- United States

- /

- Auto

- /

- NYSE:F

Taking Stock of Ford (F) After Its Earnings Beat: What the Latest Results Signal for Valuation

Reviewed by Simply Wall St

Ford Motor (F) just delivered earnings that cleared Wall Street expectations on both revenue and profit, even while juggling an aluminum shortage, softer U.S. sales, and a steep drop in electric vehicle demand.

See our latest analysis for Ford Motor.

After those stronger than expected results, Ford’s share price at around $13.09 reflects a 35.65% year to date share price return. Its 1 year total shareholder return of 30.91% and 5 year total shareholder return of 82.56% suggest momentum has been rebuilding as investors reassess execution risks and cash generation beyond the current EV growing pains.

If Ford’s rebound has you watching the auto space more closely, it could be a time to explore other auto manufacturers that might be setting up for their next leg higher.

Yet with shares now hovering above analysts’ average price target and headline earnings surging, are investors still overlooking Ford’s long term cash generation, or is the stock already pricing in its next wave of growth?

Most Popular Narrative Narrative: 4.6% Overvalued

Ford’s most followed narrative puts fair value at $12.52 per share, slightly below the $13.09 last close. This frames today’s rally as modestly stretched.

The focus on connected vehicle data, OTA software updates, and advancements in autonomous driving (BlueCruise, upcoming Level 3 capabilities) sets the stage for new, high-margin revenue streams from digital services and vehicle fleet management. This positions Ford to capture higher customer lifetime value and recurring revenues, driving top-line growth and long-term profitability.

Curious how a shrinking top line can still support richer margins, faster earnings growth, and a higher future multiple than today’s pricing implies? The full narrative unpacks the transformation math behind that apparent contradiction.

Result: Fair Value of $12.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent EV division losses, along with mounting tariff or trade headwinds, could quickly undermine the margin gains this narrative is banking on.

Find out about the key risks to this Ford Motor narrative.

Another Take On Value

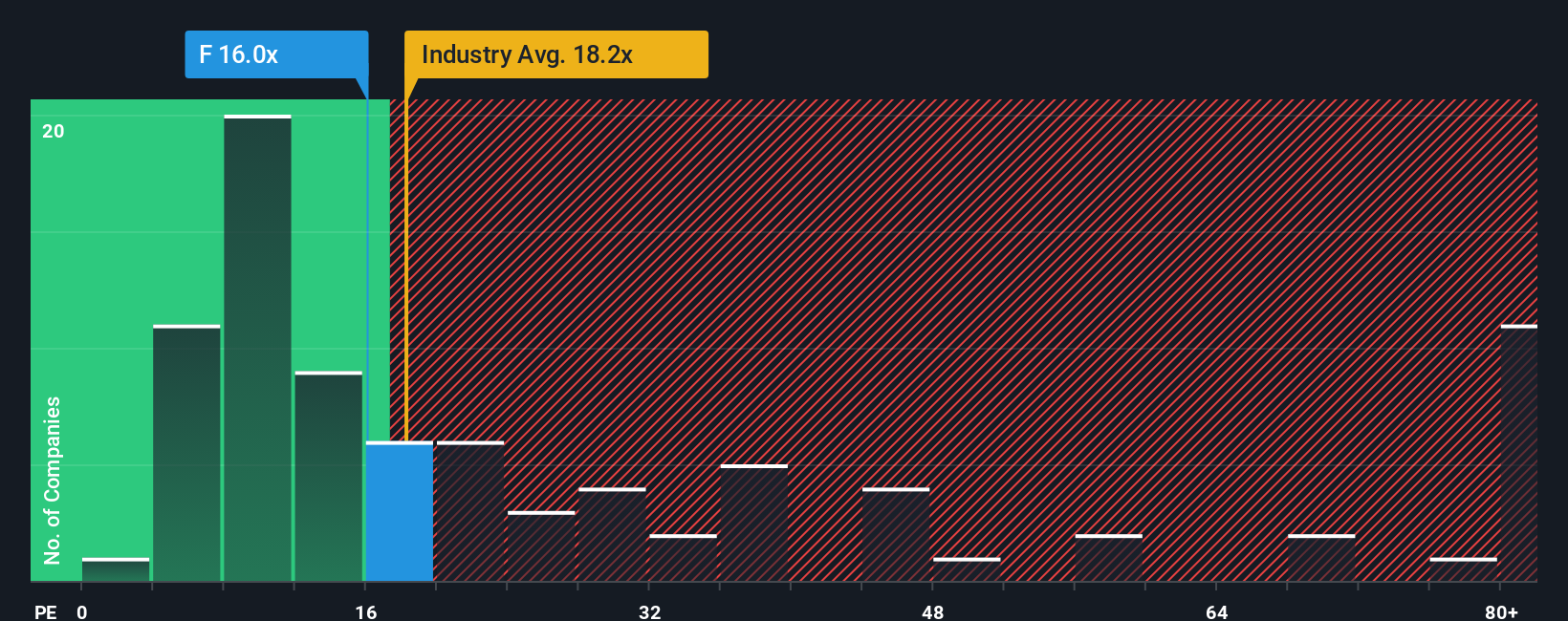

Our earnings based lens tells a different story. At 11.1 times earnings, Ford trades far below both the global auto average of 18.2 times and peer average of 25.8 times, and even under our fair ratio of 19.4 times. This signals notable upside if sentiment simply normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ford Motor Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just a few minutes. Do it your way

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Ford when some of the most exciting opportunities sit just outside the headlines, waiting for investors who are willing to look a little deeper.

- Capitalize on mispriced potential by targeting companies trading below intrinsic value using these 916 undervalued stocks based on cash flows to spot opportunities others are ignoring.

- Position yourself early in structural growth trends by scanning these 30 healthcare AI stocks reshaping diagnostics, treatment pathways, and long term healthcare economics.

- Harness high risk, high reward momentum by reviewing these 81 cryptocurrency and blockchain stocks riding advances in blockchain infrastructure, tokenization, and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026