- United States

- /

- Auto

- /

- NYSE:HOG

Benign Growth For Harley-Davidson, Inc. (NYSE:HOG) Underpins Its Share Price

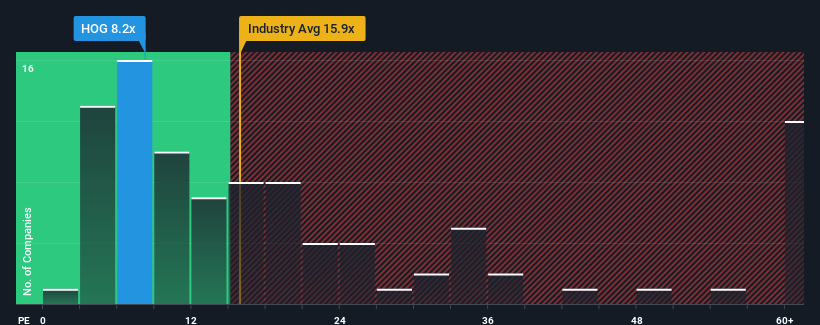

Harley-Davidson, Inc.'s (NYSE:HOG) price-to-earnings (or "P/E") ratio of 8.2x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 33x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The recently shrinking earnings for Harley-Davidson have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for Harley-Davidson

Is There Any Growth For Harley-Davidson?

The only time you'd be truly comfortable seeing a P/E as depressed as Harley-Davidson's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 61,891% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 0.9% per annum during the coming three years according to the analysts following the company. That's not great when the rest of the market is expected to grow by 11% per year.

In light of this, it's understandable that Harley-Davidson's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Harley-Davidson maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Harley-Davidson (2 make us uncomfortable!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Harley-Davidson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives