- United States

- /

- Auto

- /

- NYSE:GM

General Motors (NYSE:GM) Announces $6 Billion Share Buyback Plus Dividend Increase

Reviewed by Simply Wall St

General Motors (NYSE:GM) has recently captured investor attention with strategic financial moves aimed at enhancing shareholder value. Announcing a $6 billion share buyback program and a dividend increase to $0.15 per share reflected the company's commitment to its shareholders. Over the past week, GM's stock price experienced a 1% increase, which could be partially attributed to these announcements. This performance contrasts with the broader market's decline of 4%, suggesting that GM's initiatives may have provided a buffer against market volatility. Generally, the market was mixed as investors digested key reports from tech companies and federal economic announcements. Despite these broader concerns and market fluctuations, GM's strategic focus on shareholder returns might have contributed to its relative outperformance during this timeframe. Such efforts underscore General Motors's proactive steps in fortifying its position amidst ongoing market challenges.

See the full analysis report here for a deeper understanding of General Motors.

Over the last five years, General Motors has delivered a total shareholder return of 59.59%. This performance has unfolded amidst significant events and strategic decisions by the company. A key highlight was the company's substantial share repurchase program, which saw US$25.76 billion directed towards buybacks since 2015, reaffirming GM's commitment to enhancing shareholder value. Additionally, collaborations such as those with LG Energy Solution to develop advanced battery technology and the integration with Tesla's Supercharger network have bolstered GM's position within the evolving electric vehicle market.

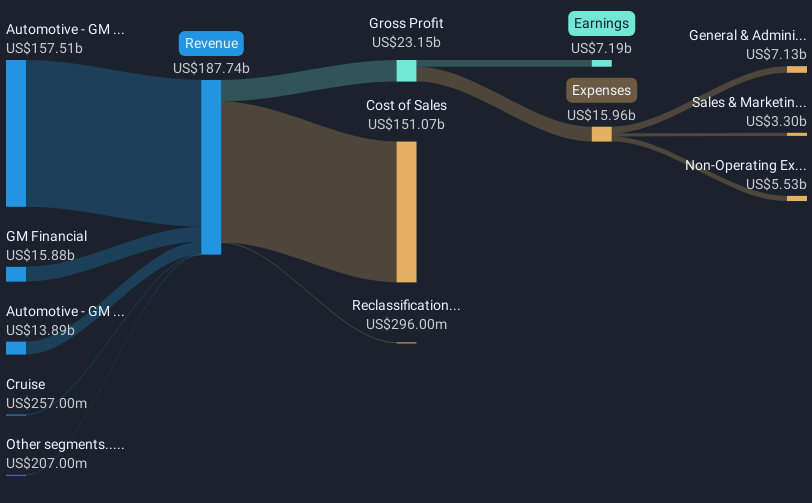

In terms of earnings, GM experienced mixed results with revenue growing to US$187.44 billion in 2024, despite a decline in net income to US$6.01 billion. Furthermore, the company has faced challenges such as earnings contraction in recent years alongside legal investigations into its practices. Nevertheless, GM outperformed the broader US market's year-long 16.9% return, illustrating its relative strength in a competitive industry landscape.

- See how General Motors measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting General Motors' growth trajectory—explore our risk evaluation report.

- Already own General Motors? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives