- United States

- /

- Biotech

- /

- NasdaqGM:CVAC

CureVac Among 3 Promising Penny Stocks To Watch

Reviewed by Simply Wall St

The market has climbed by 5.8% over the past week, and is up 4.8% over the past year, with earnings expected to grow by 14% per annum in the coming years. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant opportunities when built on solid financials. We'll explore several penny stocks that stand out for their financial strength and potential for long-term success, providing investors with a chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.48 | $364.86M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.02 | $1.2B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.87 | $651.45M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.796 | $14.15M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.93 | $55.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.83 | $48.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.33 | $70.67M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.7755 | $5.63M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $226.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.99 | $88.43M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 795 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CureVac (NasdaqGM:CVAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CureVac N.V. is a biopharmaceutical company specializing in the development of transformative mRNA-based medicines, with a market cap of approximately $715.56 million.

Operations: CureVac N.V. has not reported any specific revenue segments.

Market Cap: $715.56M

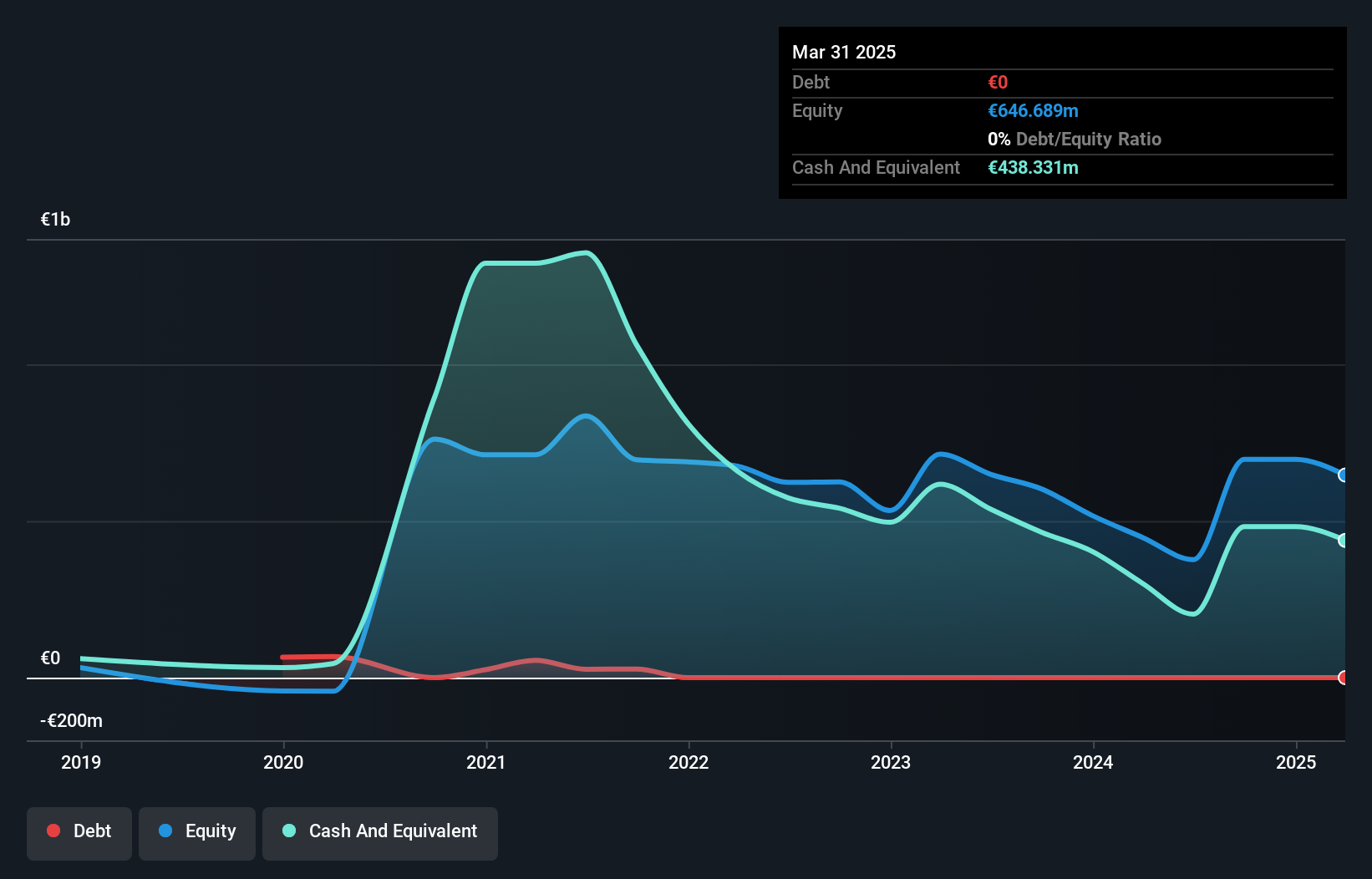

CureVac N.V., a biopharmaceutical company, has recently achieved profitability, with earnings growth making it challenging to compare past performance. The company reported significant revenue of €535.18 million for 2024, marking a substantial increase from the previous year. CureVac is debt-free and trades at a notable discount compared to its estimated fair value. Its management and board are experienced, contributing to strategic stability. Recently, CureVac received FDA clearance for a Phase 1 clinical study of CVHNLC in lung cancer patients, highlighting ongoing innovation in mRNA-based therapies despite forecasted earnings decline over the next three years.

- Take a closer look at CureVac's potential here in our financial health report.

- Gain insights into CureVac's future direction by reviewing our growth report.

NIO (NYSE:NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally with a market cap of approximately $7.89 billion.

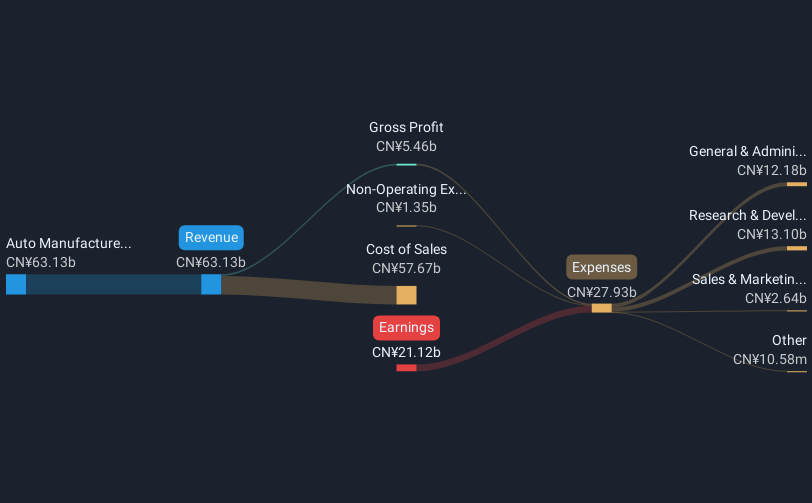

Operations: The company generates revenue primarily from its Auto Manufacturers segment, which reported CN¥65.73 billion.

Market Cap: $7.89B

NIO Inc. has been making strides in the electric vehicle sector, with recent collaborations and strategic partnerships enhancing its technological capabilities. The partnership with Flexcompute aims to optimize vehicle performance through advanced aerodynamic simulations, reducing costs and development time. Despite these advancements, NIO remains unprofitable and faces challenges such as increasing losses over the past five years at a rate of 24.4% annually. However, it maintains a strong cash position exceeding its total debt and continues to expand its battery swapping network through potential deals with CATL, which may bolster future growth prospects in this competitive market.

- Dive into the specifics of NIO here with our thorough balance sheet health report.

- Evaluate NIO's prospects by accessing our earnings growth report.

RPC (NYSE:RES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPC, Inc., along with its subsidiaries, provides a variety of oilfield services and equipment to support oil and gas companies in the exploration, production, and development of their properties, with a market cap of approximately $1.05 billion.

Operations: RPC's revenue is primarily derived from Technical Services, which generated $1.33 billion, complemented by Support Services with $88.99 million.

Market Cap: $1.05B

RPC, Inc. operates in the oilfield services sector, with a market cap of US$1.05 billion and revenue primarily from Technical Services at US$1.33 billion. Recent board restructuring aims to declassify the board for annual director elections, enhancing governance transparency. Despite no debt and strong short-term assets covering liabilities, RPC's profit margins have declined from 11.9% to 6.4%, reflecting challenges in profitability amidst industry pressures and negative earnings growth over the past year (-53.2%). The company maintains a stable dividend payout but faces volatility in returns; however, its price-to-earnings ratio suggests potential undervaluation compared to the broader market.

- Jump into the full analysis health report here for a deeper understanding of RPC.

- Examine RPC's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Get an in-depth perspective on all 795 US Penny Stocks by using our screener here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CVAC

CureVac

A biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives