- United States

- /

- Auto Components

- /

- NYSE:LEA

Lear (LEA): Examining Valuation After Deepening Palantir Partnership and New AI Transformation Gains

Reviewed by Simply Wall St

Lear (LEA) is making waves this week after unveiling a major expansion of its partnership with Palantir. The company announced it will broaden the use of Palantir’s Foundry, Warp Speed manufacturing OS, and AI Platform (AIP) across its entire global manufacturing footprint. This move is more than just a tech upgrade, as Lear credits these tools with powering its transformation program, helping the company automate processes, tackle tariff challenges, and save over $30 million in the first half of 2025 alone.

This kind of digital transformation is capturing attention for good reason. In terms of the stock, Lear’s shares have climbed 18% over the past three months, bringing the year-to-date gain to 21%. That recovery stands in contrast to a smaller 6% gain over the past year and a negative three-year return, suggesting fresh momentum is building as operational improvements take hold.

So where does this leave investors now? Is Lear an overlooked value in the midst of an AI-driven turnaround, or is the market already pricing in the company’s improved prospects?

Most Popular Narrative: 1.2% Undervalued

The prevailing narrative sees Lear trading at a modest discount to its projected fair value. Analysts broadly support a slightly bullish outlook, which is justified by future earnings potential.

"Lear's recent wins of modular, electronics-rich seating and wire programs with major global EV automakers (including nearly $1 billion in E-Systems awards year-to-date and strong interest in ComfortFlex/ComfortMax seats) position the company to benefit from growing demand for advanced vehicle electrification and connectivity. This sets the stage for higher revenue per vehicle and supports long-term top-line growth and margin improvement."

Want to unpack the strategic moves driving Wall Street’s consensus? This narrative centers on bold revenue growth, expanding margins, and earnings power. What are the pivotal figures propelling Lear’s fair value above the current price? Discover the numbers behind the story that shapes analyst conviction.

Result: Fair Value of $114.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent challenges with E-Systems and shifting automaker production schedules could undermine Lear’s long-term growth and put pressure on future earnings expectations.

Find out about the key risks to this Lear narrative.Another View: DCF Model Points to Much Bigger Upside

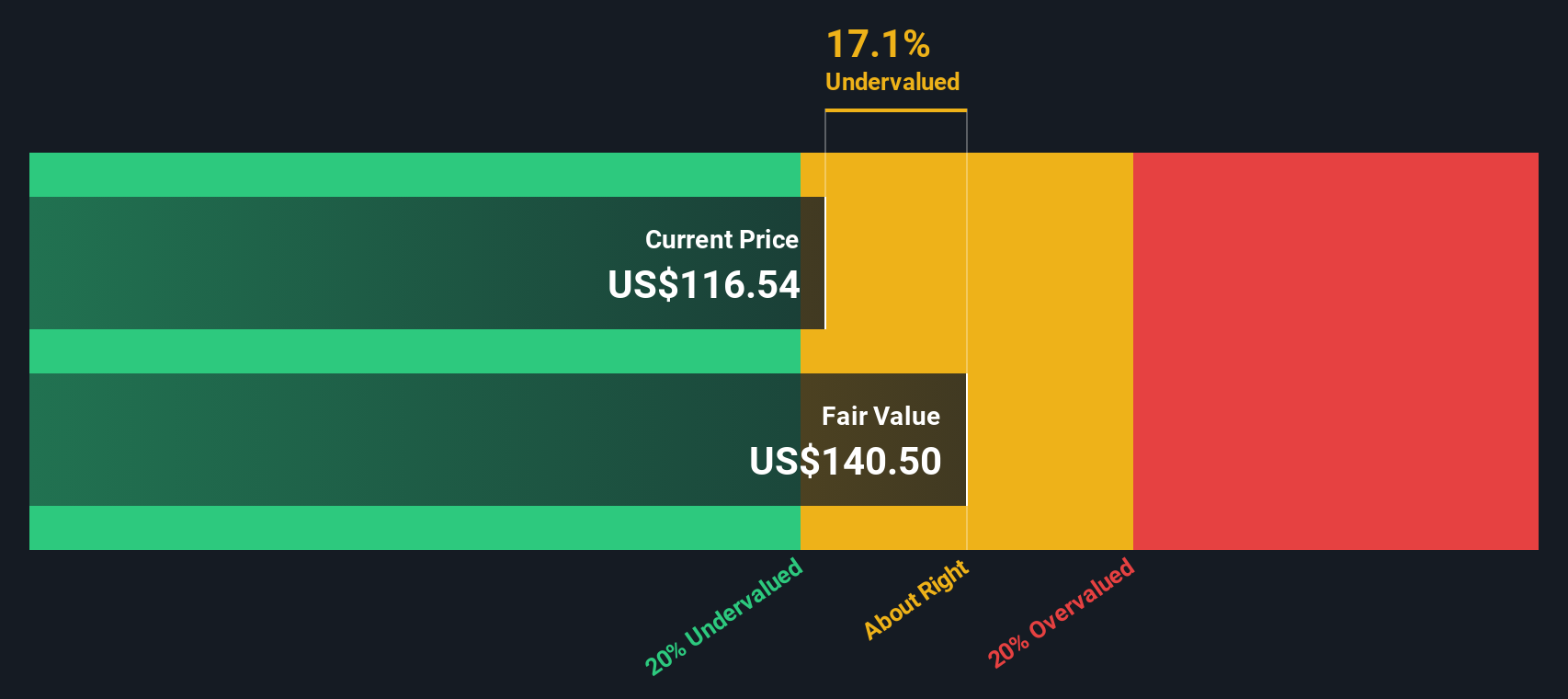

Looking beyond analyst targets, our DCF model paints a strikingly bullish picture. It suggests that Lear’s shares are trading well below what future cash flows could justify. Could the market be missing a deeper value story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lear for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lear Narrative

If you see Lear’s future taking a different course, or if independent research is more your style, crafting your own full narrative takes just a few minutes. Do it your way.

A great starting point for your Lear research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and supercharge your watchlist with stocks handpicked for real potential. Ignore these opportunities and you could miss out on your next breakthrough investment.

- Uncover companies riding the boom in artificial intelligence by checking out the latest picks in AI penny stocks.

- Tap into steady income streams by browsing top options among dividend stocks with yields > 3%.

- Catch under-the-radar gems trading below their true value right now through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)