, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives